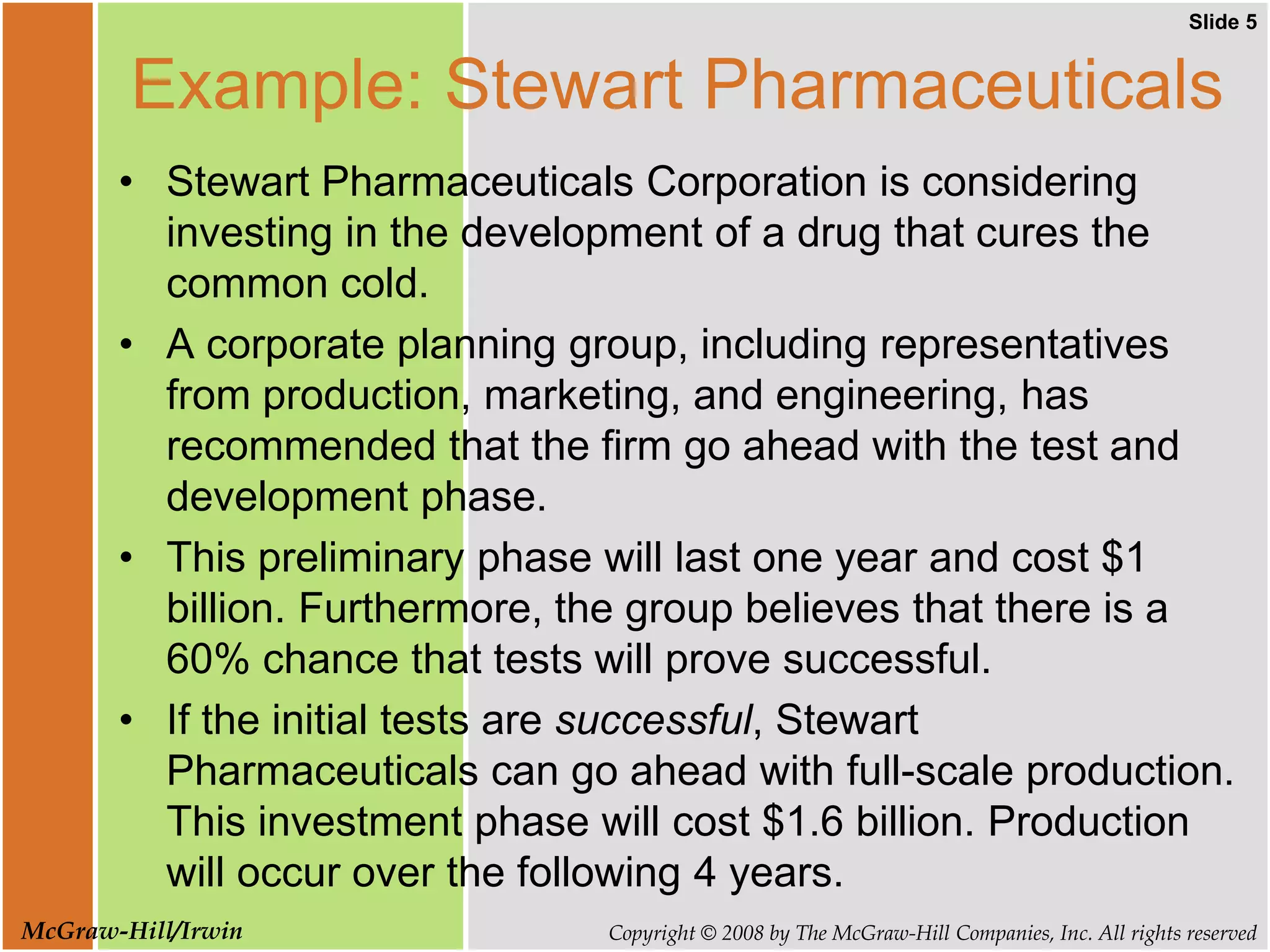

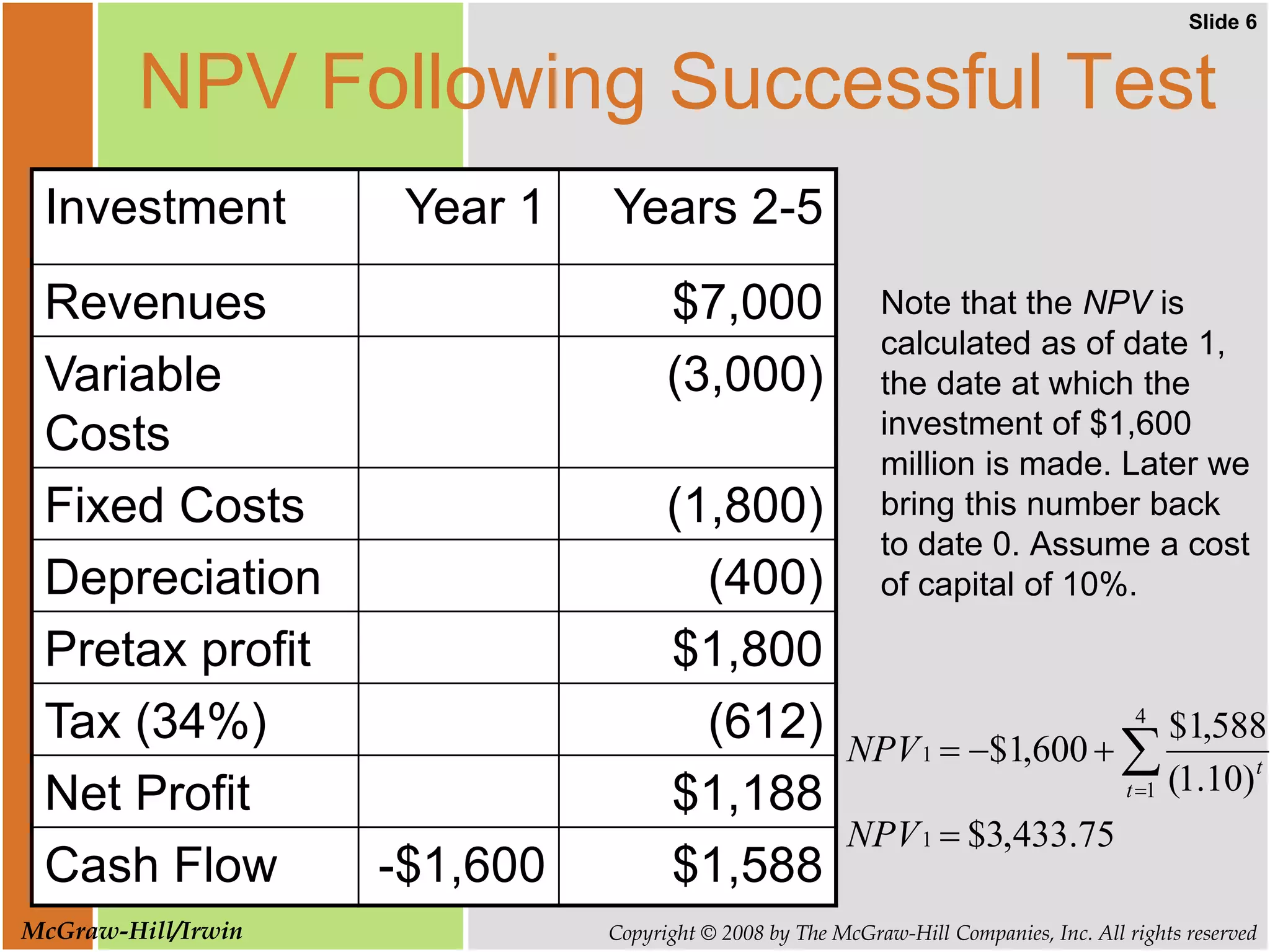

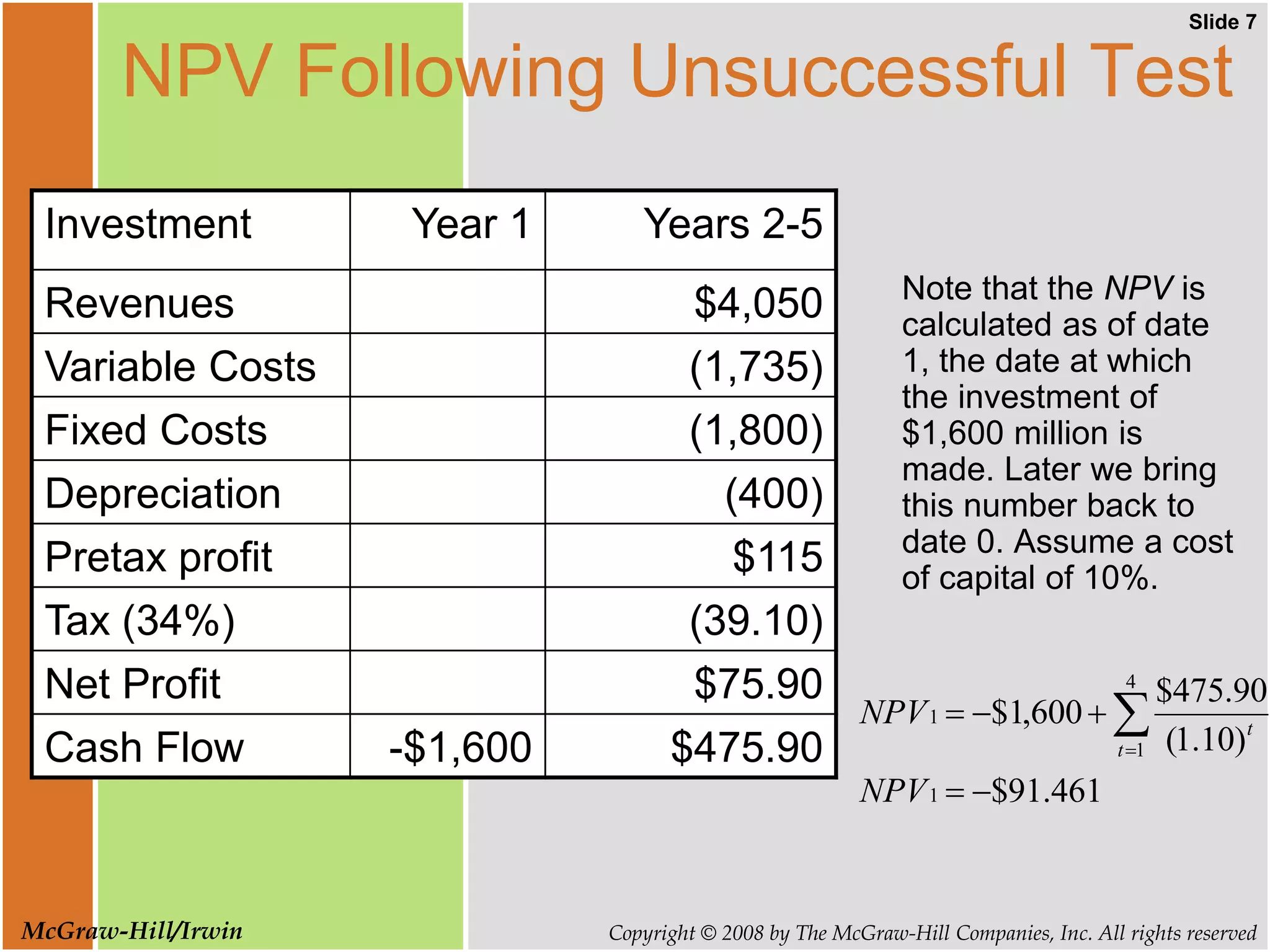

