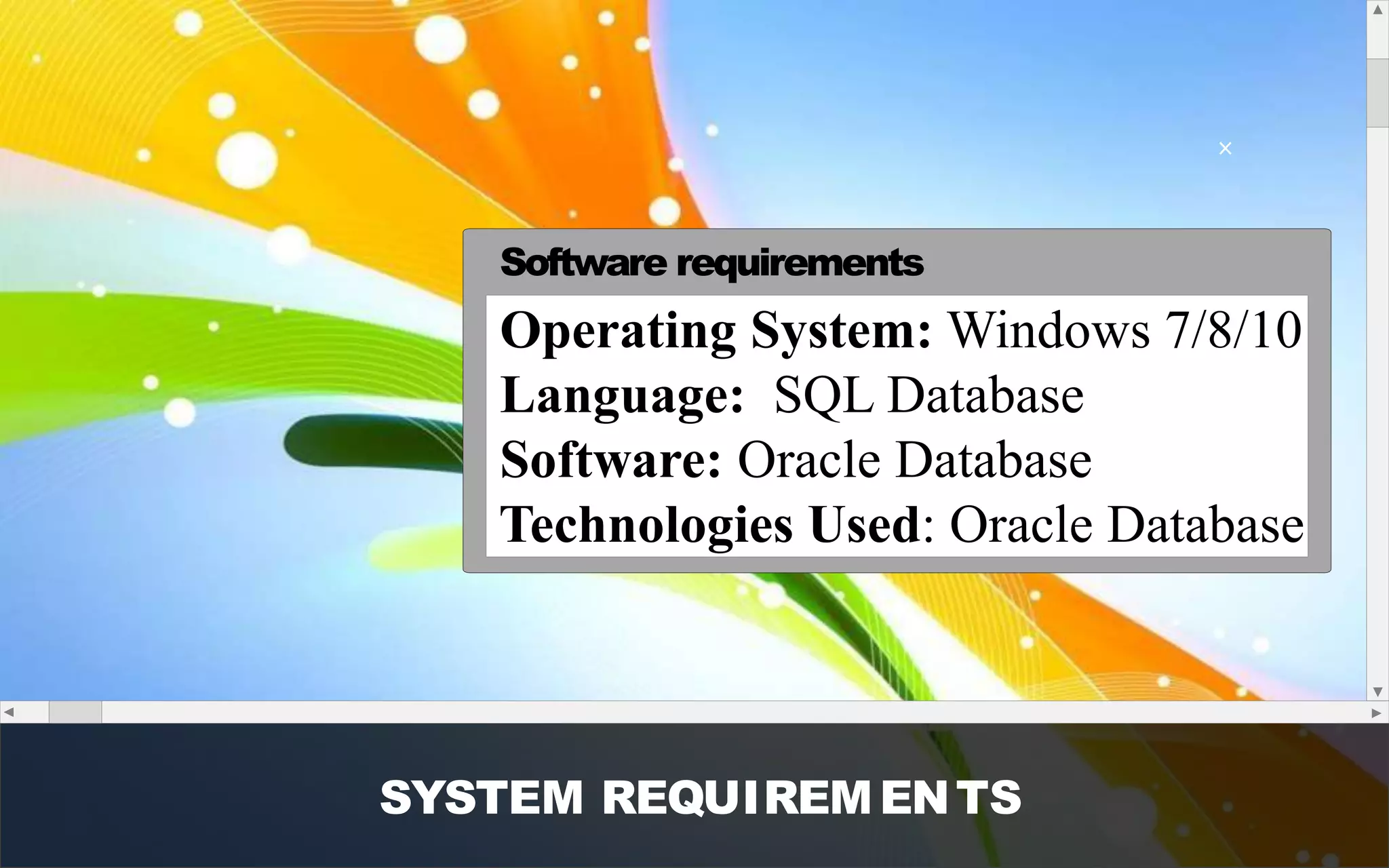

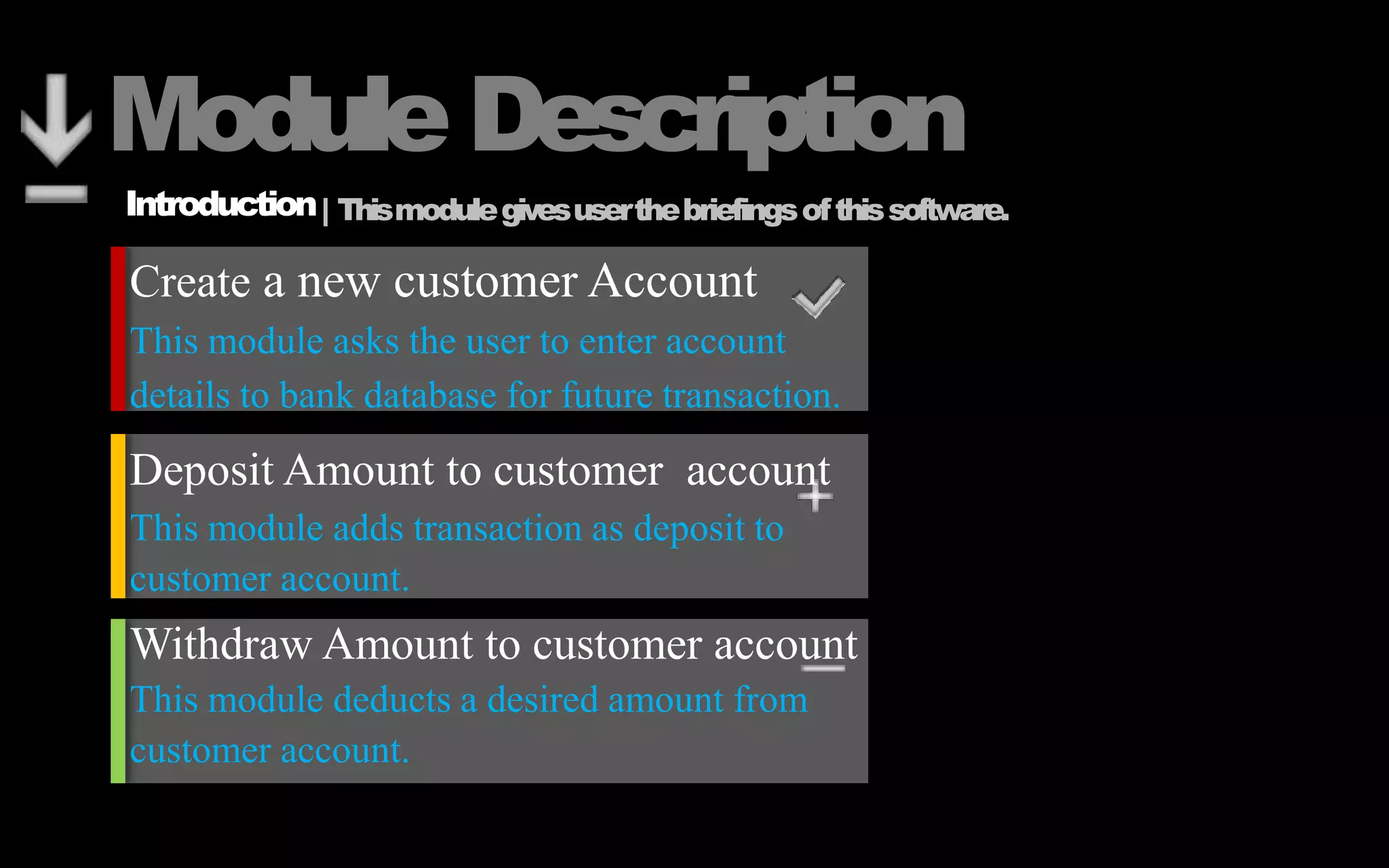

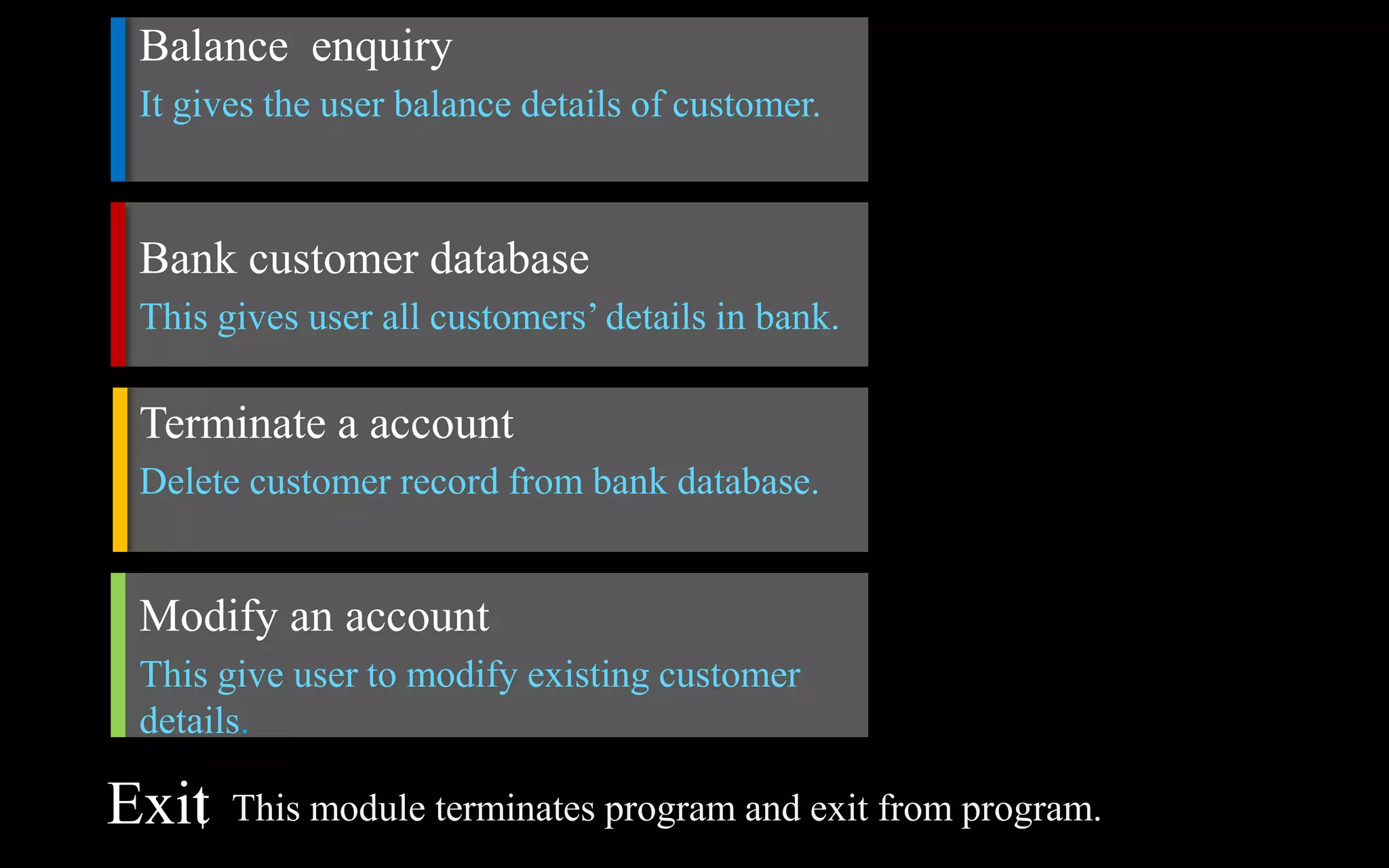

