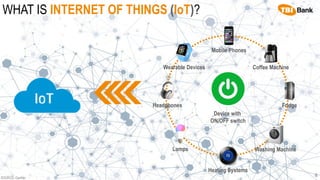

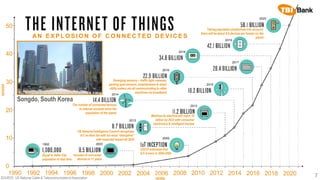

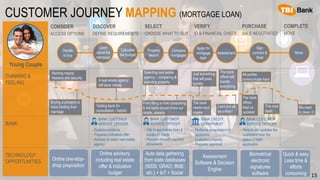

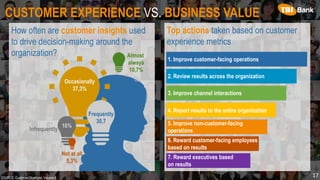

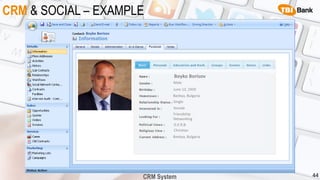

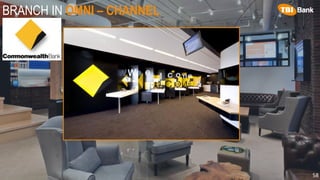

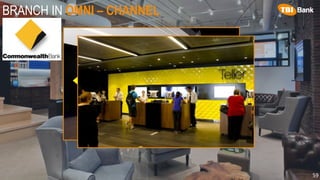

The document discusses digital banking and omni-channel banking. It covers topics like internet banking, mobile banking, the internet of things, customer experience, content creation, data analytics, predictive analytics, CRM systems, and ensuring consistency across channels. The key aspects are using customer data and insights to improve the customer experience across online, mobile, and physical channels to provide a seamless omni-channel banking experience.