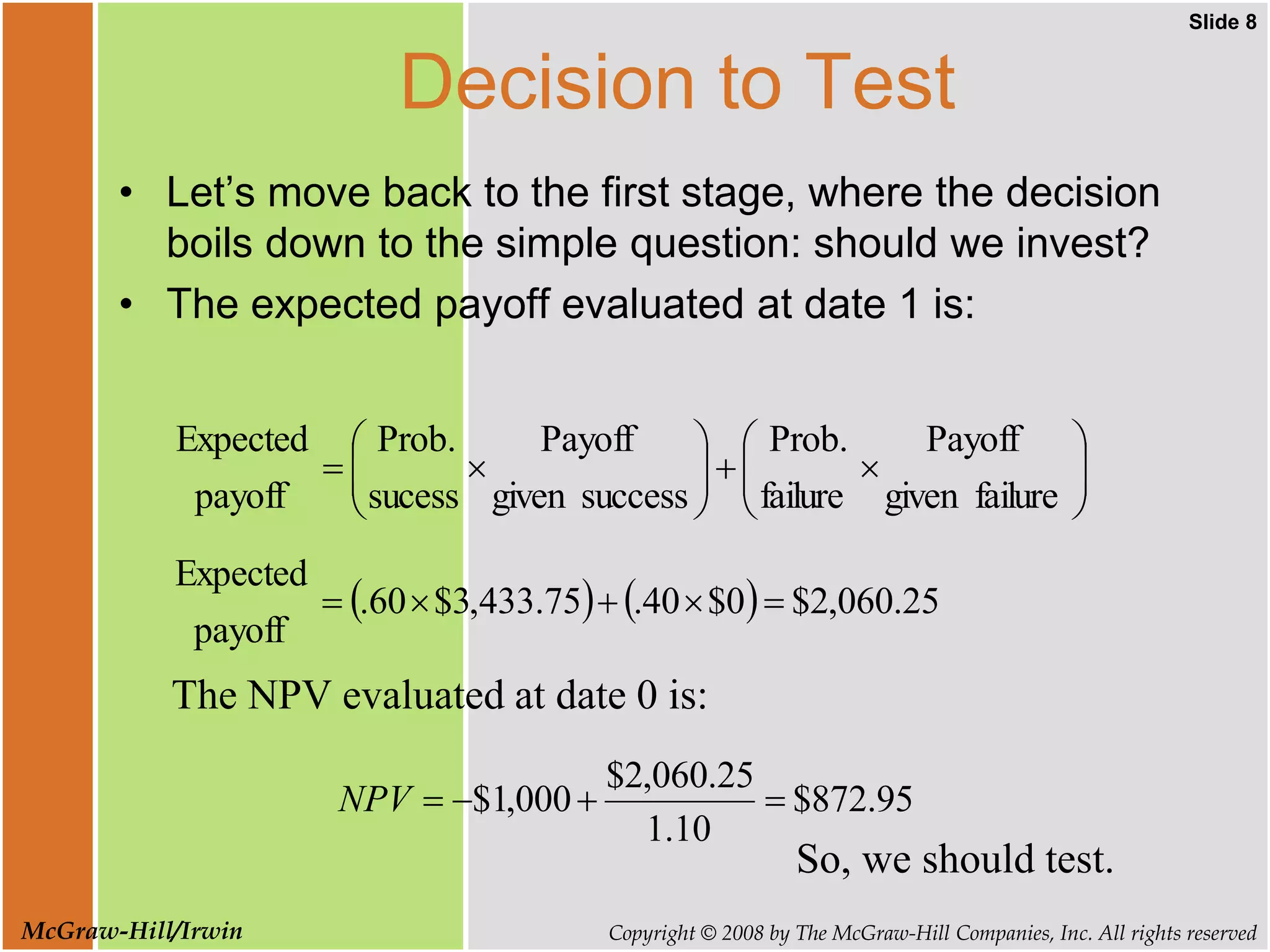

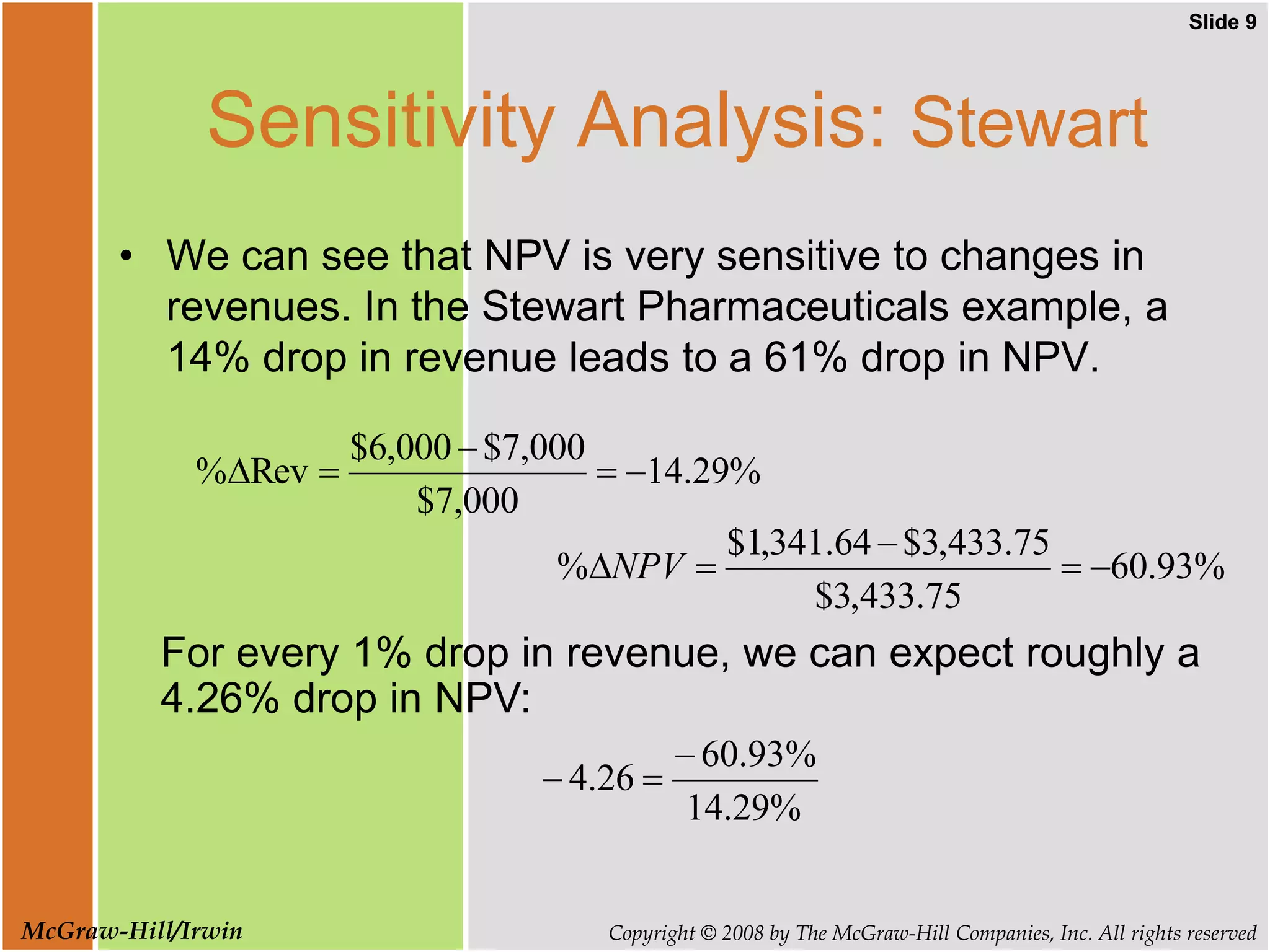

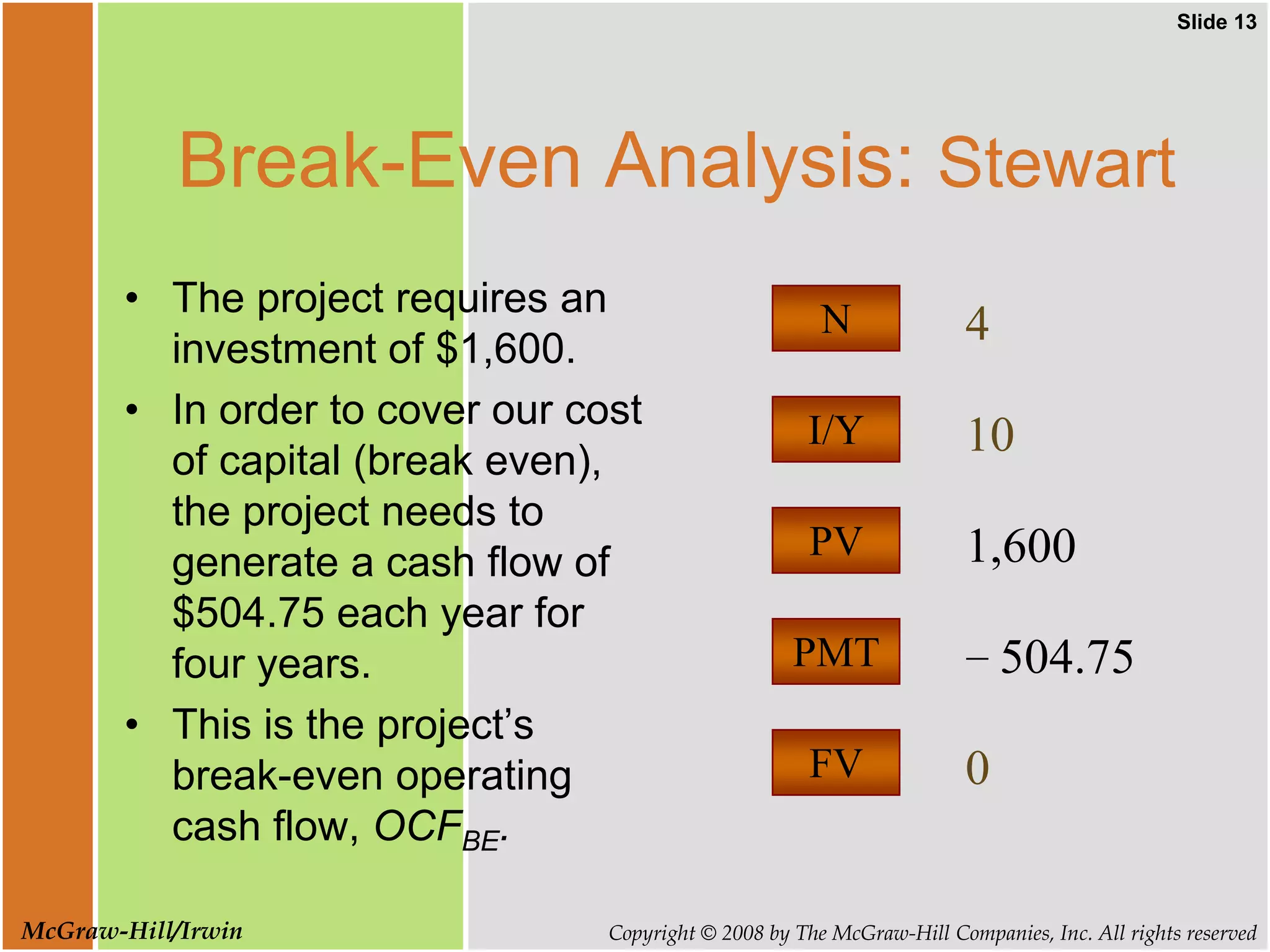