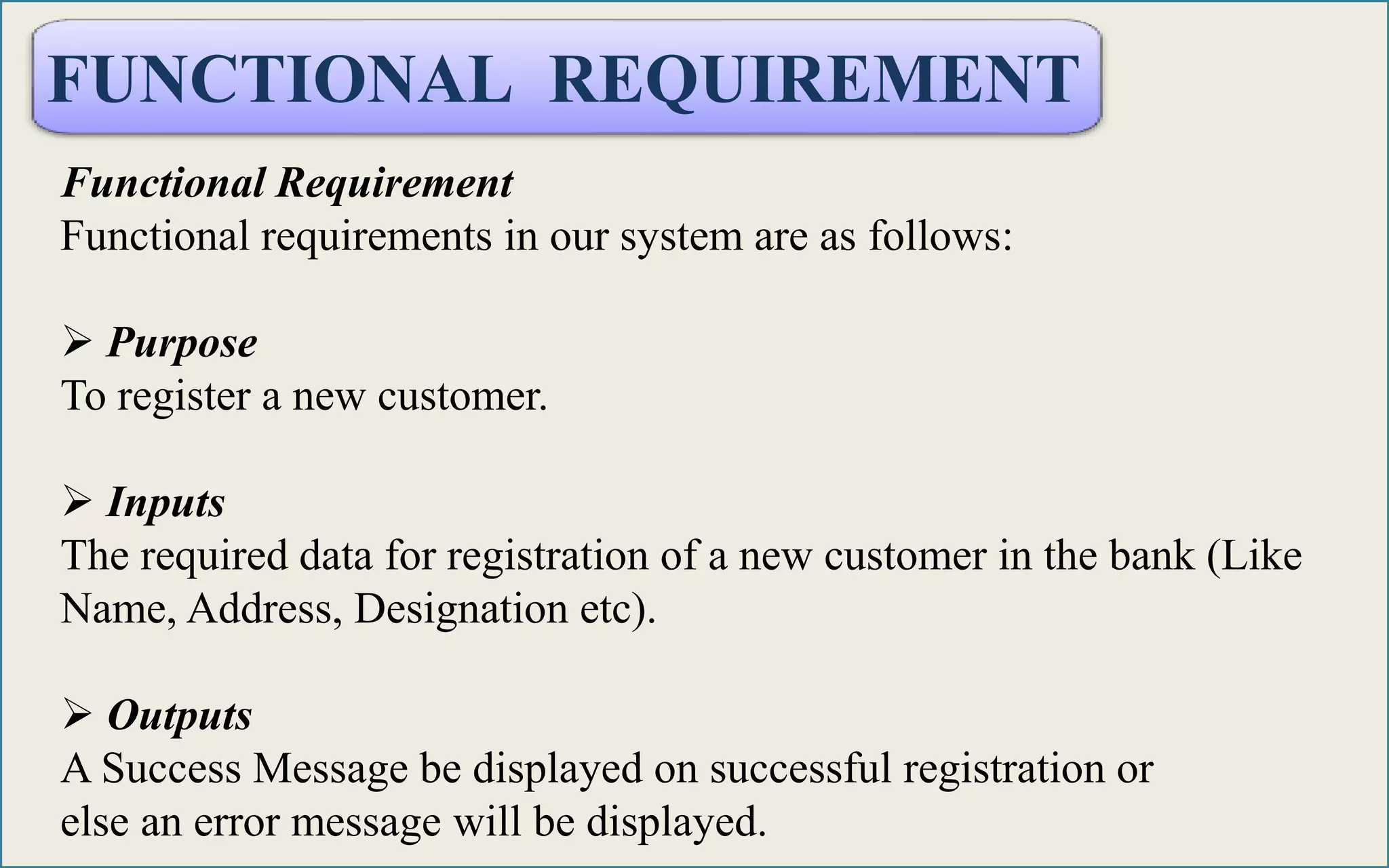

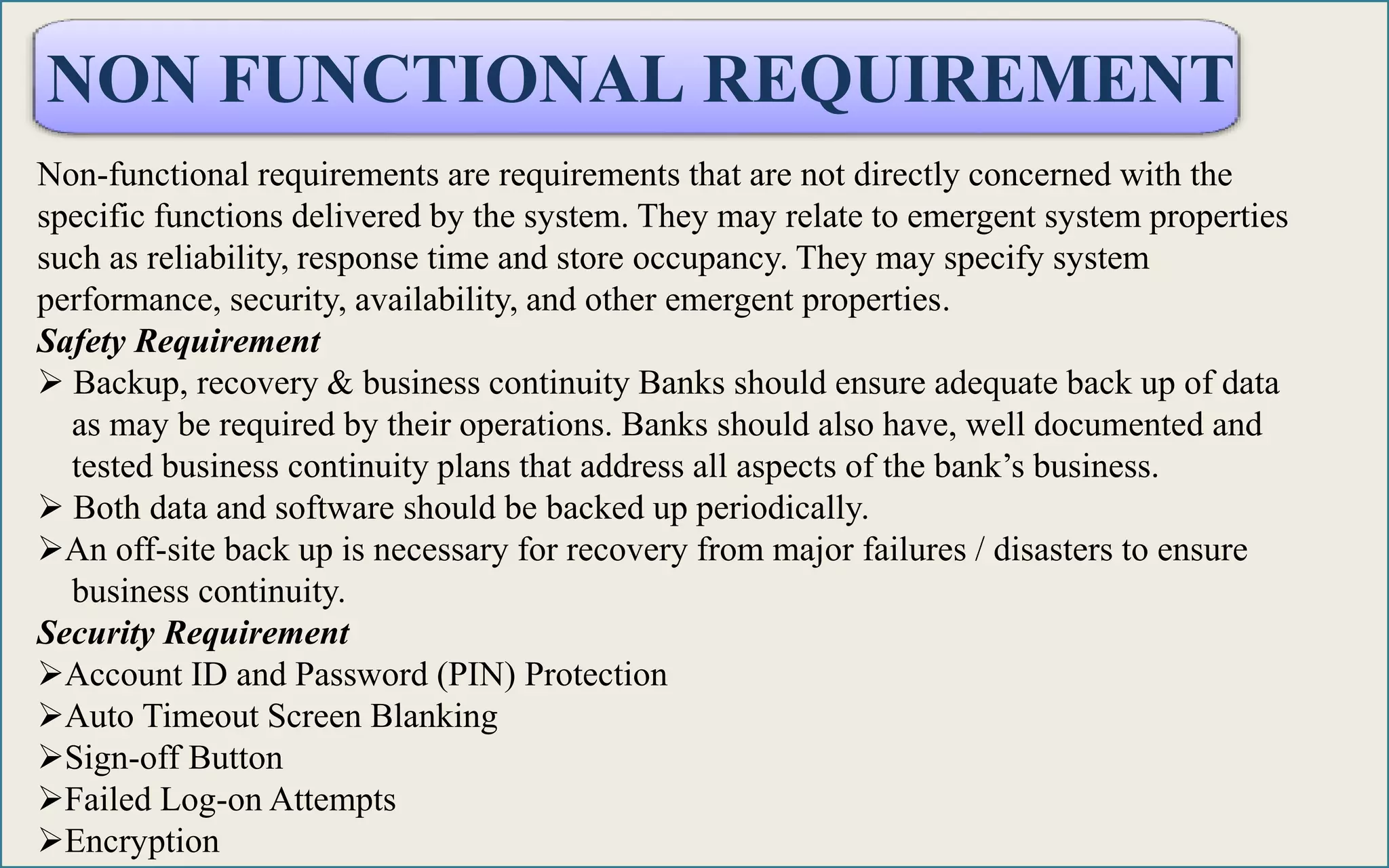

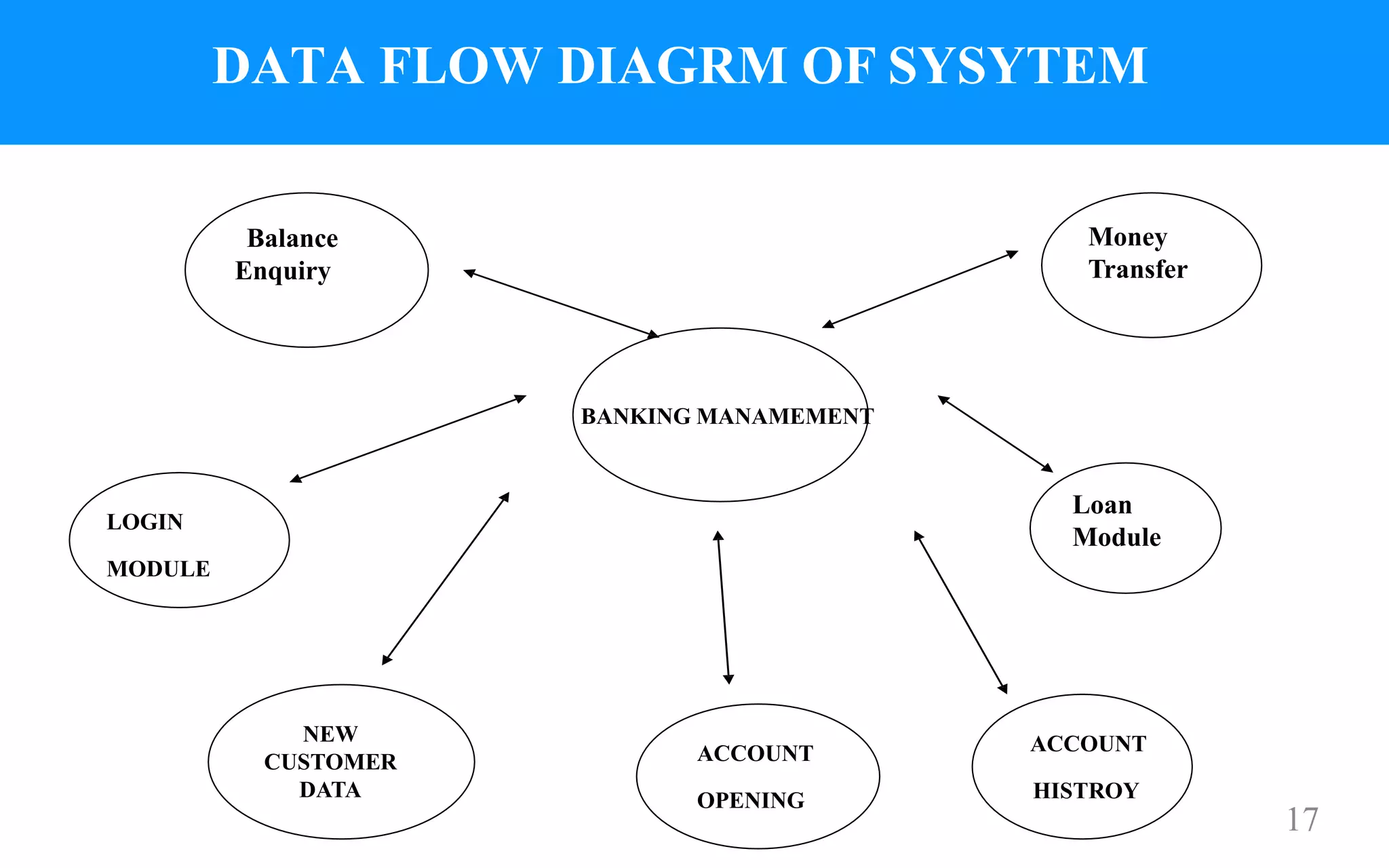

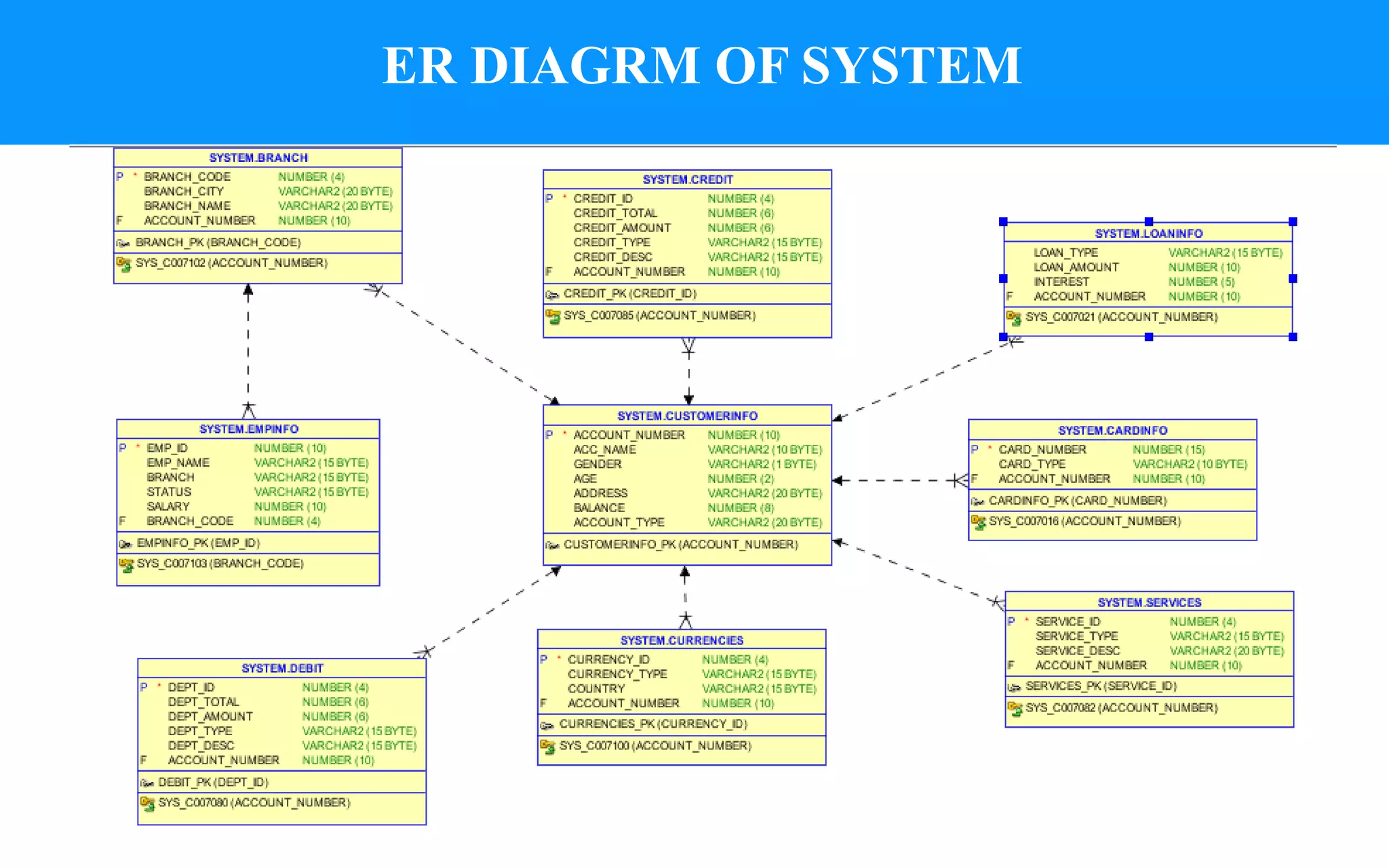

