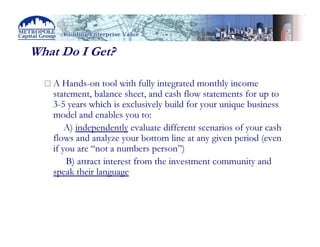

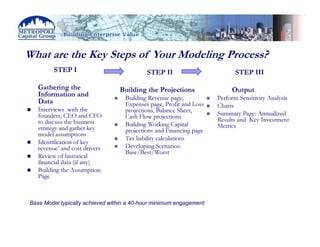

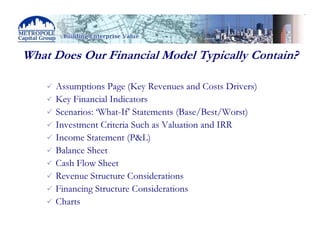

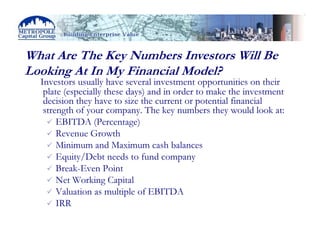

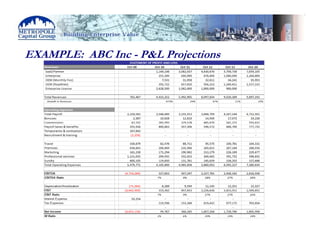

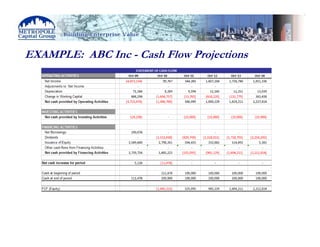

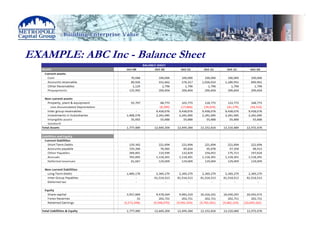

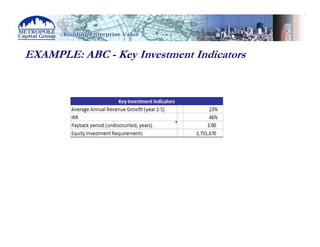

The document discusses the importance of creating financial projections, also known as a financial model, for both attracting investors and managing a business. It explains that a financial model forecasts key financial metrics like revenue, expenses, profits, cash flows, and balance sheets. Building the model requires gathering business assumptions and data to develop mathematical formulas that project how the business will perform financially. The model output includes income statements, cash flow statements, charts, and key investment indicators that investors consider like EBITDA, revenue growth, cash balances, valuation, and internal rate of return. Creating a customized model captures the unique aspects of a business and allows evaluating "what if" scenarios to understand the financial implications of different assumptions.