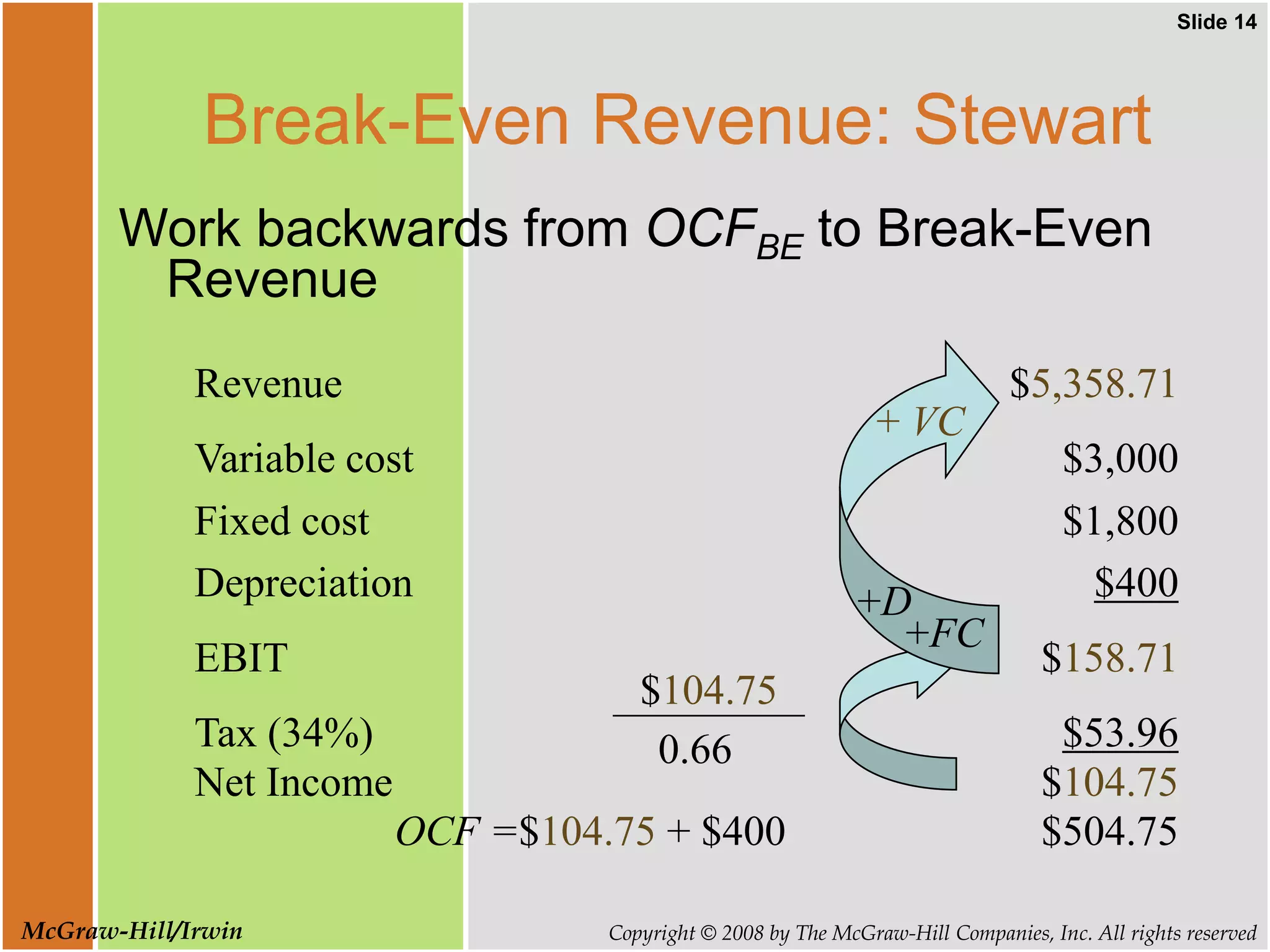

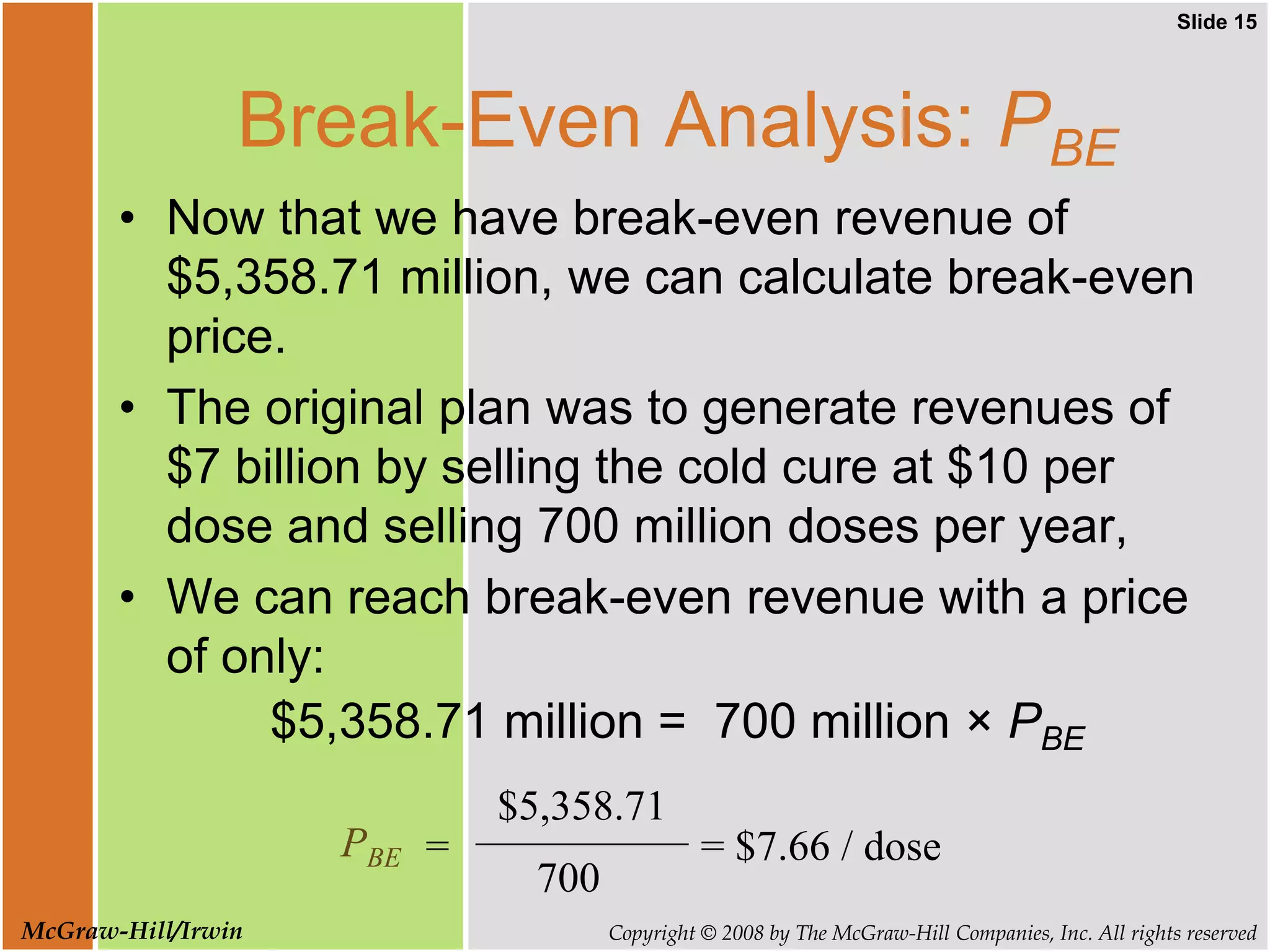

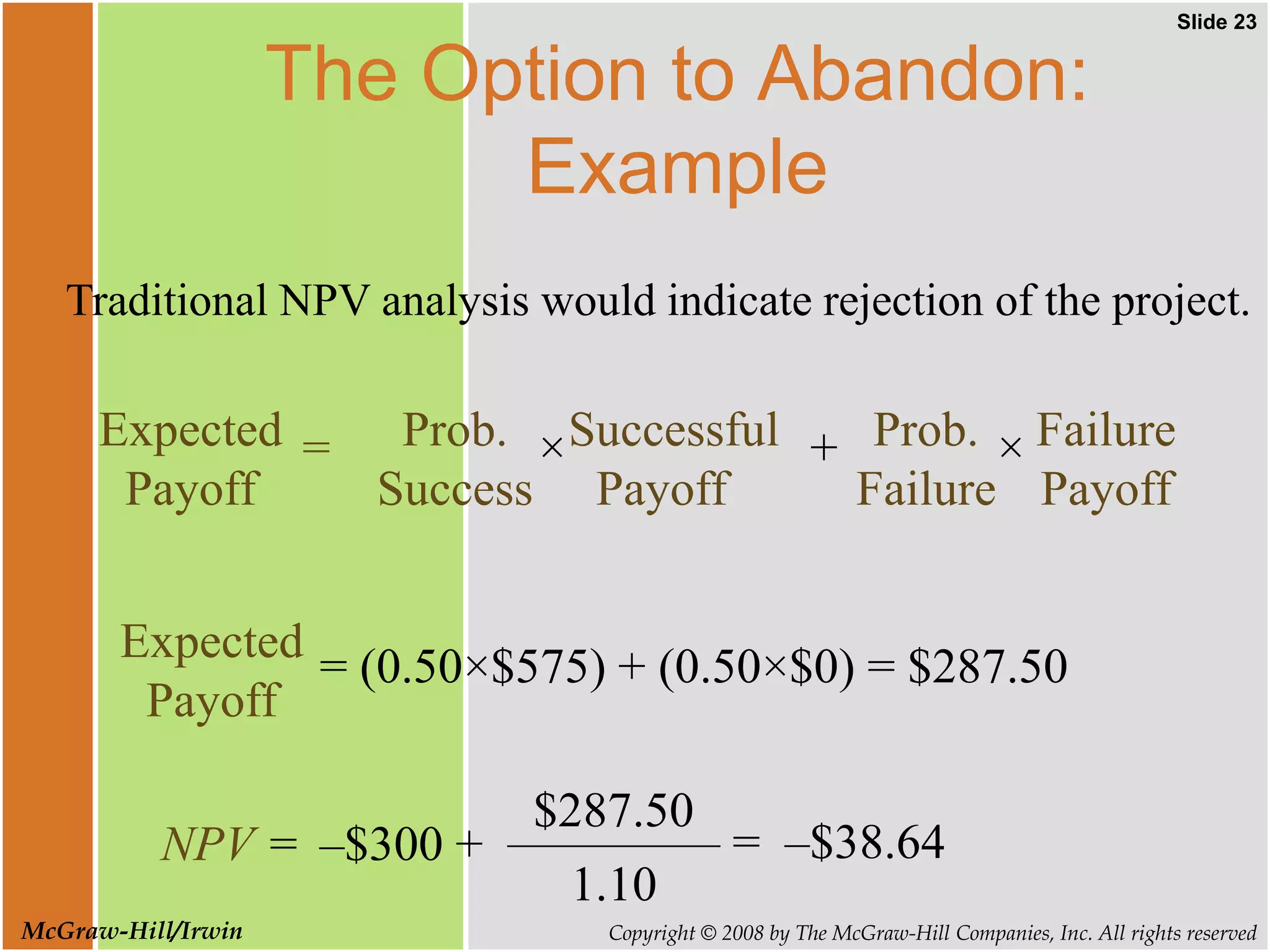