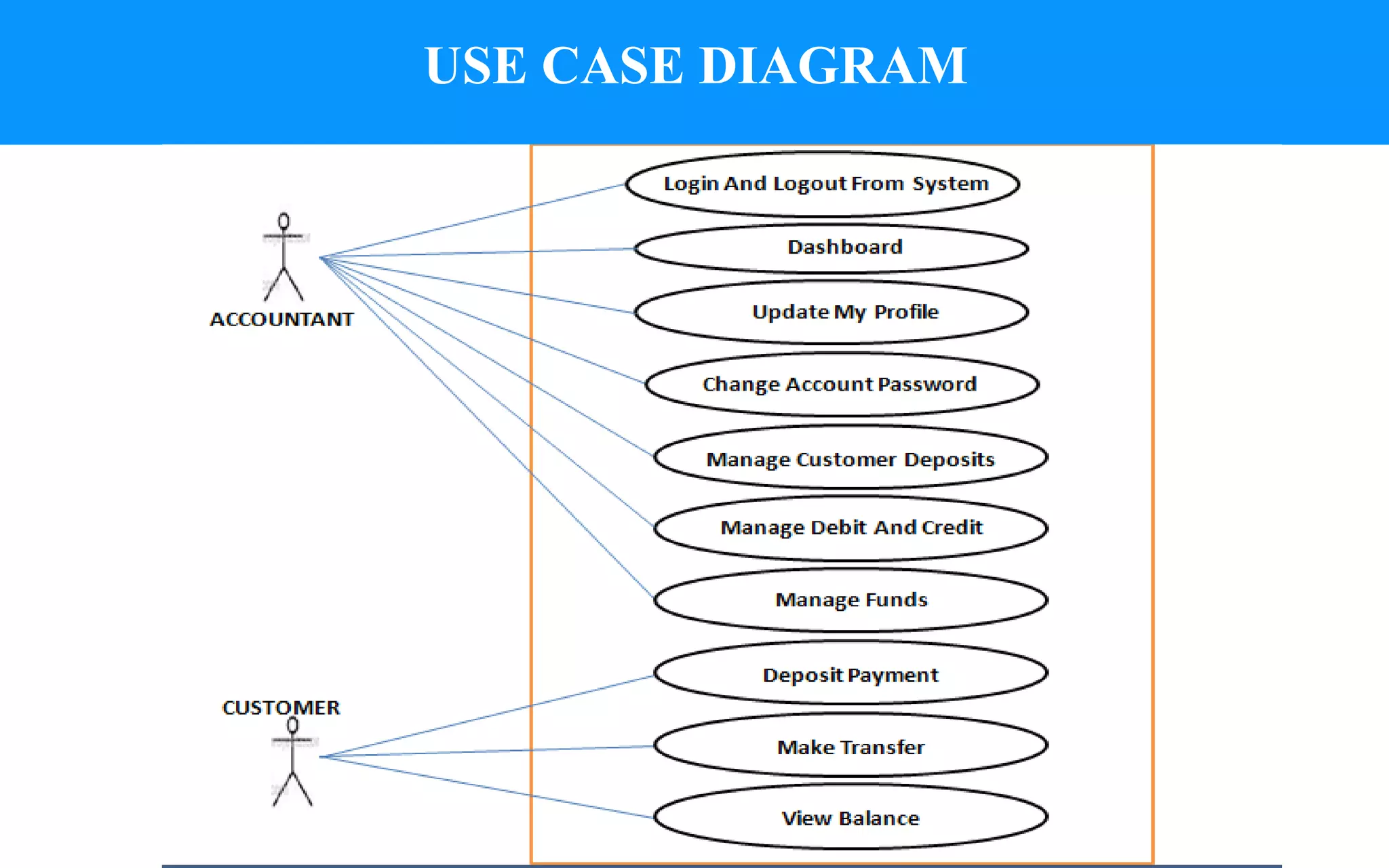

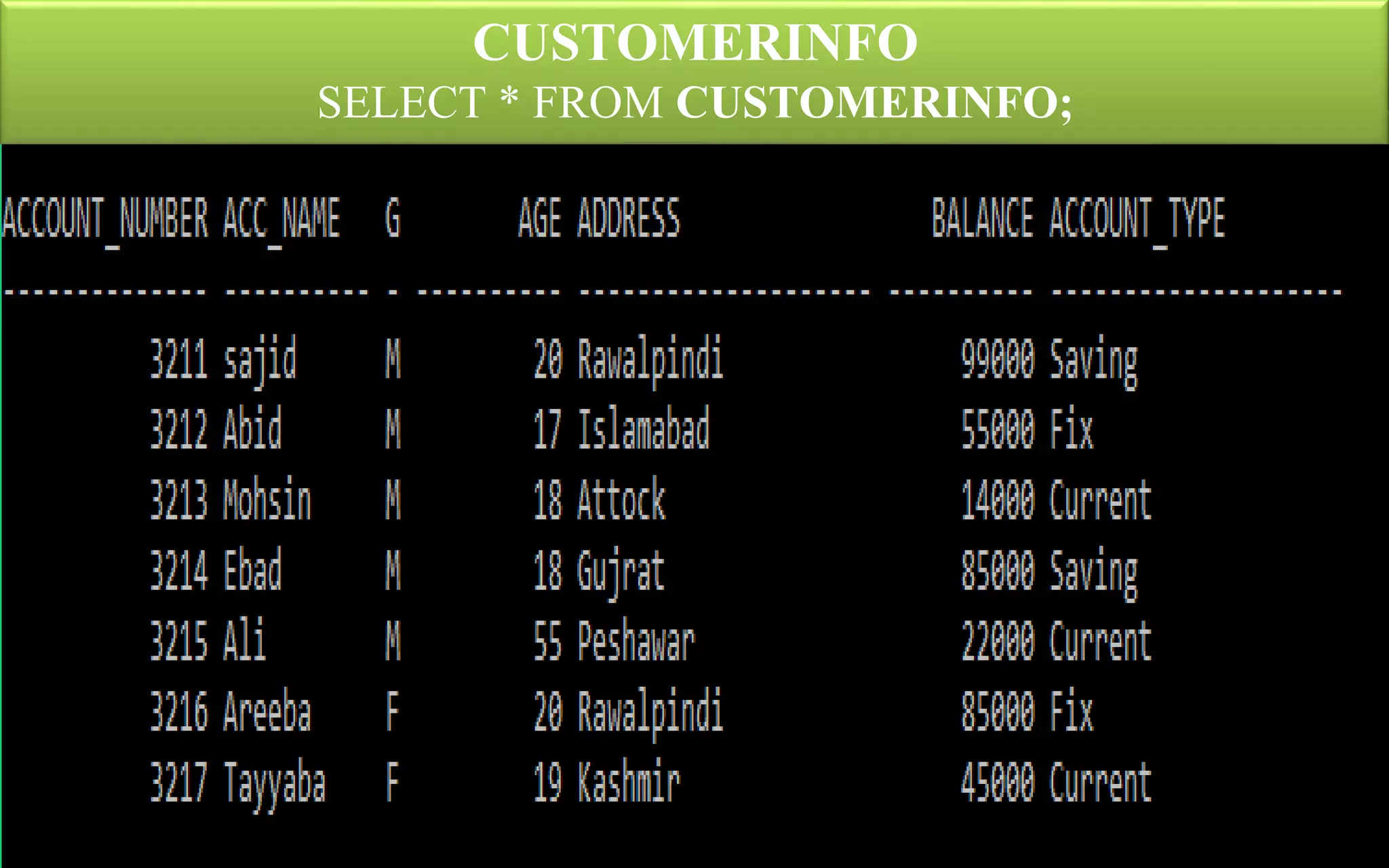

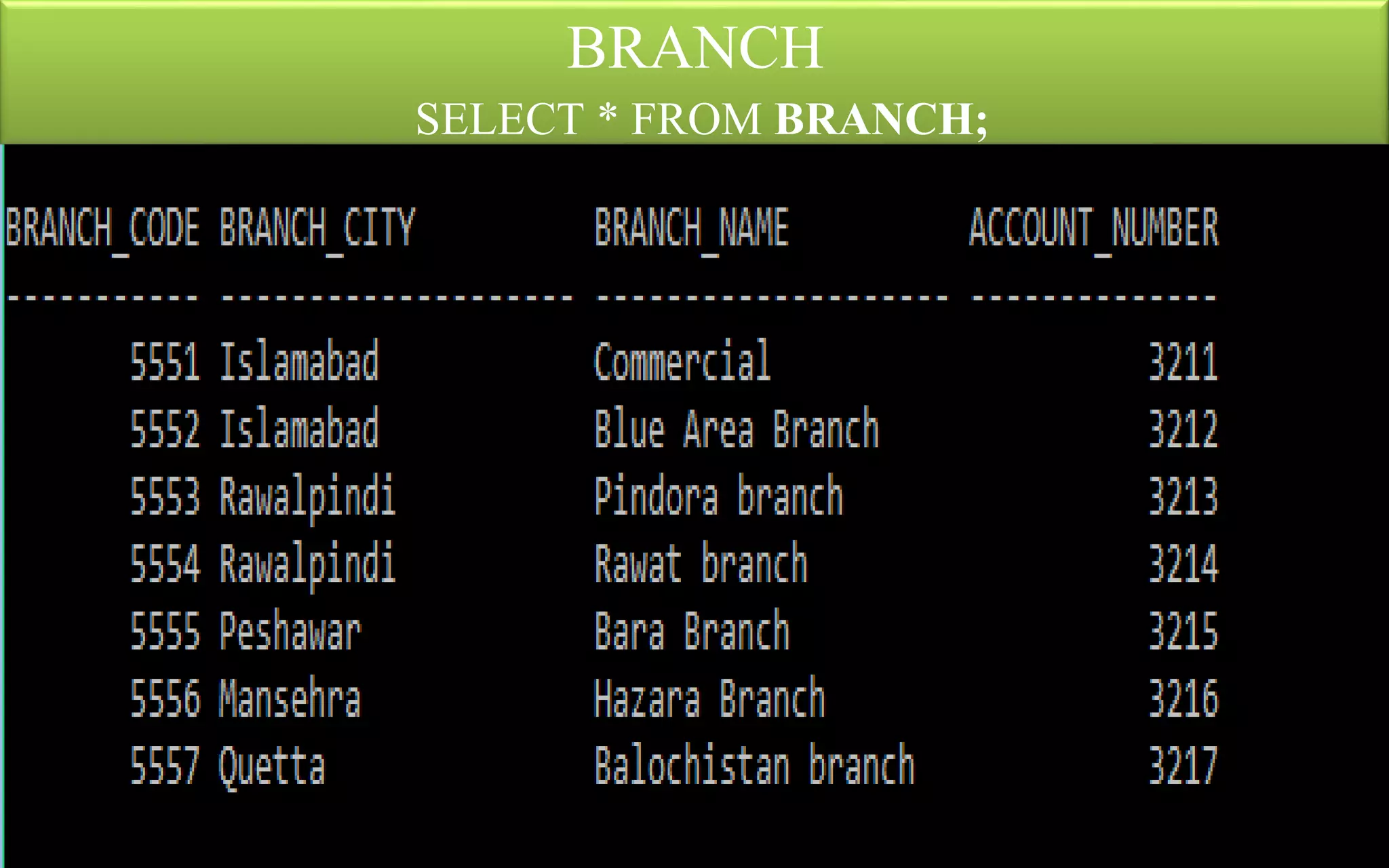

