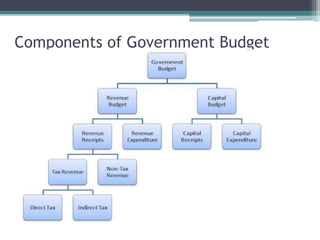

The document defines and explains the key components of a government budget. It notes that a budget is a financial plan that shows projected income and expenditures for a fiscal year. It has two main components: the revenue budget and the capital budget. The revenue budget includes revenue receipts like taxes and non-tax revenues, as well as expenditures funded by these receipts. The capital budget includes capital receipts like borrowings and asset sales, as well as capital expenditures for long-term assets. In totality, the budget reflects the government's financial plans and position.