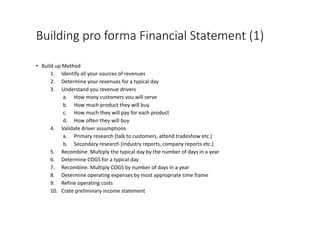

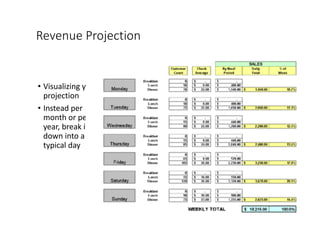

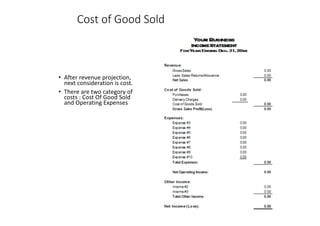

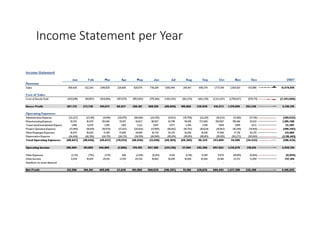

The document discusses common mistakes made when creating pro forma financial statements for a business, including underestimating costs and revenues, and not accounting for the time needed to generate revenue and secure financing. It then provides guidance on building accurate pro forma financial statements through bottom-up forecasting of revenues and costs, comparison to industry benchmarks, and creation of income statements, cash flow projections, and balance sheets on a monthly and annual basis for the first few years of the business.