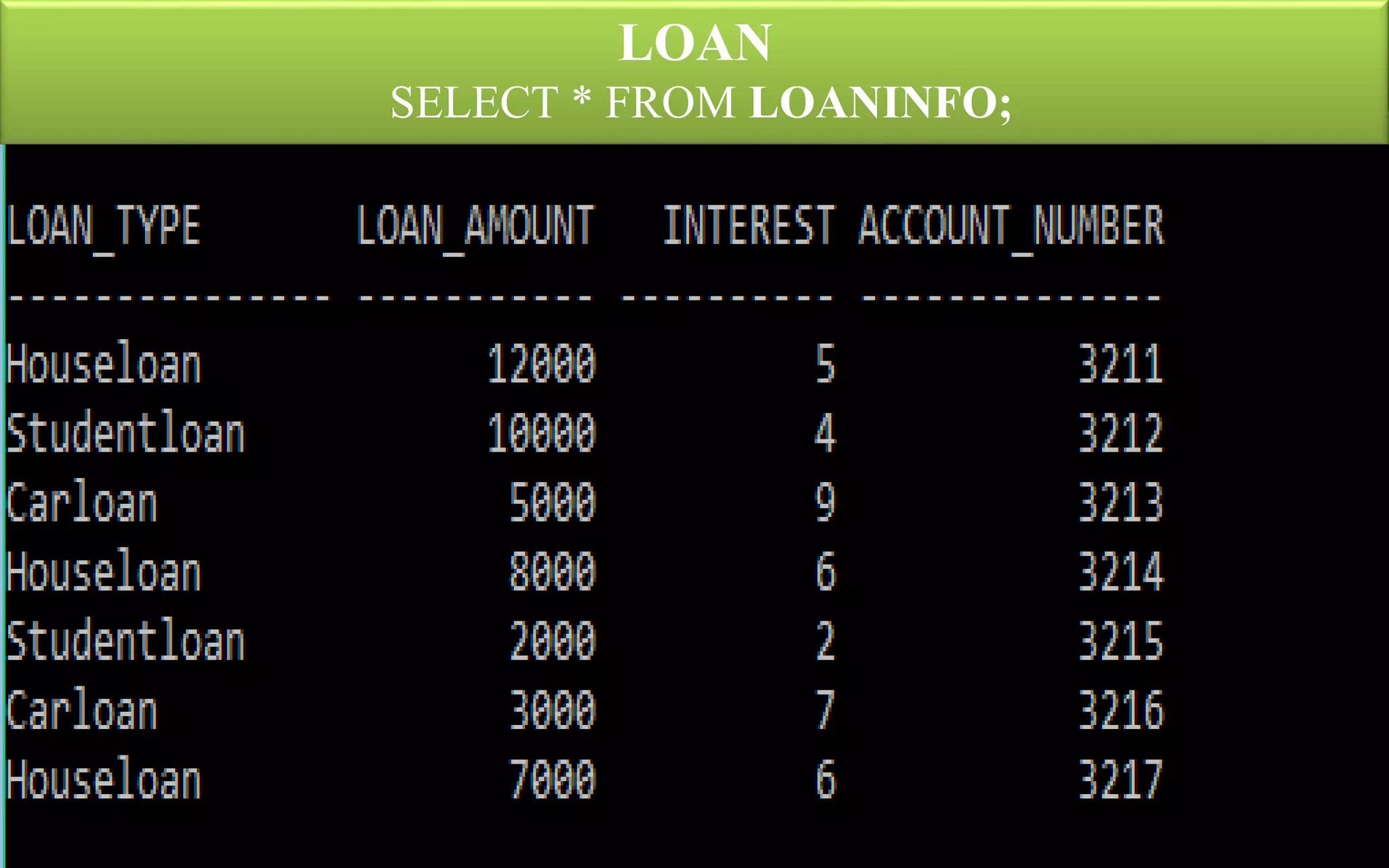

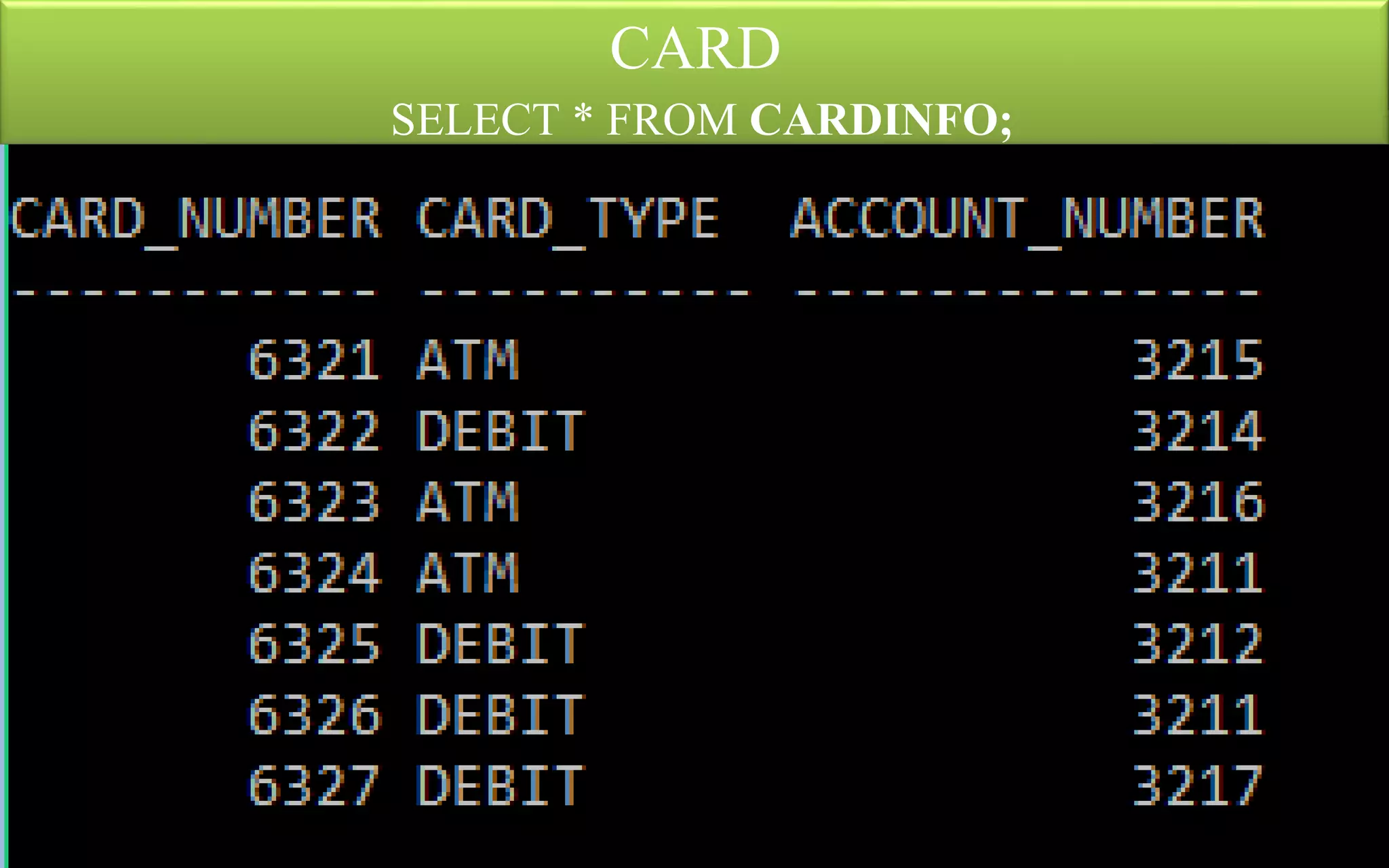

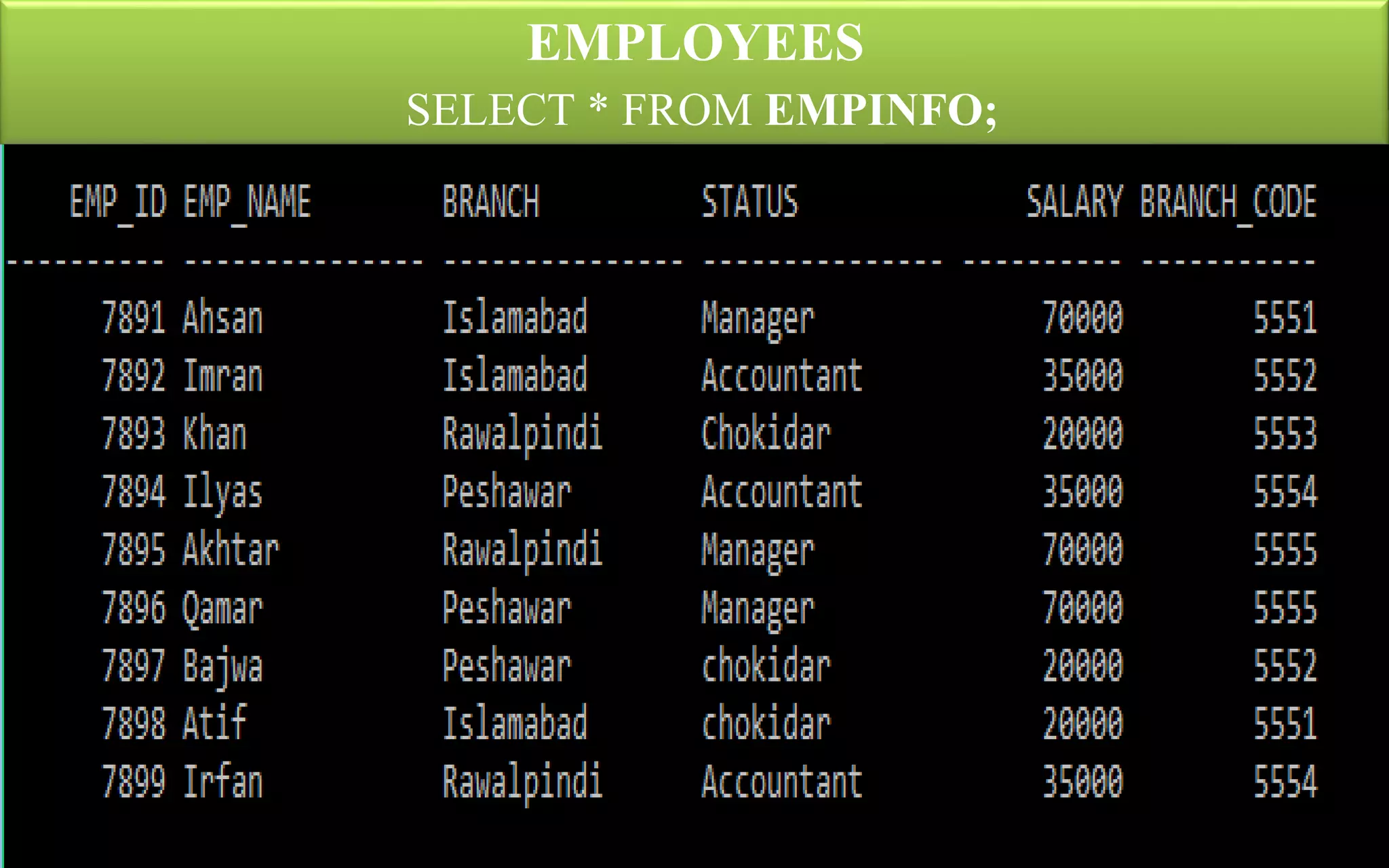

