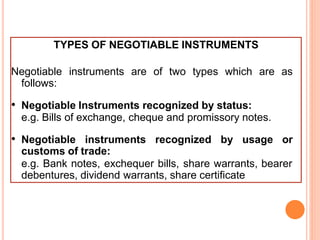

The document discusses the Negotiable Instruments Act of 1881 in India. It defines key terms like negotiable instrument and outlines some key features of negotiable instruments like being freely transferable through delivery or endorsement, the holder having free title from defects, and certain presumptions around consideration and dates. It also discusses different types of negotiable instruments recognized by law like promissory notes, bills of exchange, and cheques. For each, it provides definitions, essential elements, and parties involved. Overall, the document provides a comprehensive overview of negotiable instruments and the legal framework governing them in India as per the Negotiable Instruments Act of 1881.