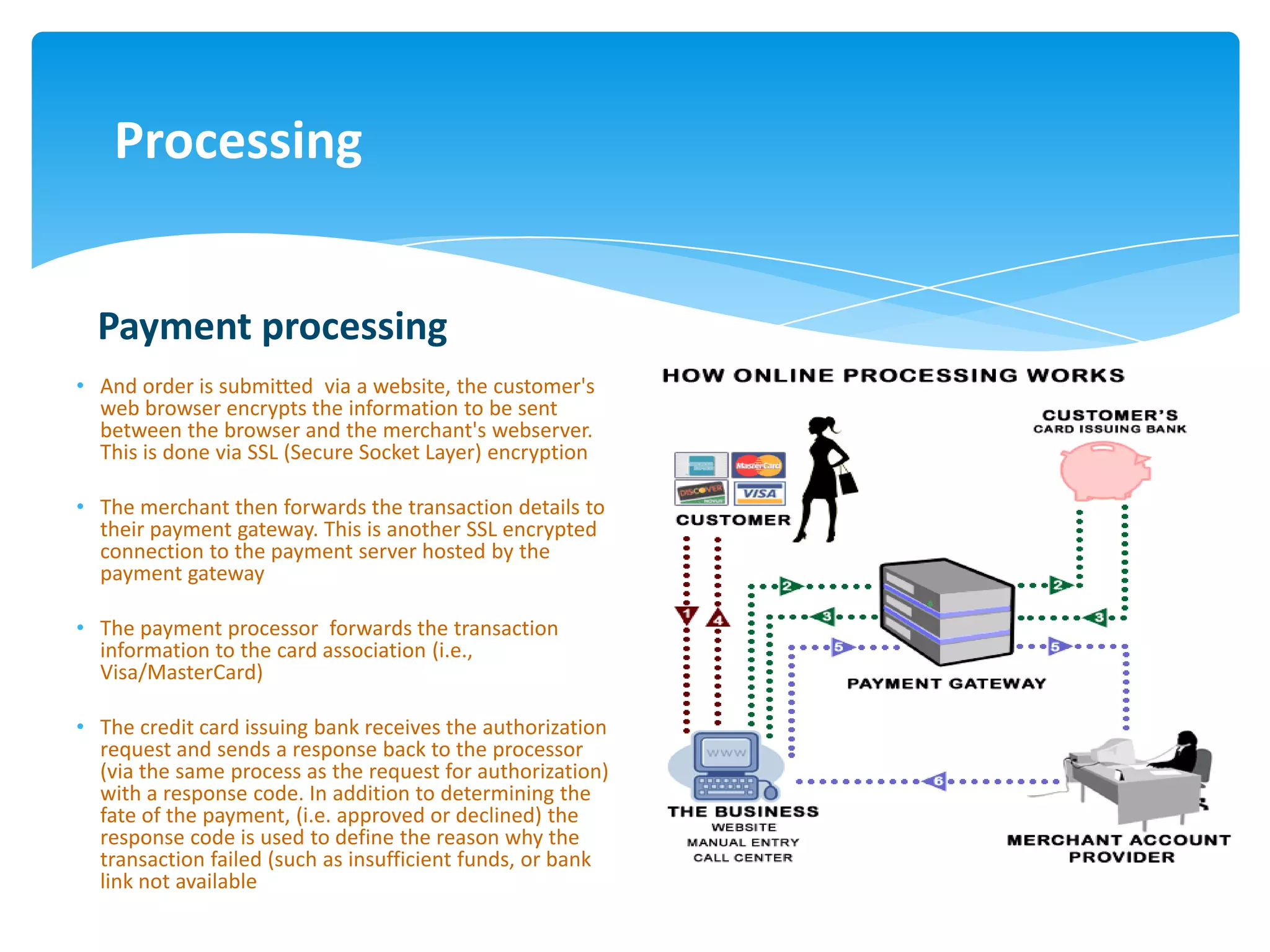

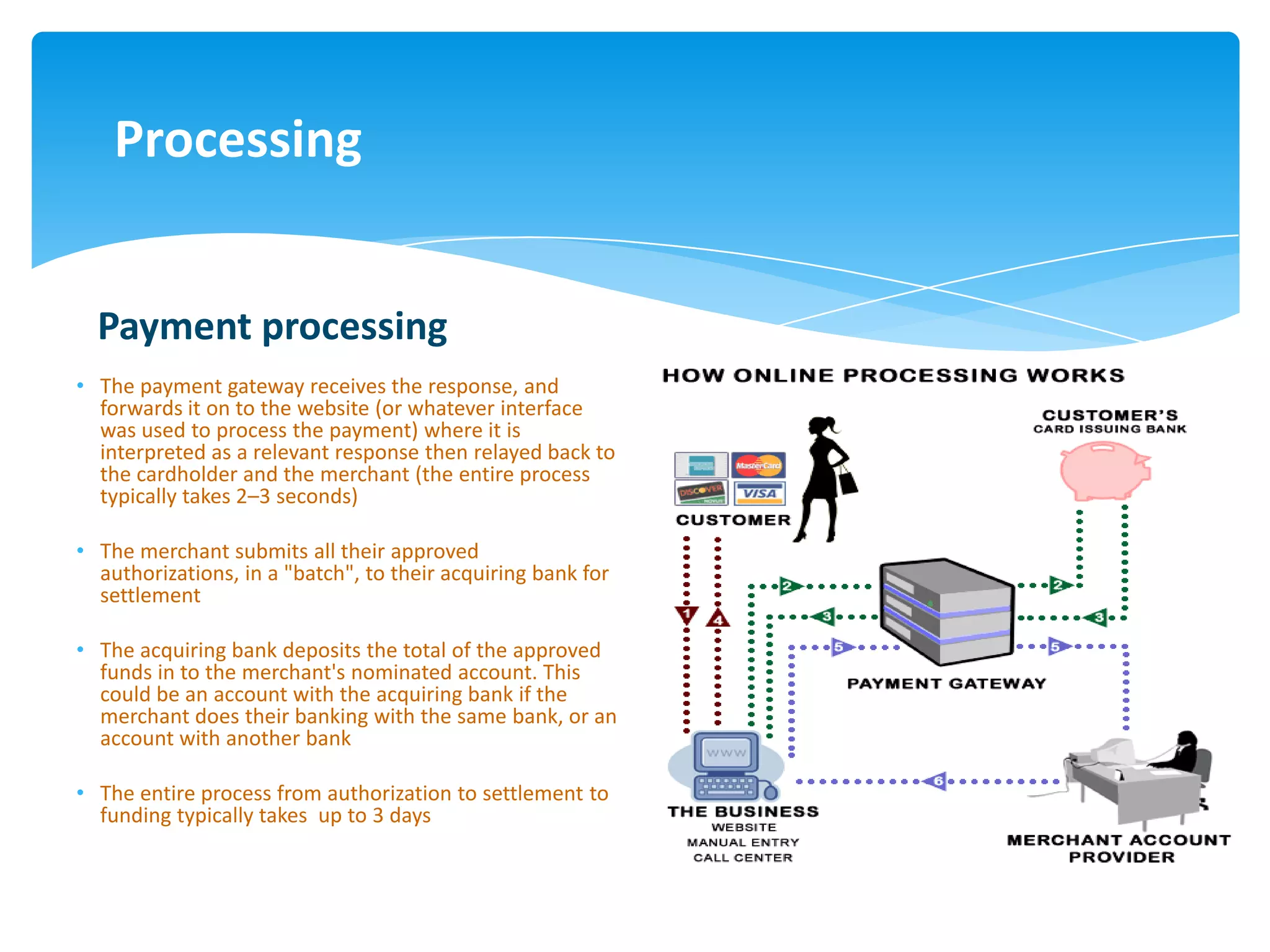

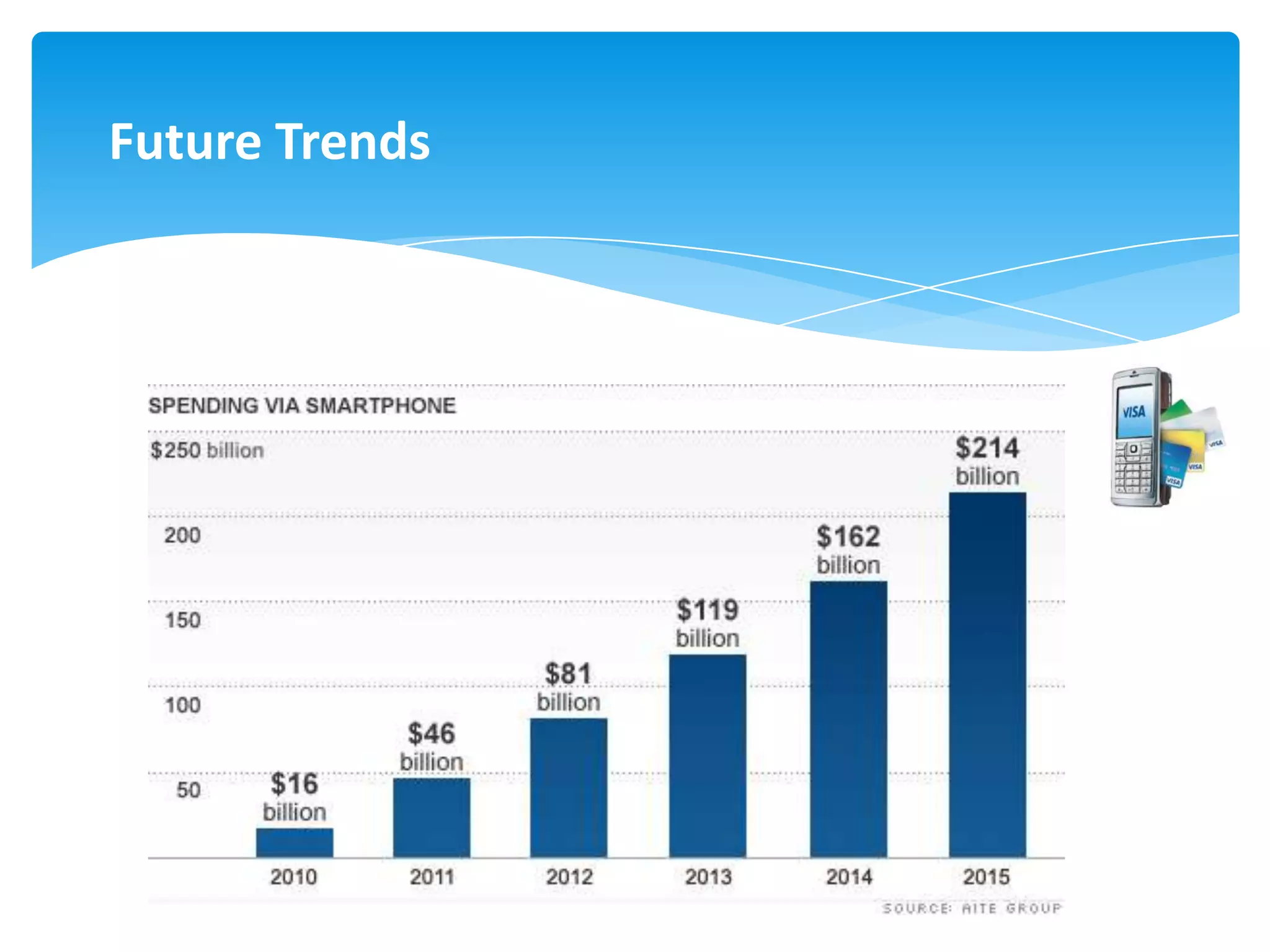

This document discusses payment gateways, processing of payments, and future trends in mobile payments. It provides an overview of how payment gateways facilitate transactions between merchants and banks. It describes how payments are processed, including encryption of data and authorization. It also discusses security measures like 3D Secure and PCI compliance. Finally, it outlines emerging technologies for mobile payments, including storing payment details on devices and using phones for contactless "tap and pay" transactions.