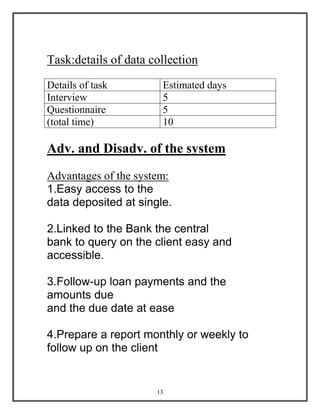

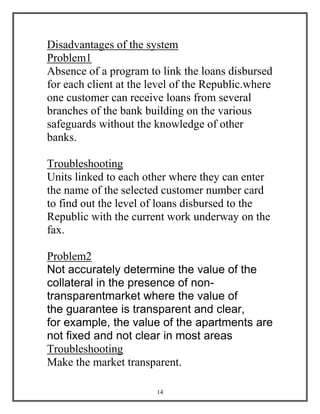

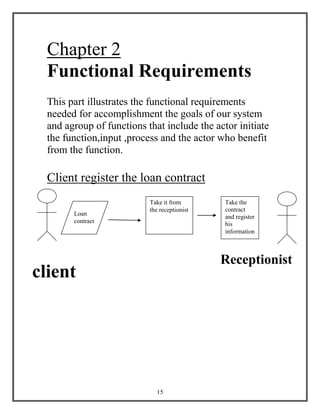

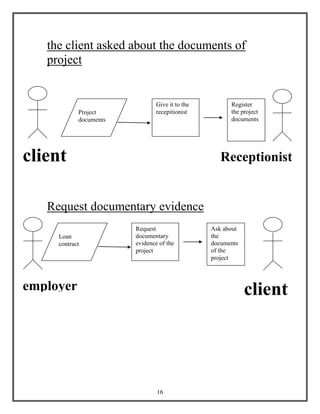

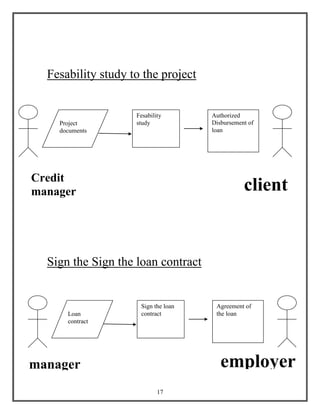

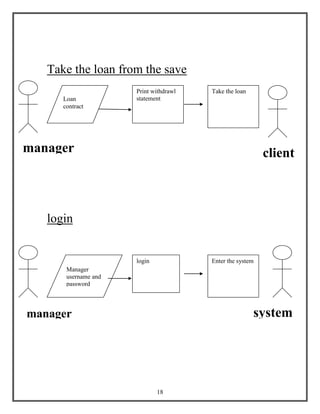

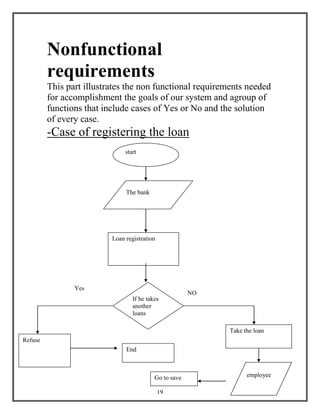

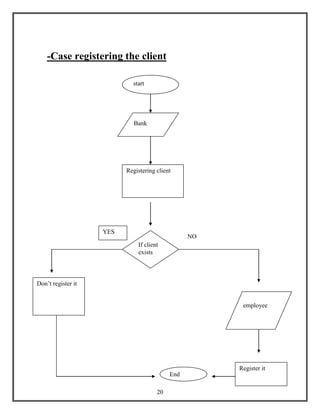

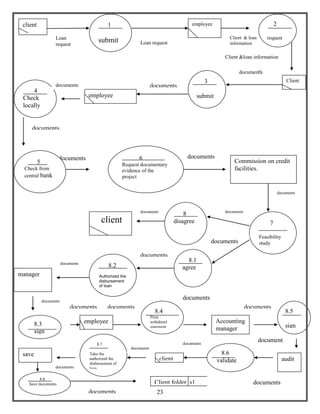

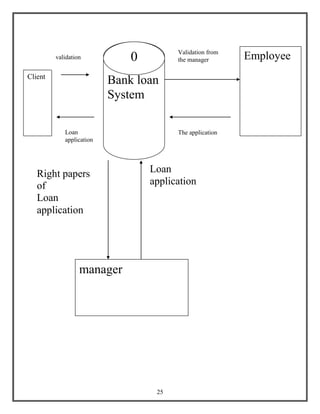

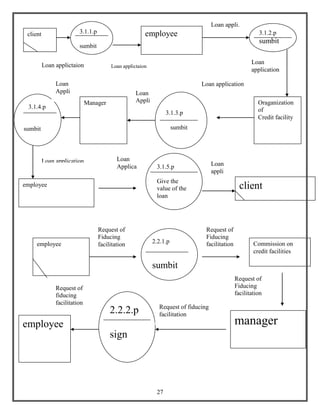

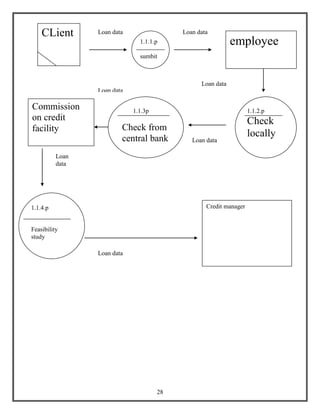