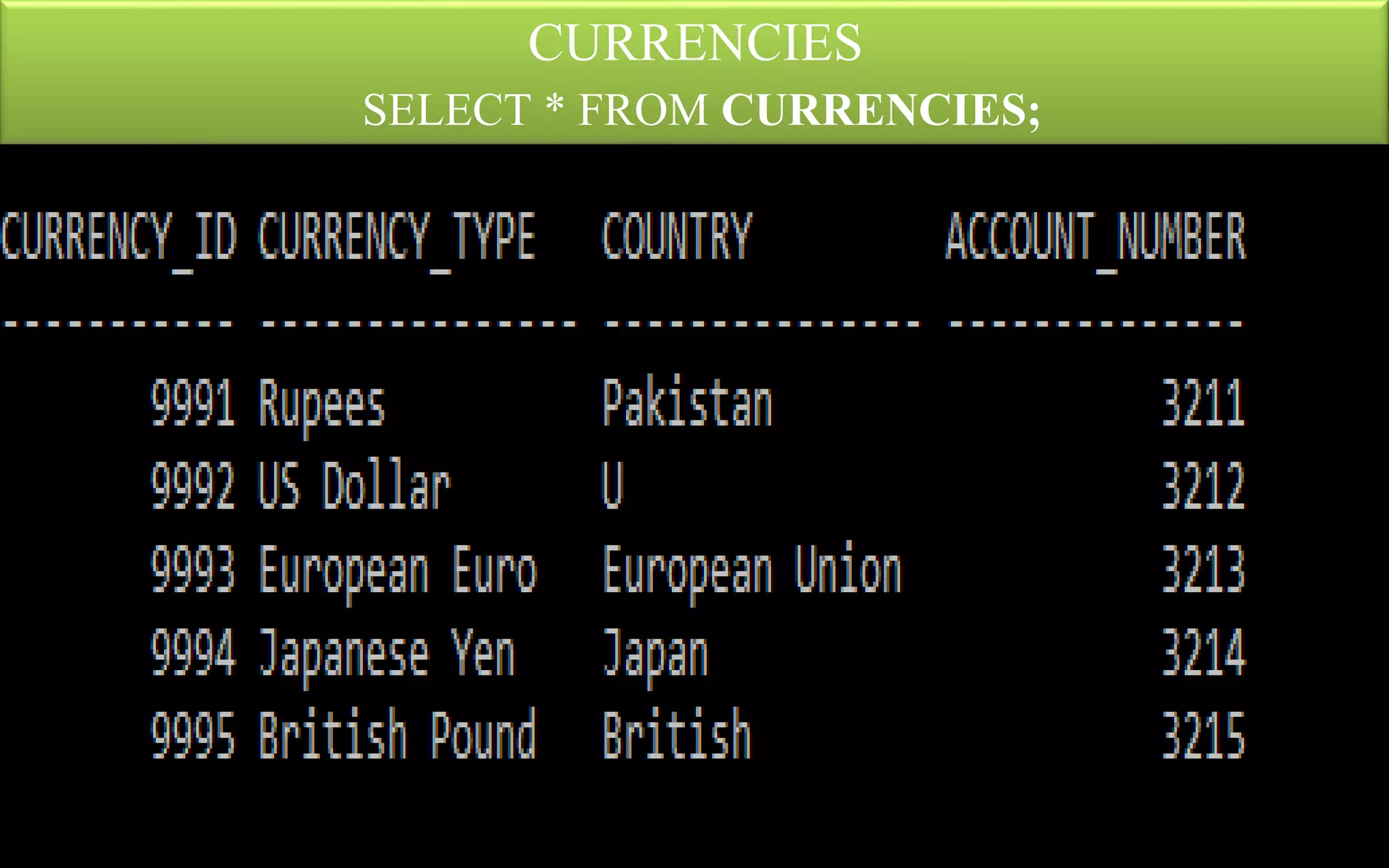

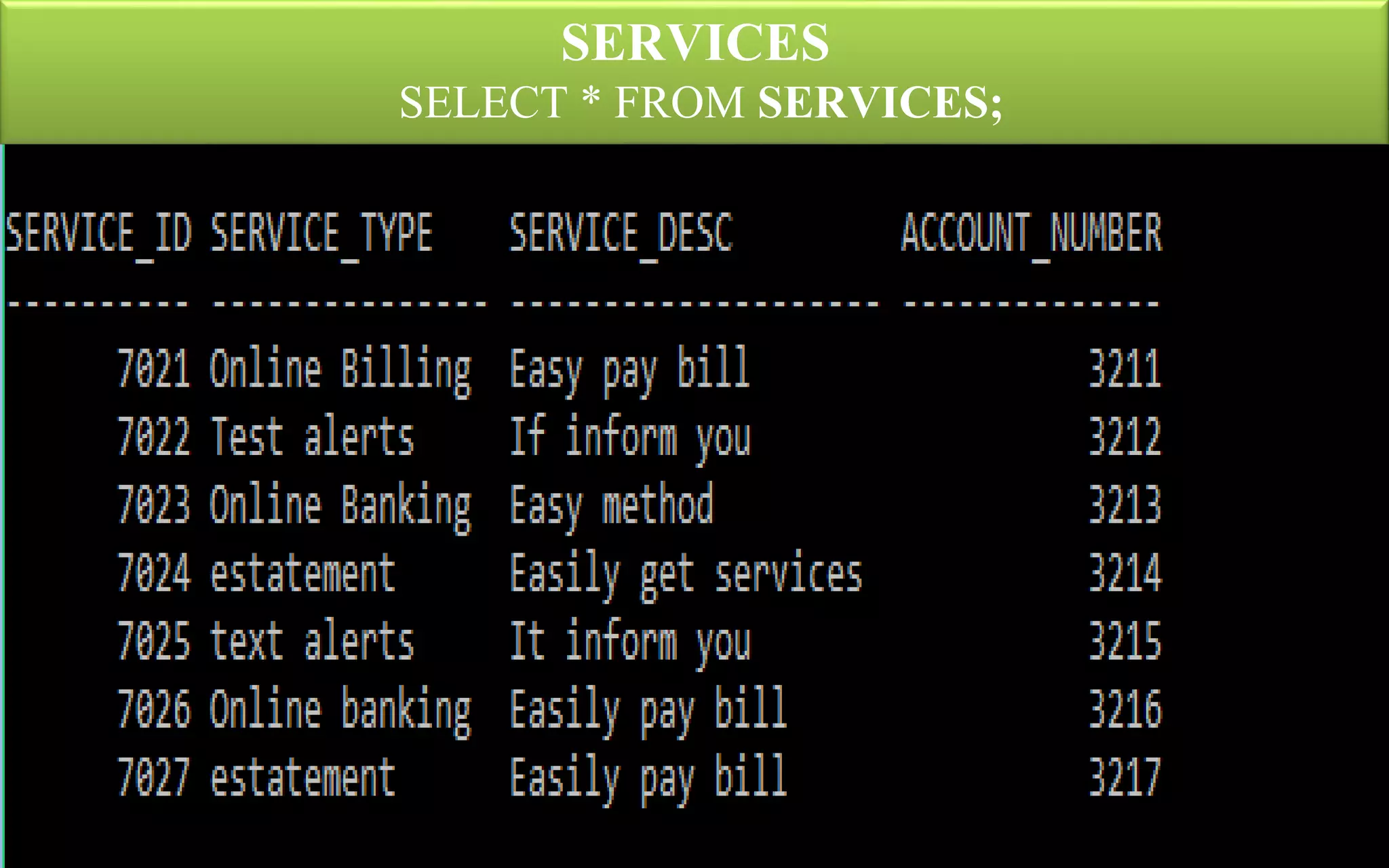

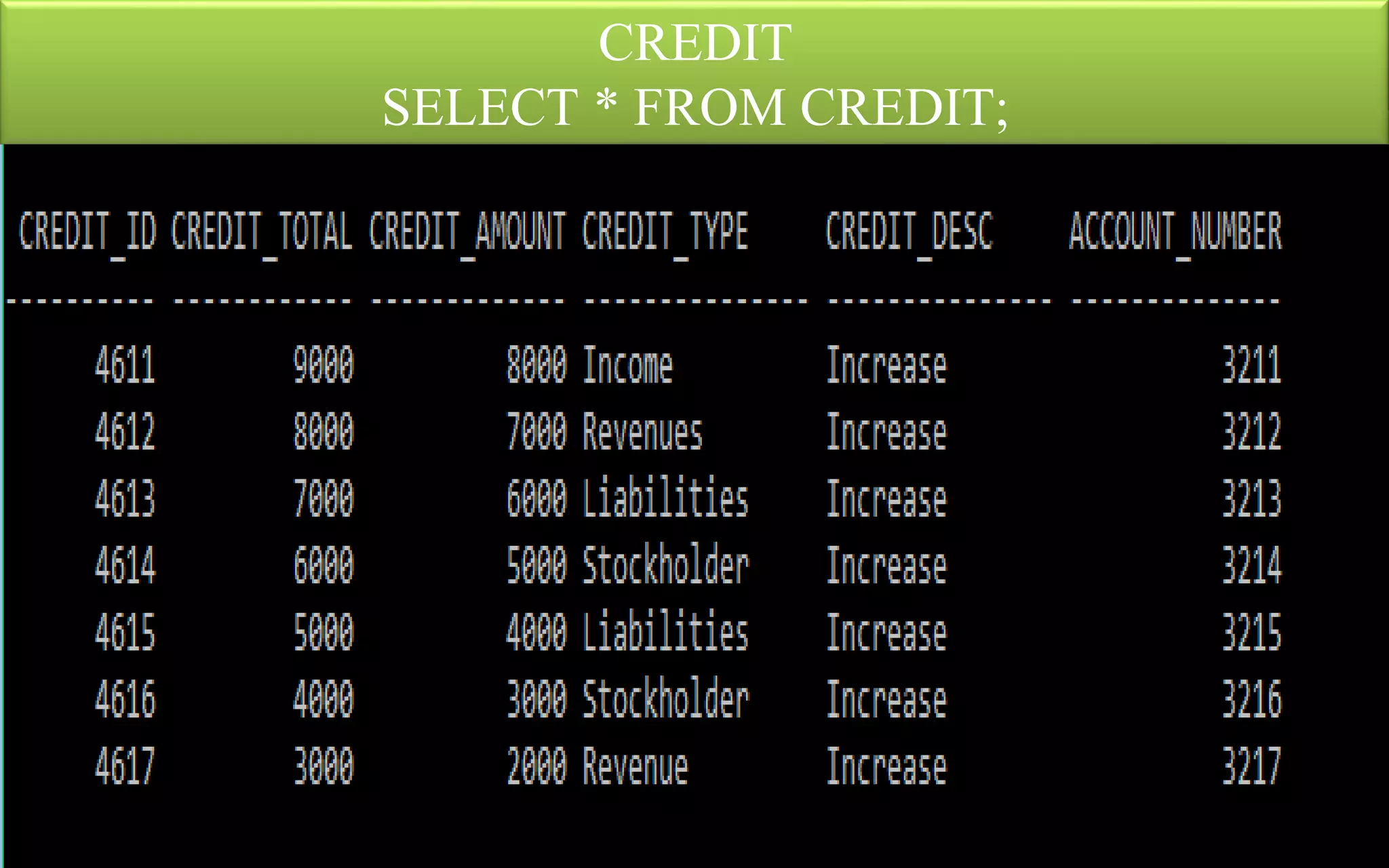

