Embed presentation

Downloaded 71 times

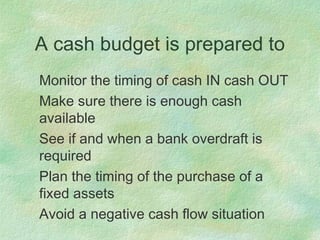

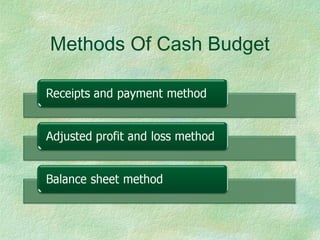

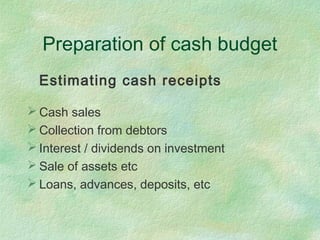

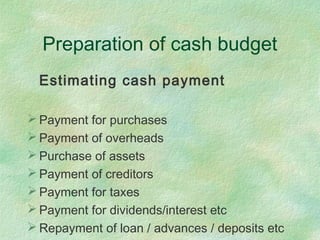

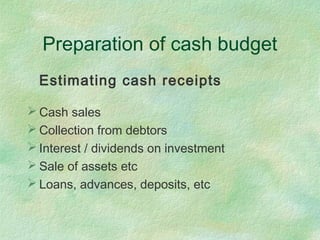

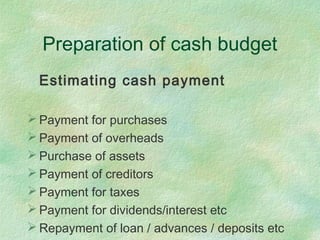

This document provides information about cash budgeting including what a cash budget is used for, items included in cash inflows and outflows, and how adjustments can be made. A cash budget monitors the timing of cash in and out, ensures enough cash is available, and identifies if and when an overdraft is required. Cash inflows include sales, loans, and asset sales, while outflows include expenses, principal payments, asset purchases, and ending cash. Cash budgets can be prepared annually, quarterly, bi-monthly, or monthly and estimate cash flows over the periods.