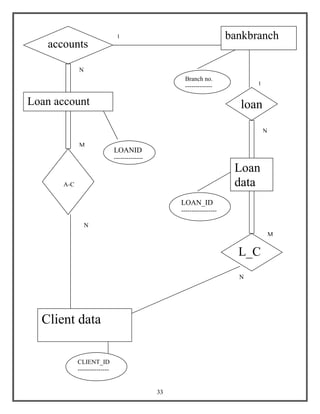

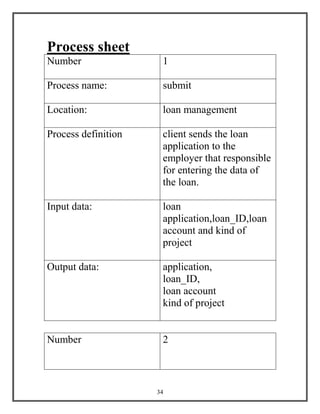

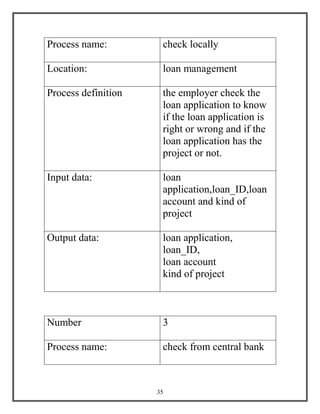

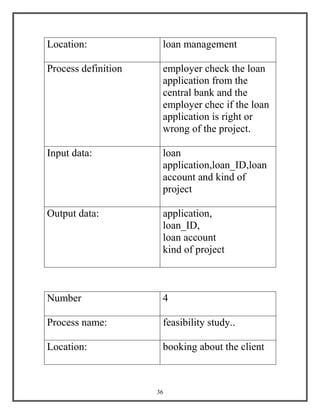

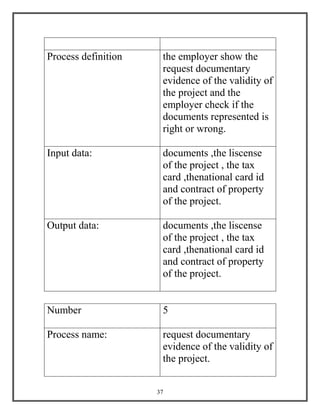

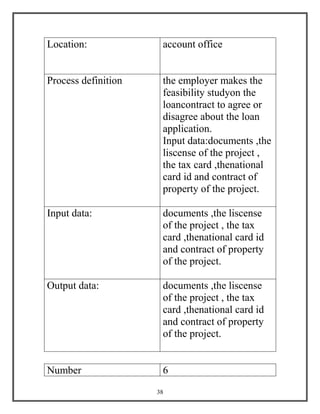

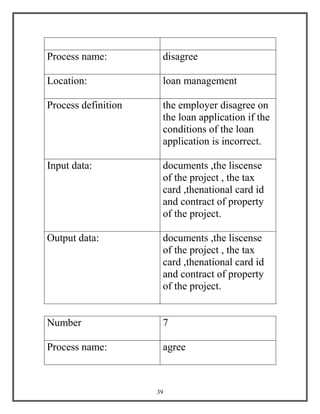

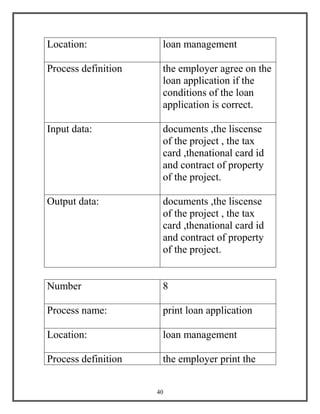

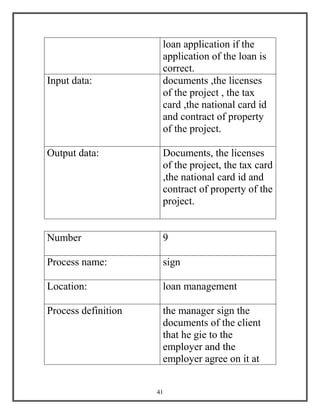

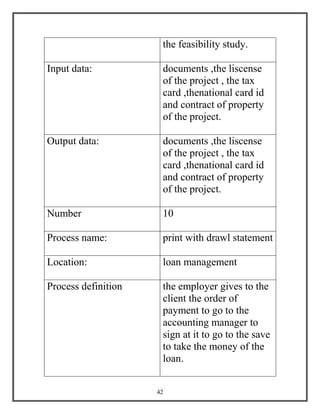

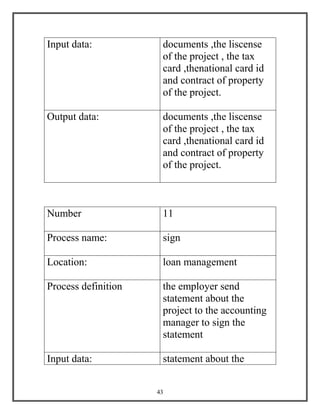