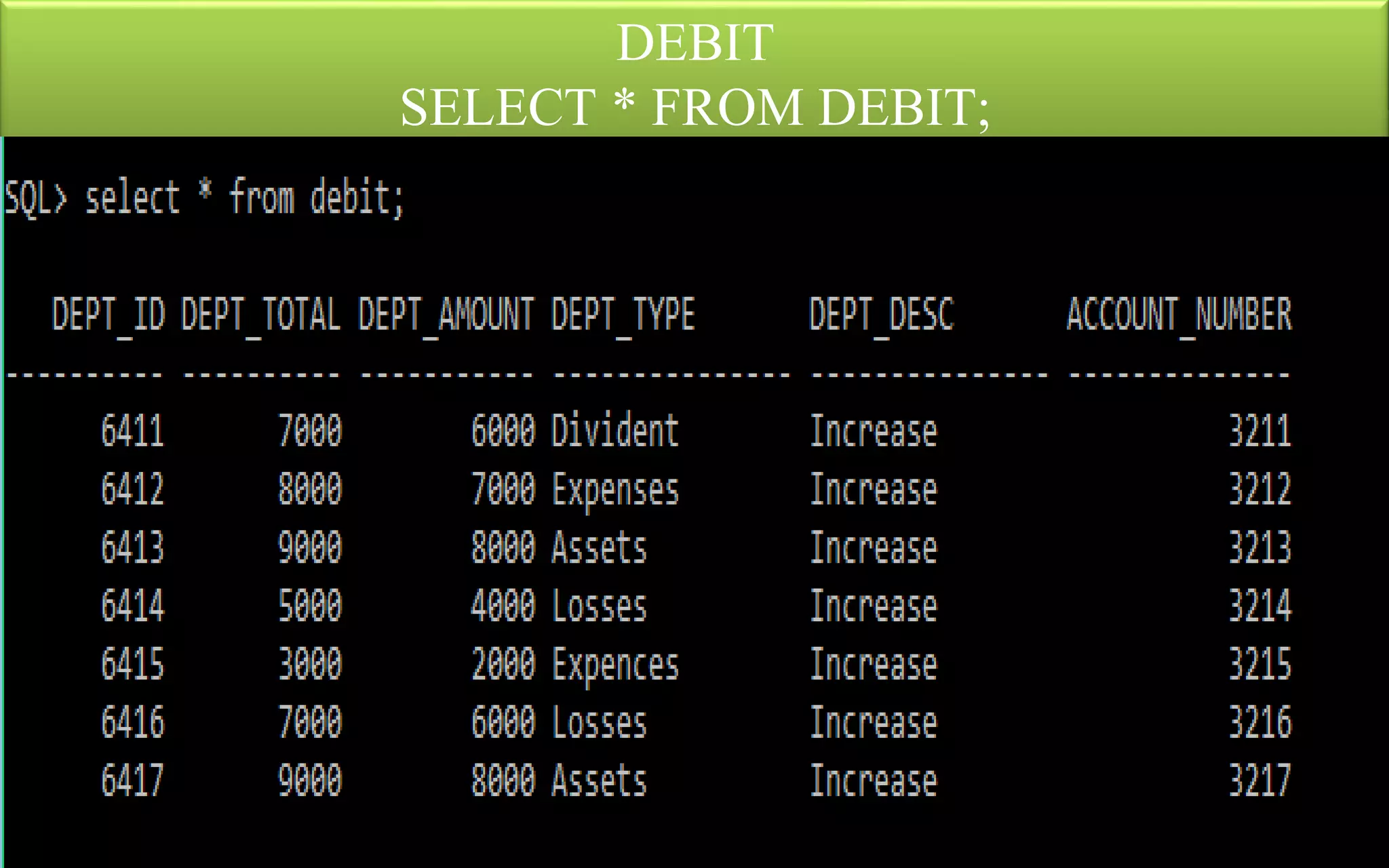

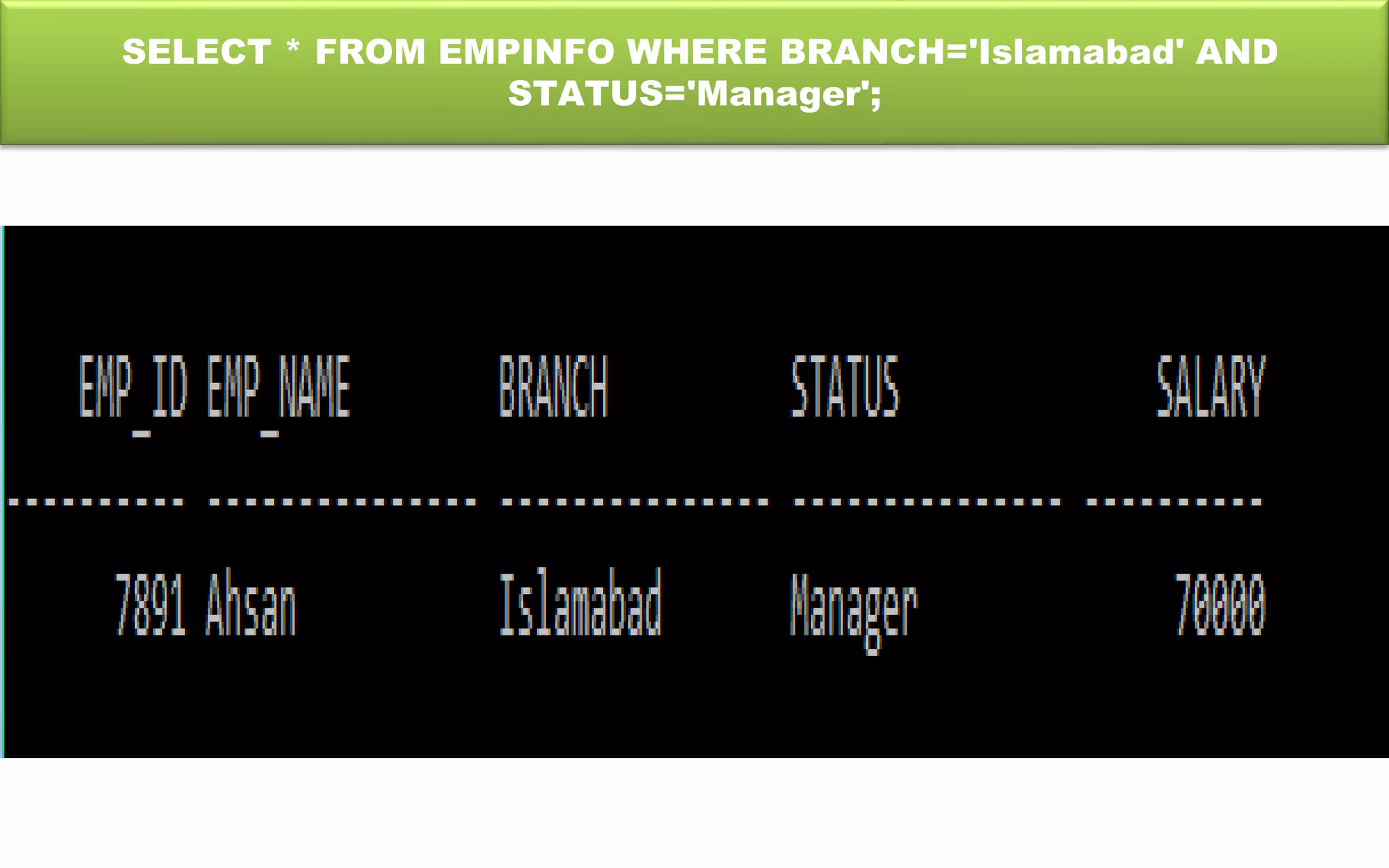

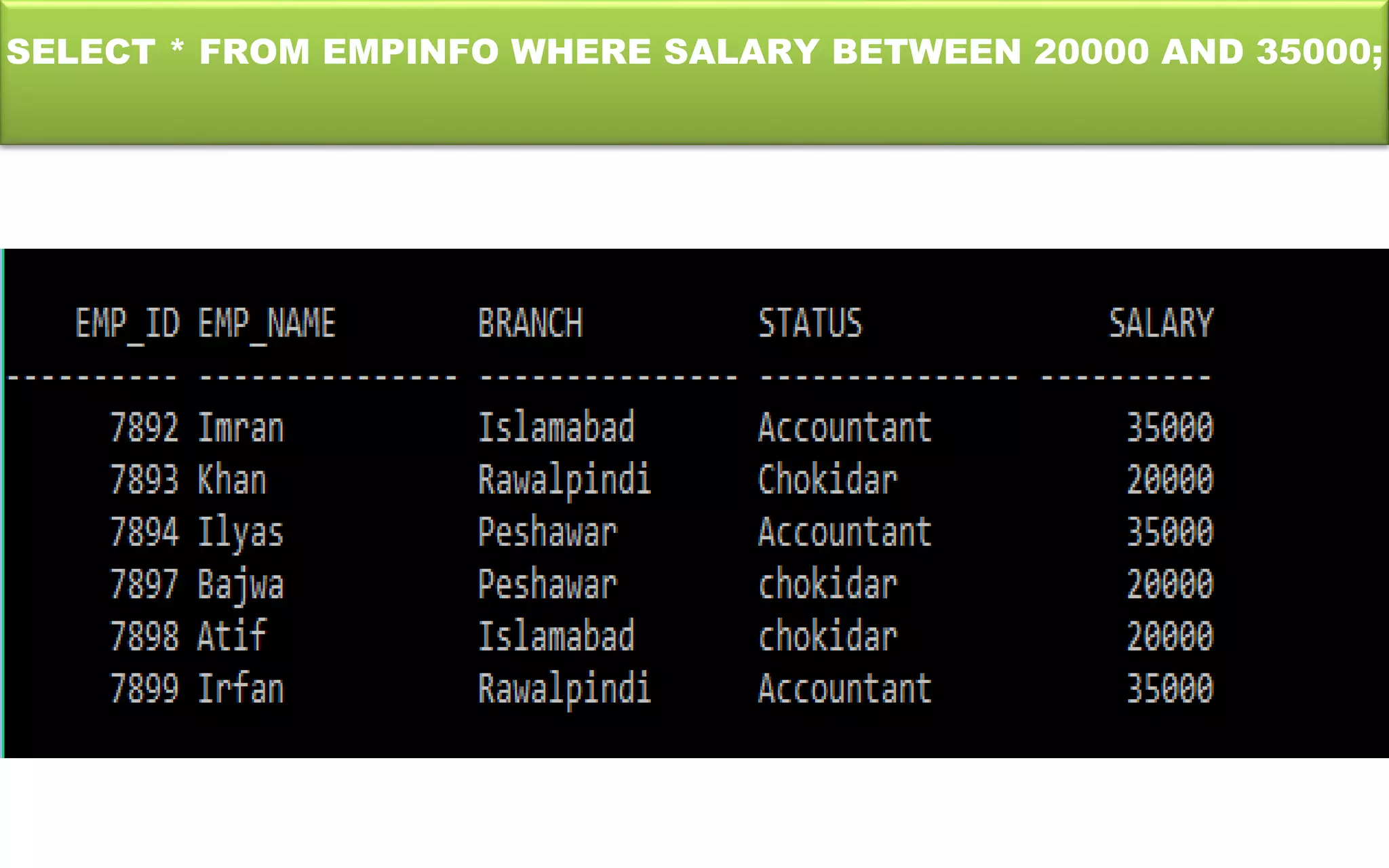

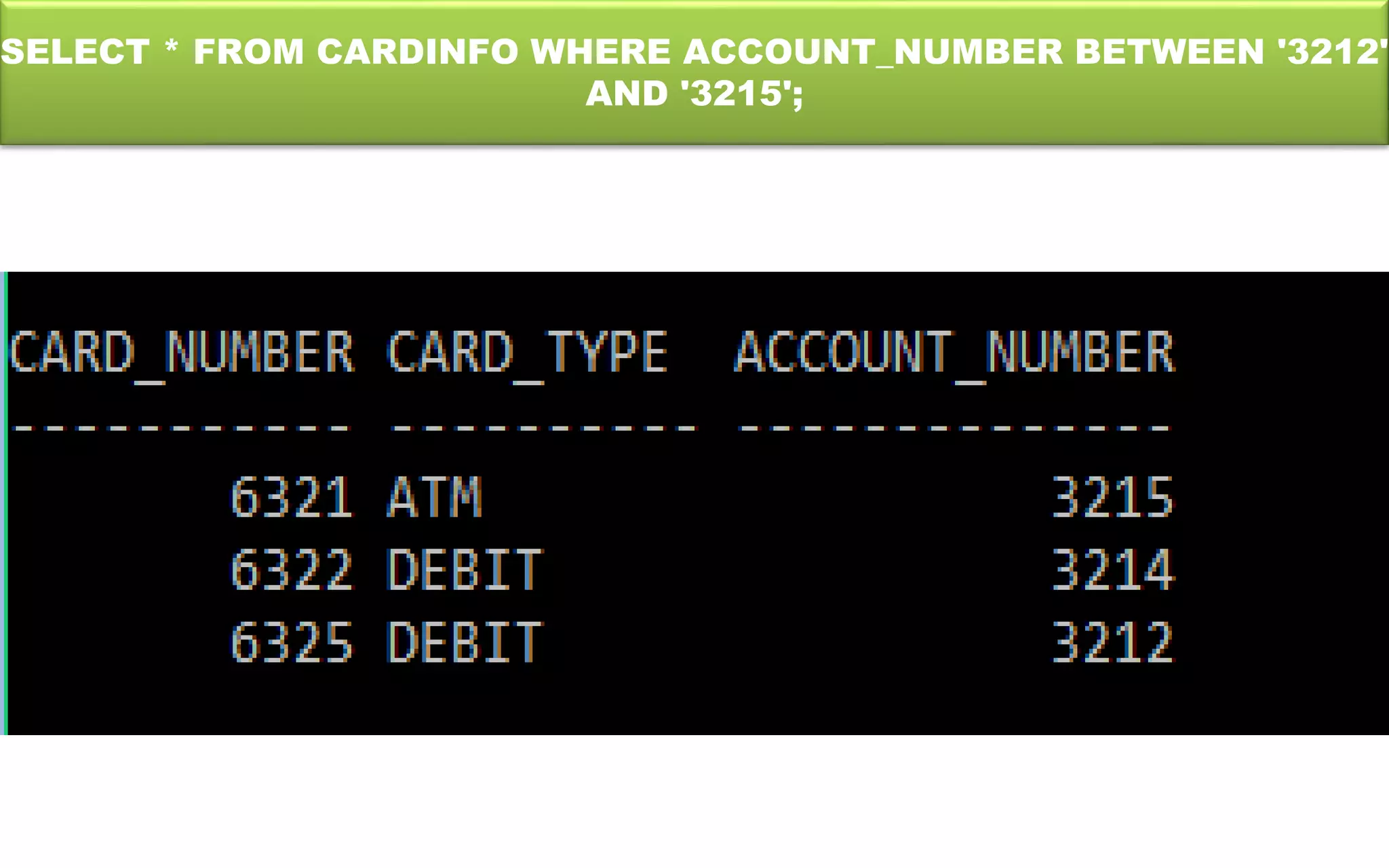