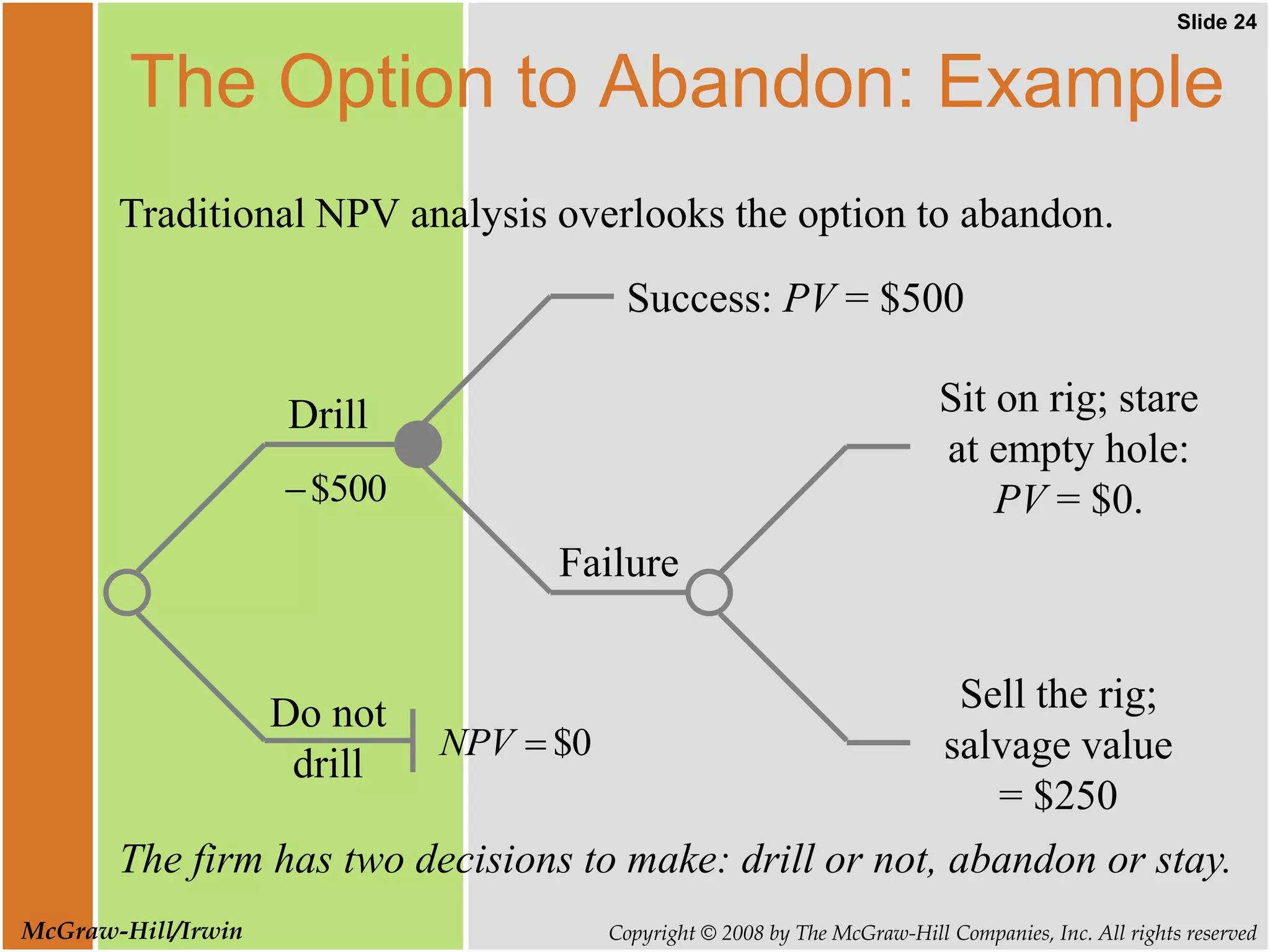

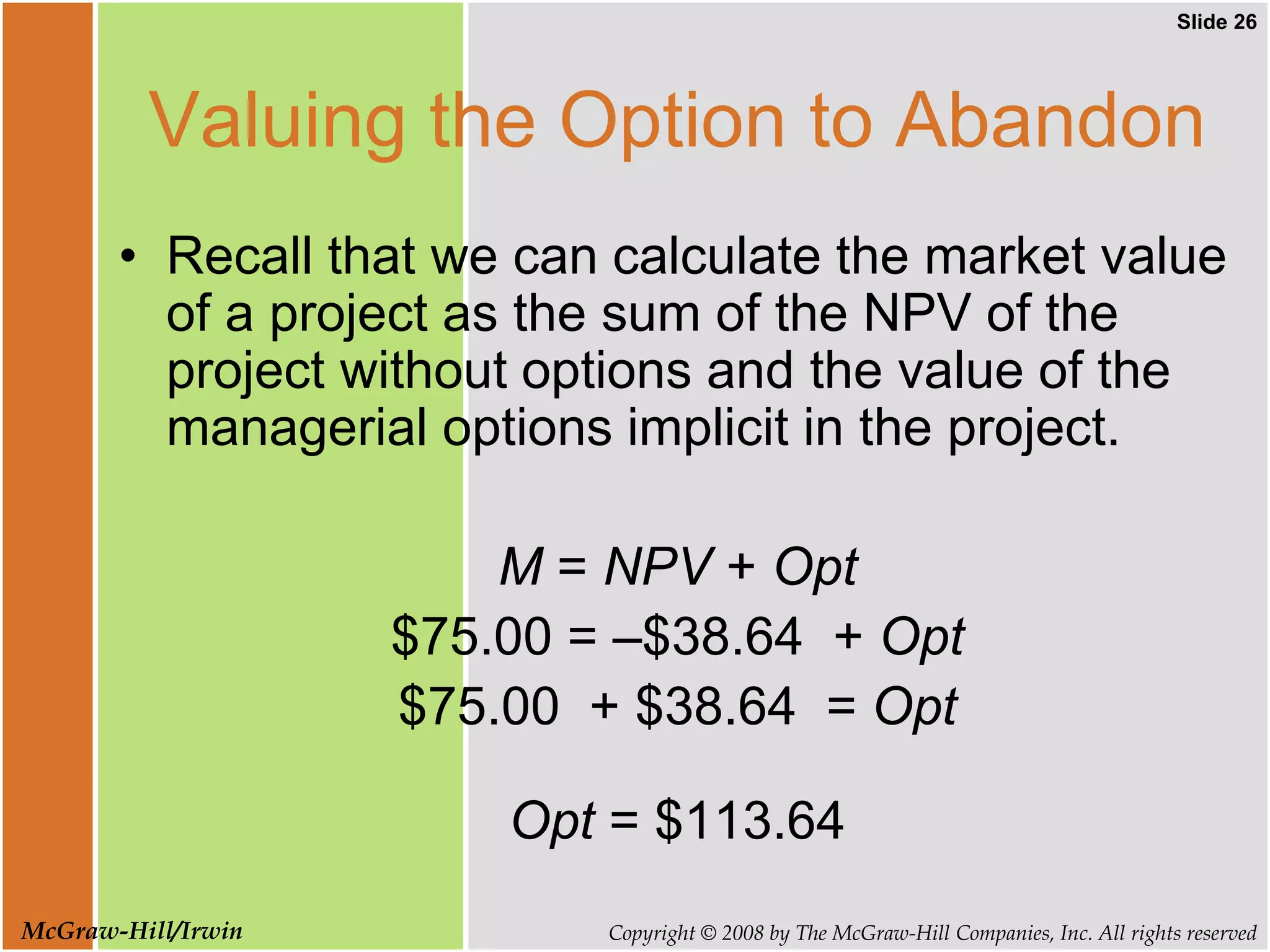

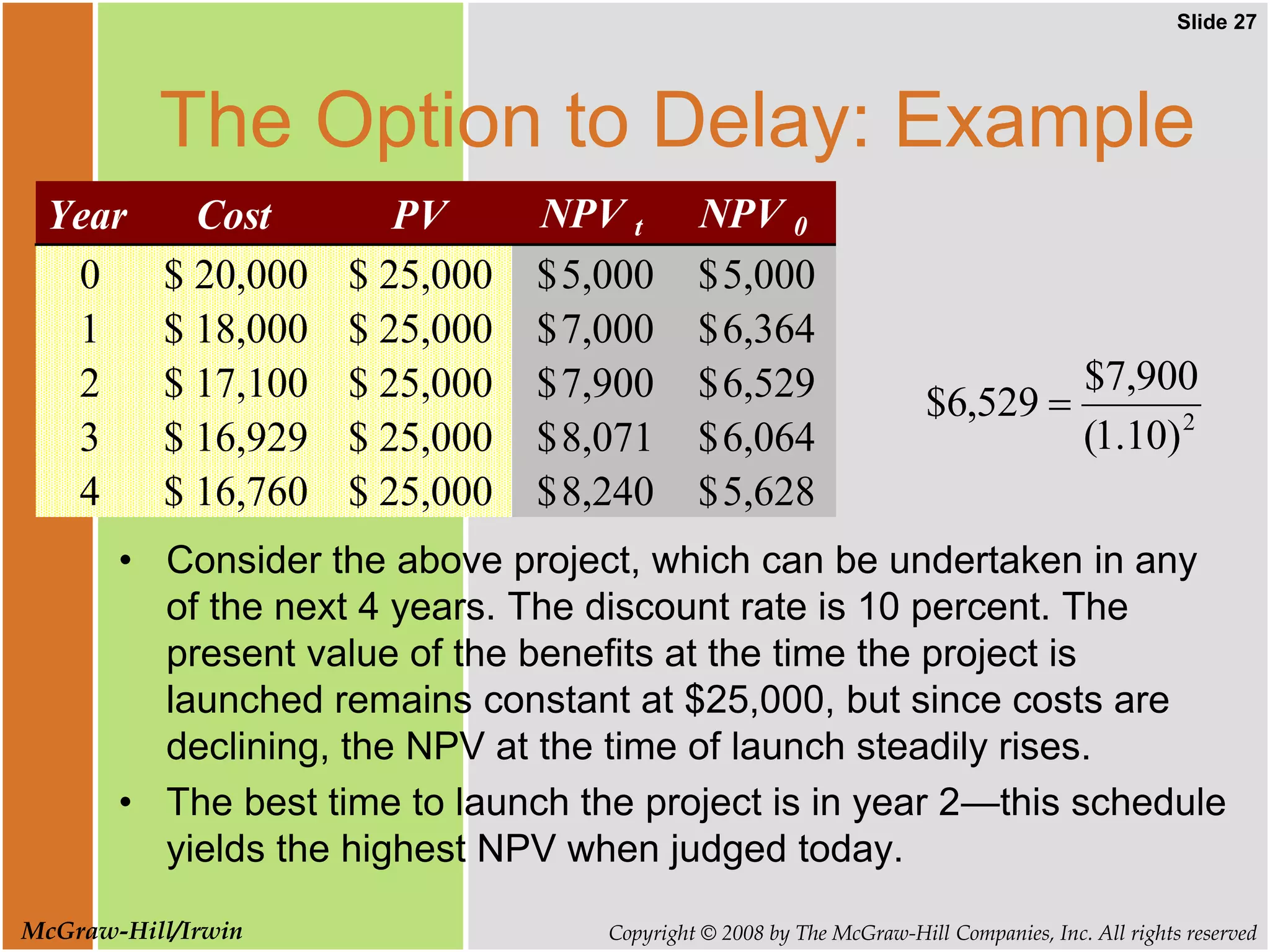

