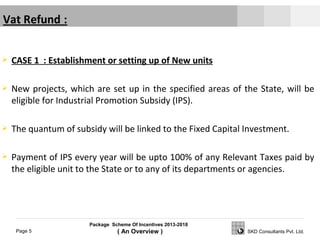

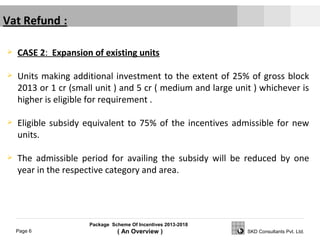

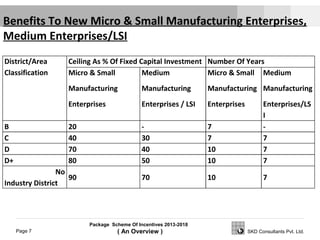

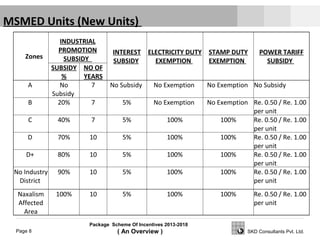

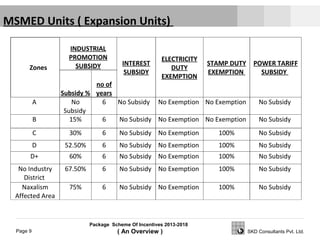

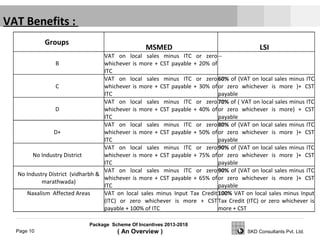

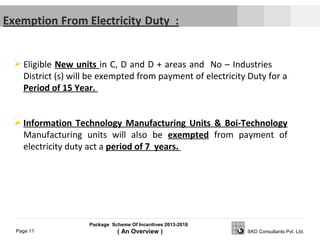

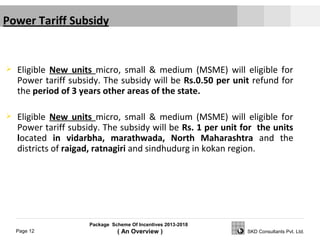

The document provides an overview of Maharashtra's Package Scheme of Incentives from 2013-2018. The scheme aims to promote industrialization by providing various fiscal incentives to new and expanding industrial units based on their location and investment size. Key benefits include VAT refunds, electricity duty exemption, power tariff subsidy, interest subsidy, and stamp duty waiver. Eligible units must fall under micro, small, medium or large & mega categories and be located in designated incentive zones to qualify for the subsidies and tax breaks outlined in the scheme.