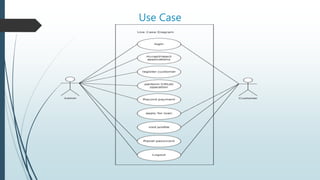

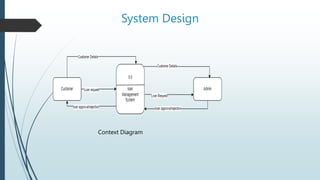

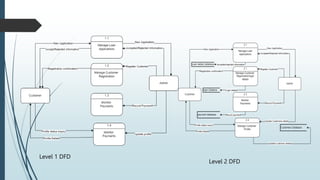

This document outlines a loan management system created by Raksha Paudel. The system was created for Grahak Upayog Saving and Credit Co-operative Limited to help manage their loan application and customer data. Previously, the organization's processes were manual, time-consuming and error-prone. The new system allows customers to apply for loans online and check their loan profiles. It aims to reduce manual work, protect data by limiting access, and provide an online service for customers. The system was created using tools like Xampp server, PHP, HTML, JavaScript, CSS and Bootstrap. It allows most work to be done digitally, sends emails to customers, and secures data by restricting access to authorized users only