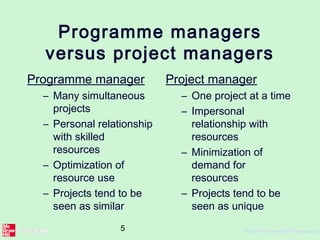

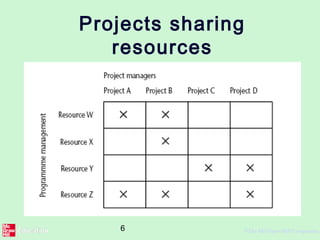

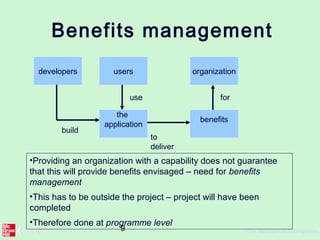

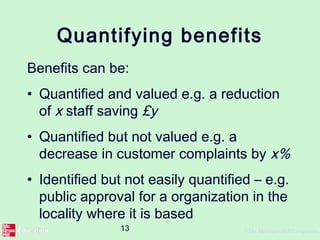

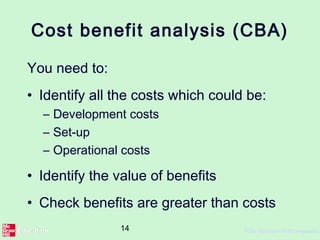

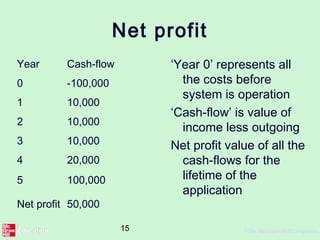

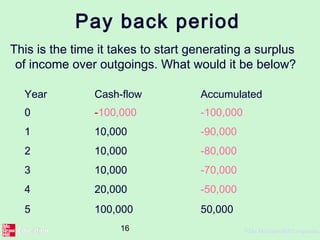

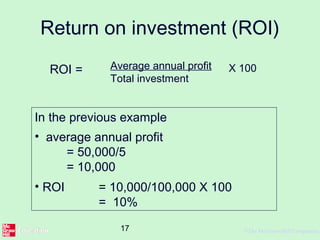

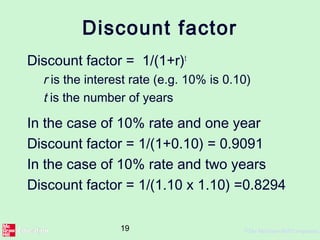

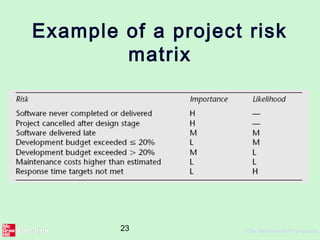

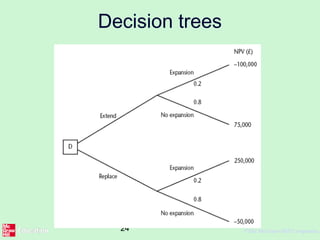

This document discusses programme management and project evaluation techniques. It covers programme management, benefits management, cost benefit analysis, cash flow forecasting and project risk evaluation. Key points include defining programme management as coordinating multiple related projects, identifying expected benefits, quantifying and balancing costs and benefits, evaluating risks, and using techniques like net present value, internal rate of return and decision trees to evaluate projects.