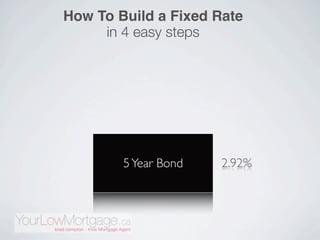

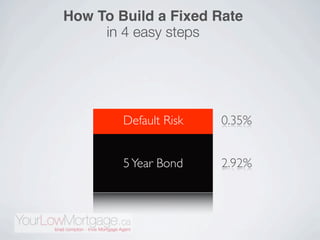

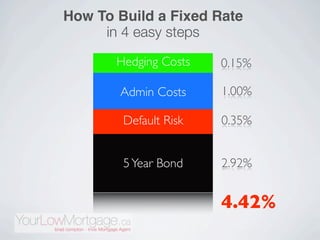

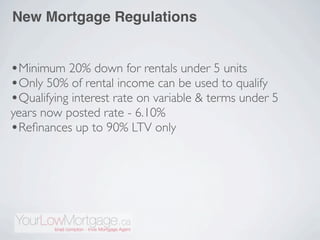

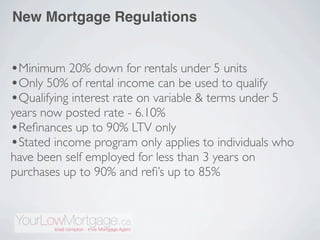

The document discusses the current state and future projections of fixed and variable interest rates, emphasizing factors that influence them and consumer protection strategies. It highlights the Bank of Canada's prime lending rate, anticipated increases, and recent mortgage regulation changes, including stricter requirements for rental properties. Key recommendations for consumers include obtaining pre-approval and considering refinancing options.