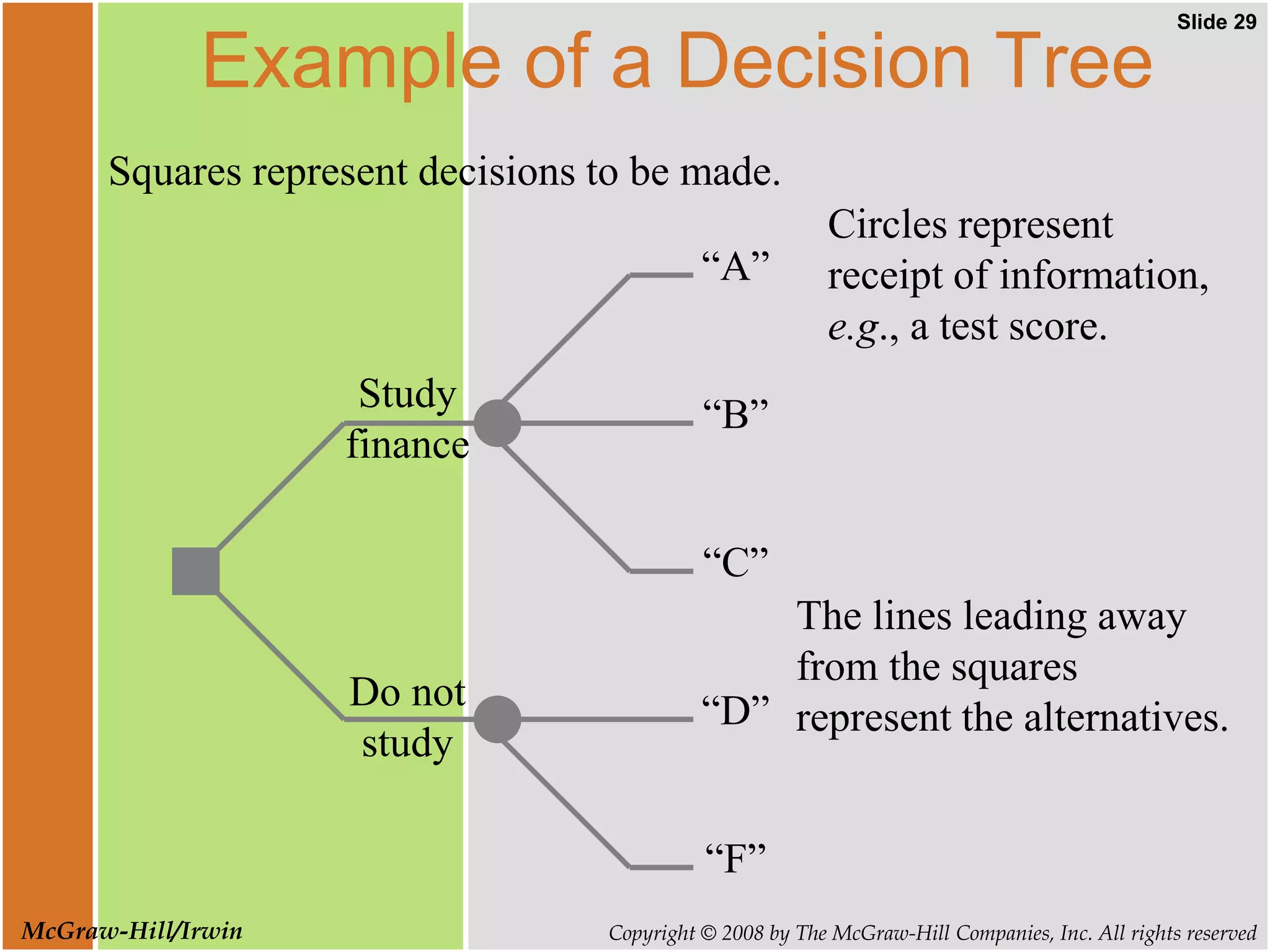

This document outlines key concepts related to risk analysis, real options, and capital budgeting. It covers topics like sensitivity analysis, Monte Carlo simulation, real options, and decision trees. Specific examples are provided, such as evaluating a pharmaceutical company's decision to invest $1 billion in testing a potential cure for the common cold. Break-even analyses are also demonstrated to determine the revenue and price needed for projects to reach the break-even point.