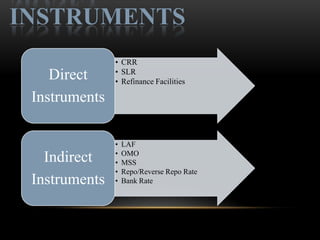

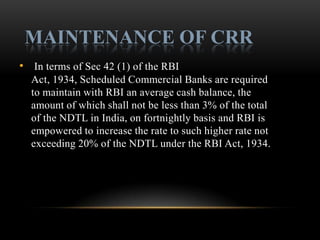

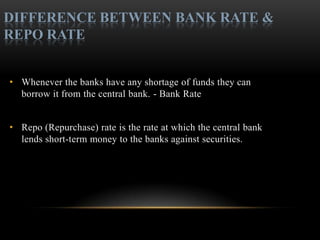

The document discusses various monetary policy instruments used by the Reserve Bank of India to regulate money supply and credit conditions. It explains key tools like cash reserve ratio (CRR), statutory liquidity ratio (SLR), refinance facilities, open market operations (OMO), liquidity adjustment facility (LAF), market stabilization scheme (MSS), repo rate, reverse repo rate, and bank rate. It provides details on how these tools work and their impact on the economy, interest rates, exchange rates, inflation, and common people.