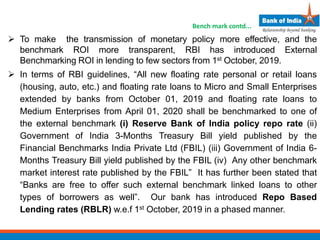

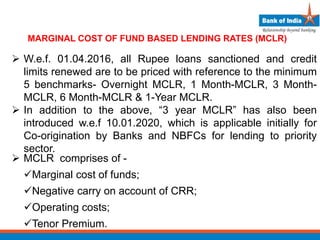

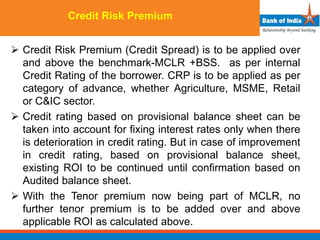

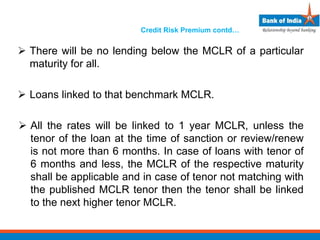

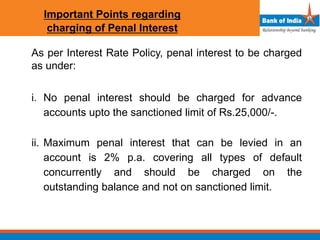

The document discusses the evolution of interest rate policies on advances in India. It begins with deregulation of interest rates in 1977, which gave banks freedom to set their own benchmark rates. Over time, various benchmarks were introduced, including the Base Rate system in 2010 and Marginal Cost of Funds based Lending Rates (MCLR) in 2016. MCLR comprises four components and is the minimum rate below which banks cannot lend. In 2019, the Reserve Bank of India mandated external benchmarks for certain loans, leading banks to introduce Repo Based Lending Rates (RBLR) linked to the repo rate. The document provides details on the composition of MCLR and RBLR and the applicability of these rates