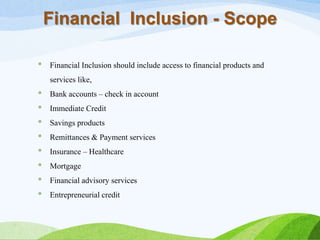

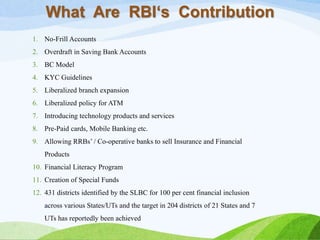

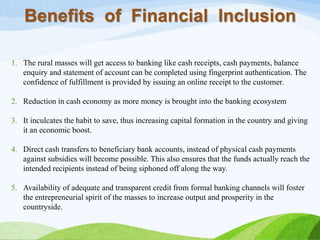

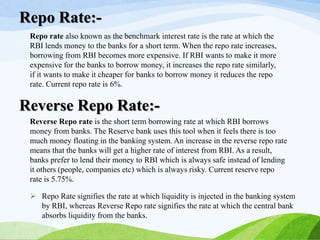

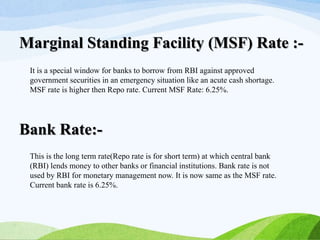

This document provides information on various key terms related to financial inclusion and interest rates in India. It defines financial inclusion as ensuring access to appropriate financial products and services for all sections of society, especially vulnerable groups, at an affordable cost. It discusses the Reserve Bank of India's role in promoting financial inclusion through various initiatives like no-frills accounts, business correspondent models, and financial literacy programs. The document also explains terms like repo rate, reverse repo rate, cash reserve ratio, statutory liquidity ratio, base rate, and call rates which are tools used by RBI to regulate monetary policy and liquidity in the banking system.