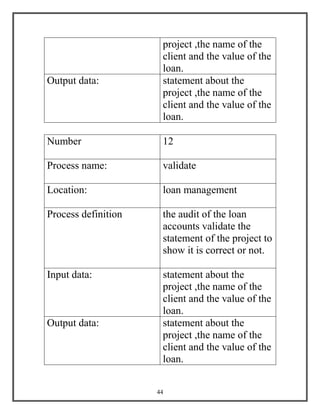

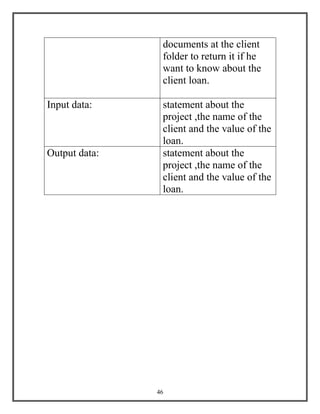

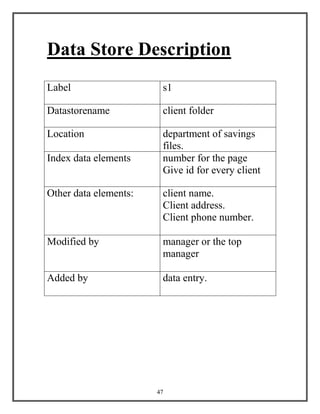

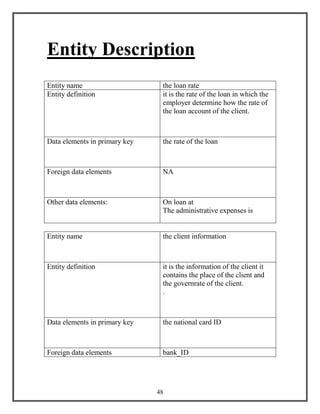

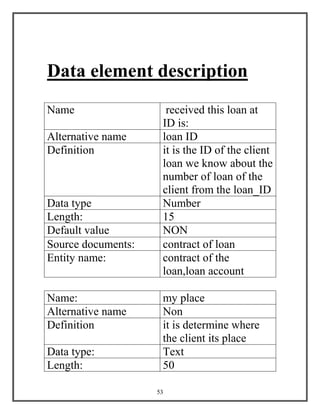

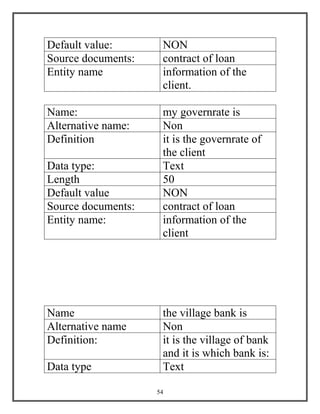

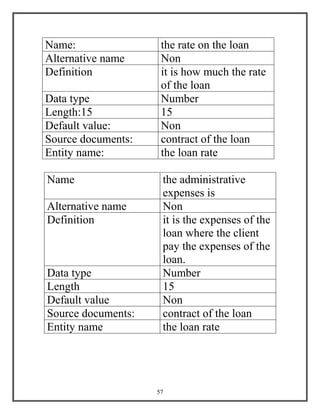

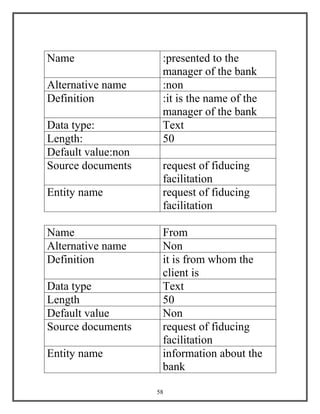

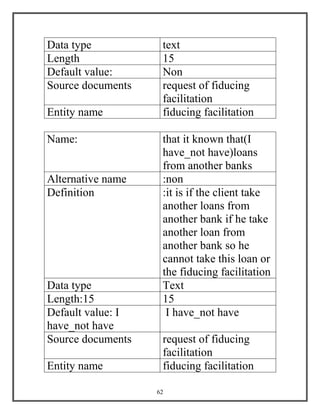

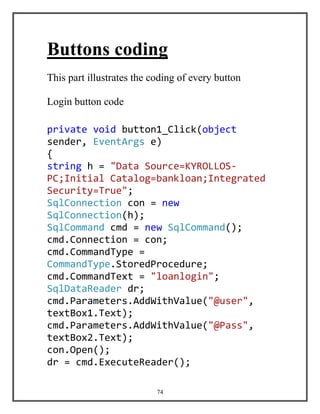

The document outlines the details of a graduation project for a banking loan system, including an introduction, objectives, requirements, functional requirements, data flow diagrams, and various other sections detailing the analysis and design of the system. The project aims to computerize the loan process for a bank and provide a decision support system to help managers determine if clients should be approved for loans. The system will manage client and loan data, allow for loan applications and approvals, and facilitate taking and repaying loans.