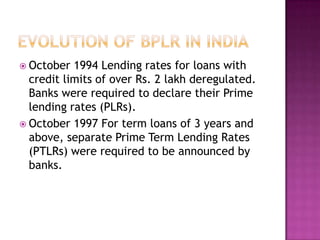

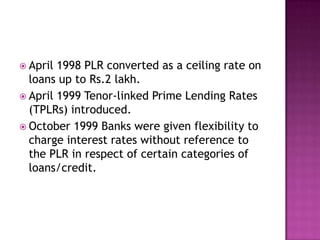

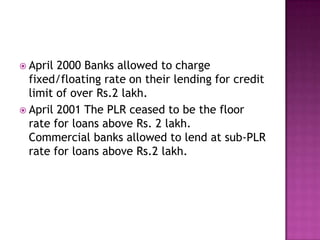

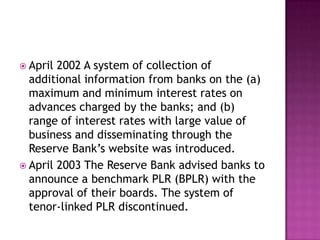

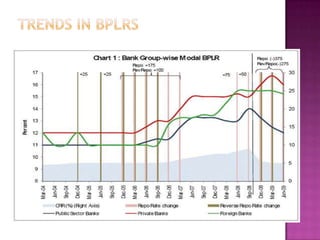

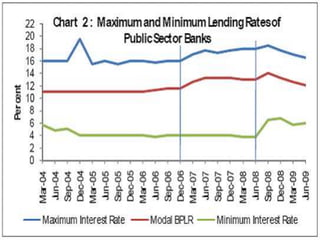

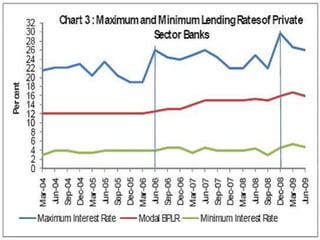

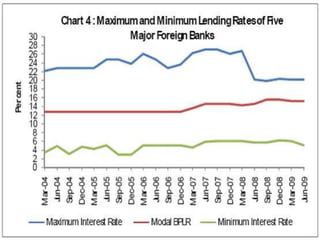

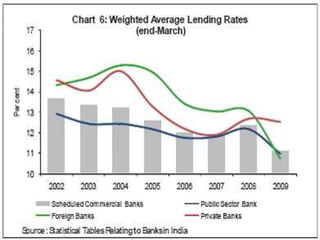

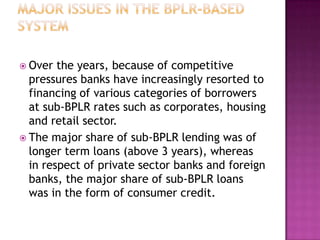

The document discusses the prime lending rate (PLR), which is a reference interest rate used by banks to lend to favored customers. It provides an overview of the history and regulation of PLR in India, including the introduction of the benchmark prime lending rate (BPLR) in 2003. The summary also notes that banks have increasingly lent below the BPLR due to competitive pressures and issues with the transparency and downward stickiness of the BPLR.