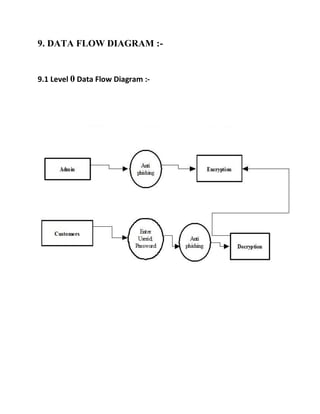

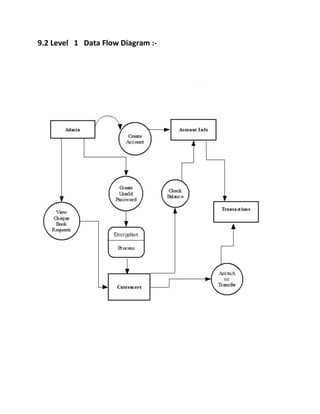

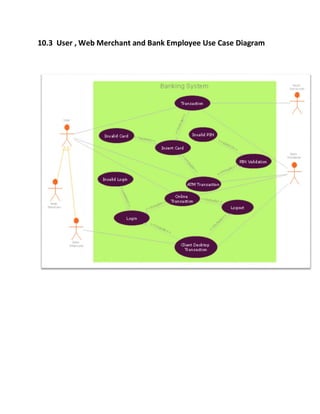

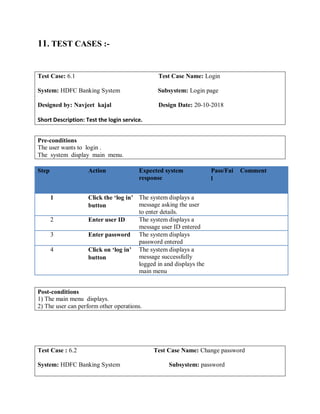

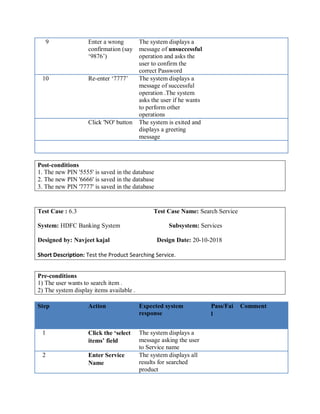

The document is a project report on HDFC Bank submitted by Navjeet Kajal in partial fulfillment of the requirements for a Bachelor of Technology degree in Computer Science and Engineering. It provides an overview of HDFC Bank and describes the functional specifications of an online banking system, including login, validation, payment and transfer of money, and transaction reporting. It covers the interface requirements, performance requirements, and definitions for key terms. Data flow diagrams and use case diagrams are also included.