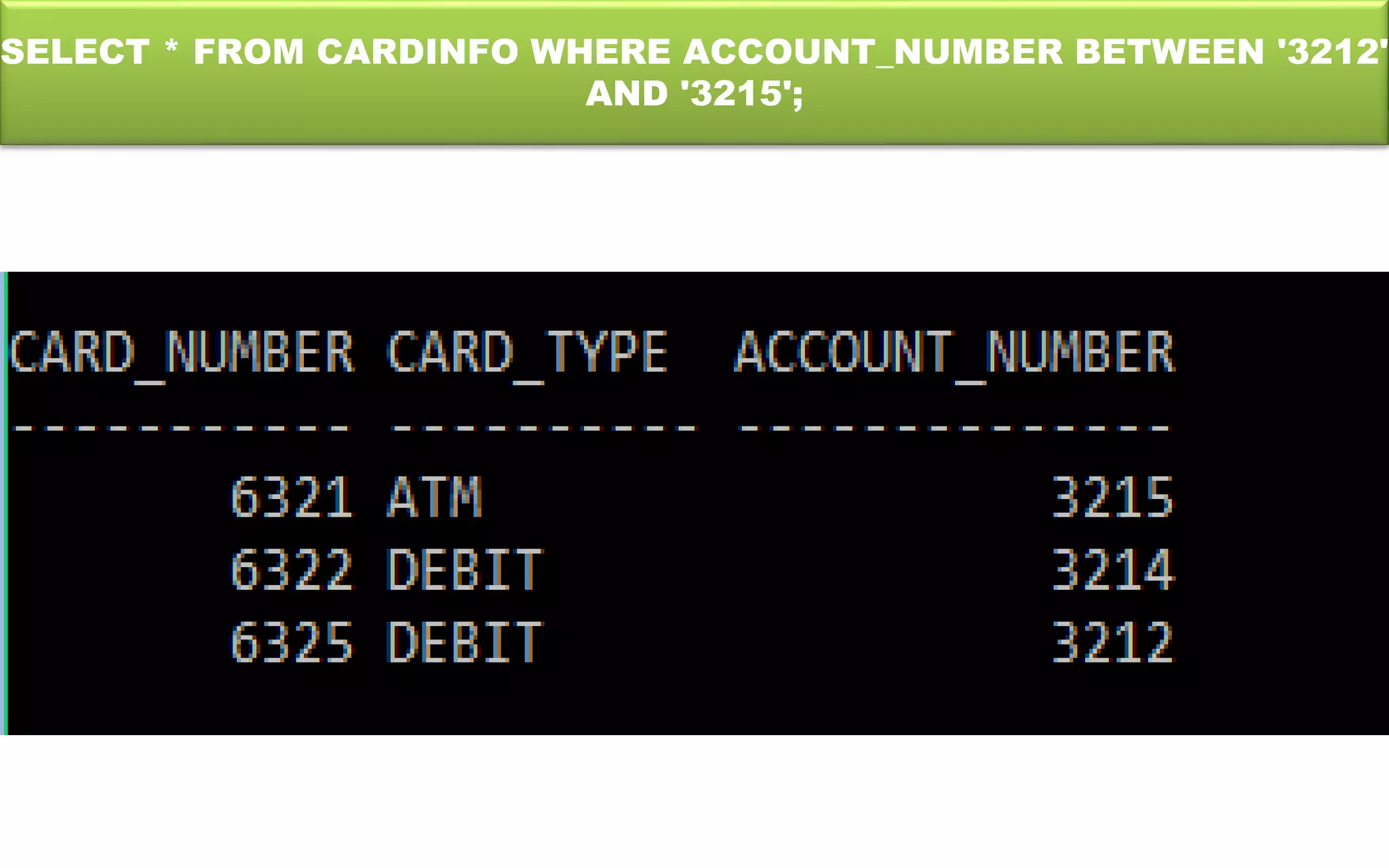

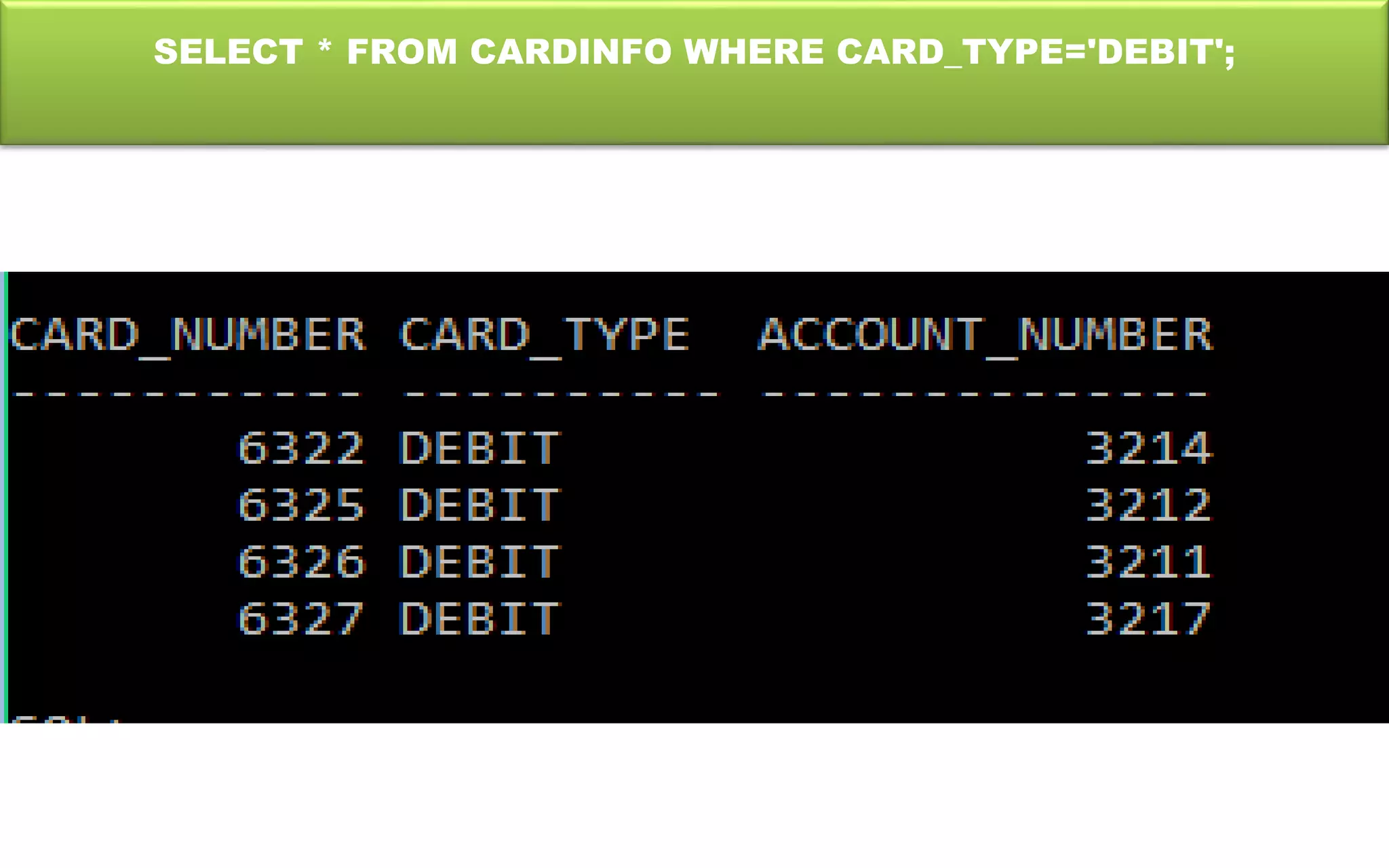

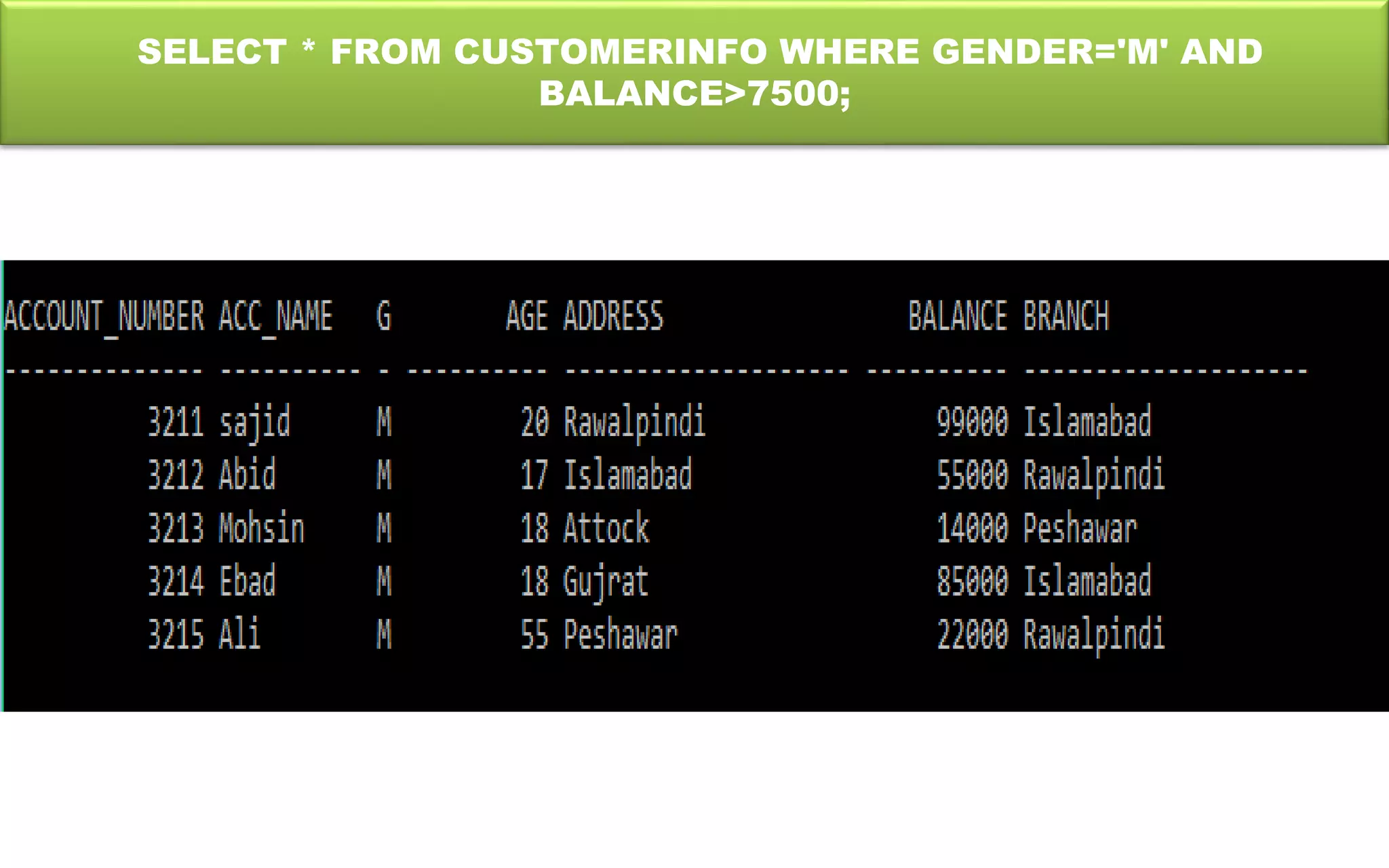

