This document discusses price discrimination, specifically dumping as a form of price discrimination. It provides definitions of price discrimination and dumping. Price discrimination occurs when a firm charges different prices for the same good that are not proportional to differences in costs. Dumping is a specific type of price discrimination where a firm sells a product in a foreign country for less than the price charged domestically or for less than the cost of production. The document explores reasons why firms may engage in dumping and issues it can cause.

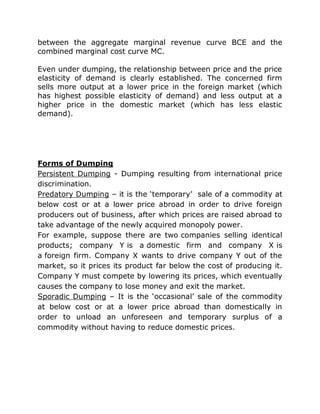

![The price determination under dumping is slightly different from

the one explained earlier, where the firm enjoys monopoly power

in each sub-market. Under dumping, instead of taking just lateral

summation of the two marginal revenue curves,[we take the

composite curve BCE as the aggregate] marginal revenue (AMR)

curve. The firm will be in equilibrium at point 'E‘ where this curve

is intersected! by its given marginal cost curve MC from below.

The equilibrium output OQF determined by dropping perpendicular

on the X-axis is to be distributed between the home market and

the foreign market in such a way that marginal revenue in each

market is equal to each other and to the marginal cost EQ F It is

clear from Fig. 4 that 'C' is the point of equilibrium of the firm in

the home market, where marginal revenue CQ D is equal to

marginal cost EQF. Thus, OQD amount of total output is sold in the

home market.

Fig. 4: Price Determination under Dumping

It is clear from the ARD curve of the firm that RQD or OPD price

will be charged for OQD amount of output in the home market.

The remaining amount OQF ? OQD = QDQF of the total output will

be sold in the foreign market. The total output in the two markets

is OQD + QDQF = OQF. The profit maximizing equilibrium condition

of the firm can be written as MRD = MRF = AMR = MC. The total

profit of the firm is given by the shaded area shown in Fig. 4](https://image.slidesharecdn.com/dumping-pricediscrimination-110401055552-phpapp02/85/Dumping-price-discrimination-8-320.jpg)