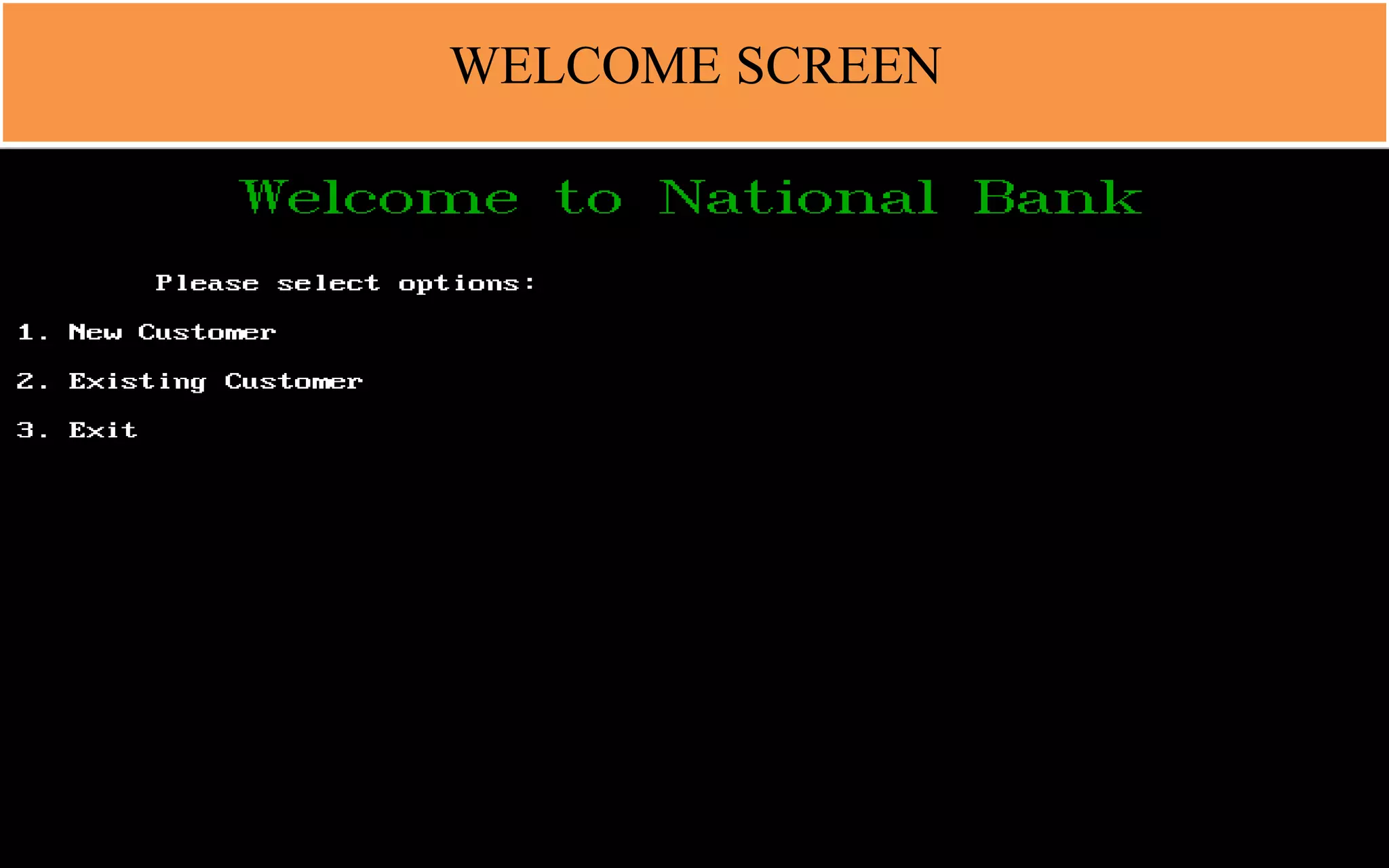

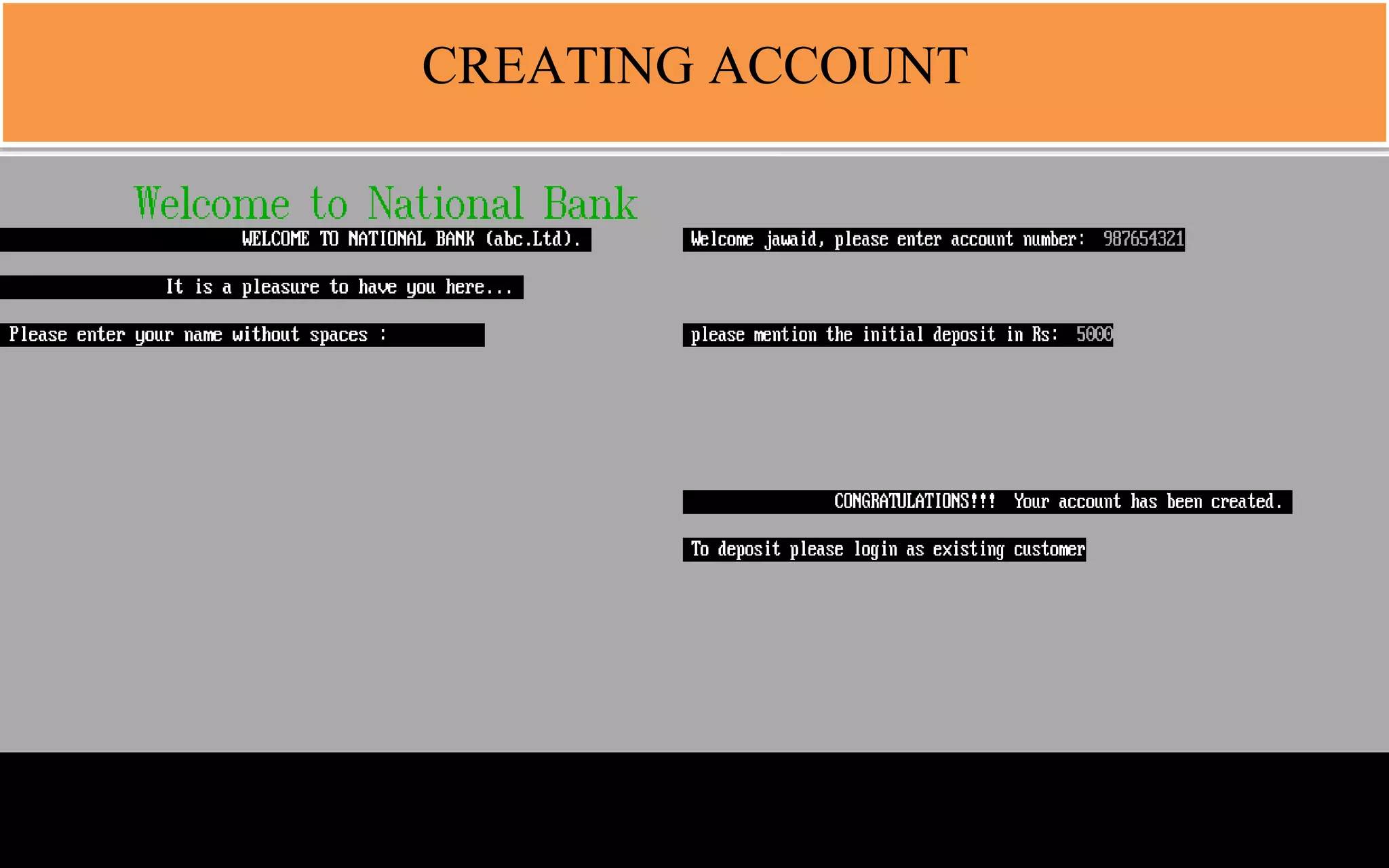

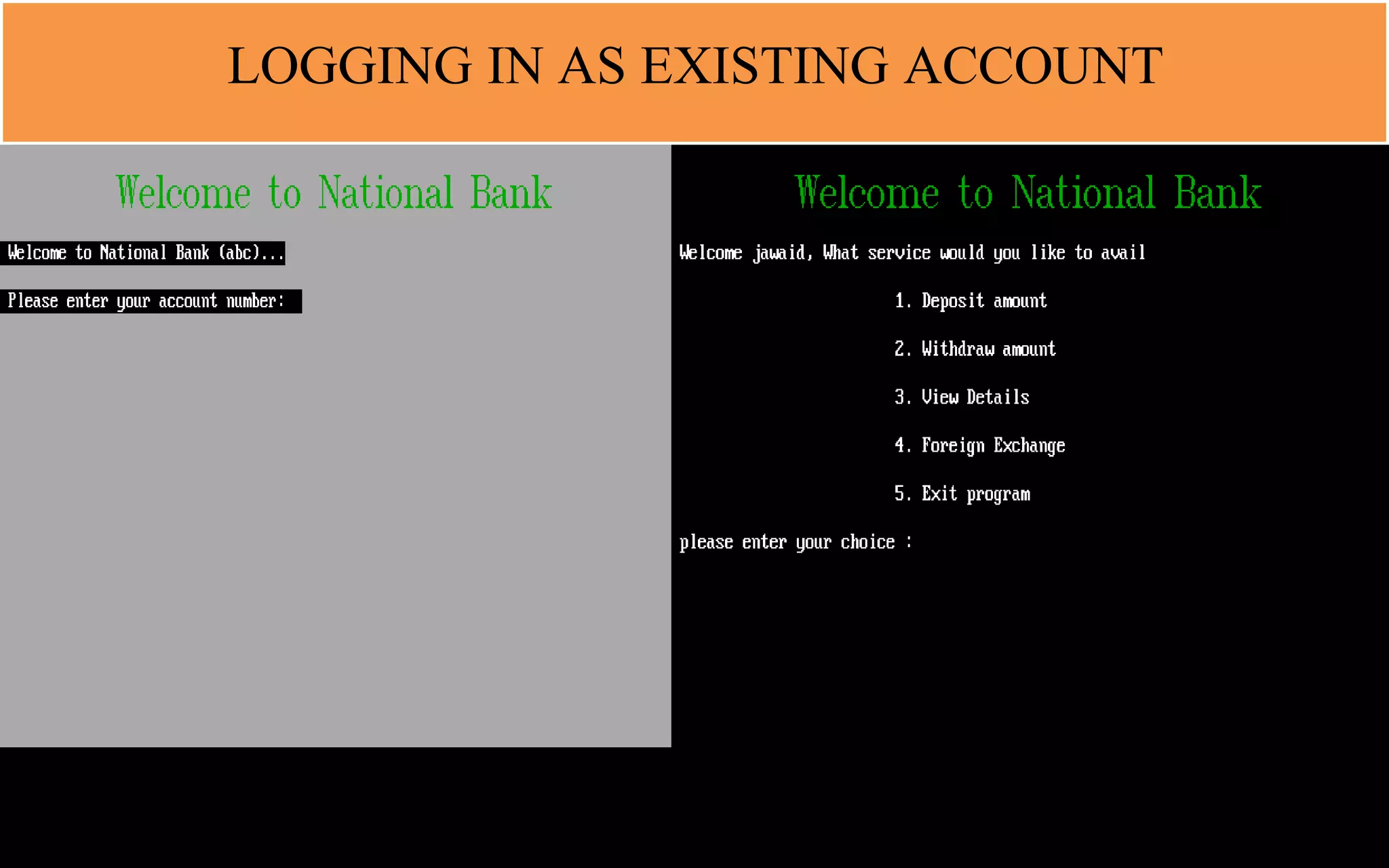

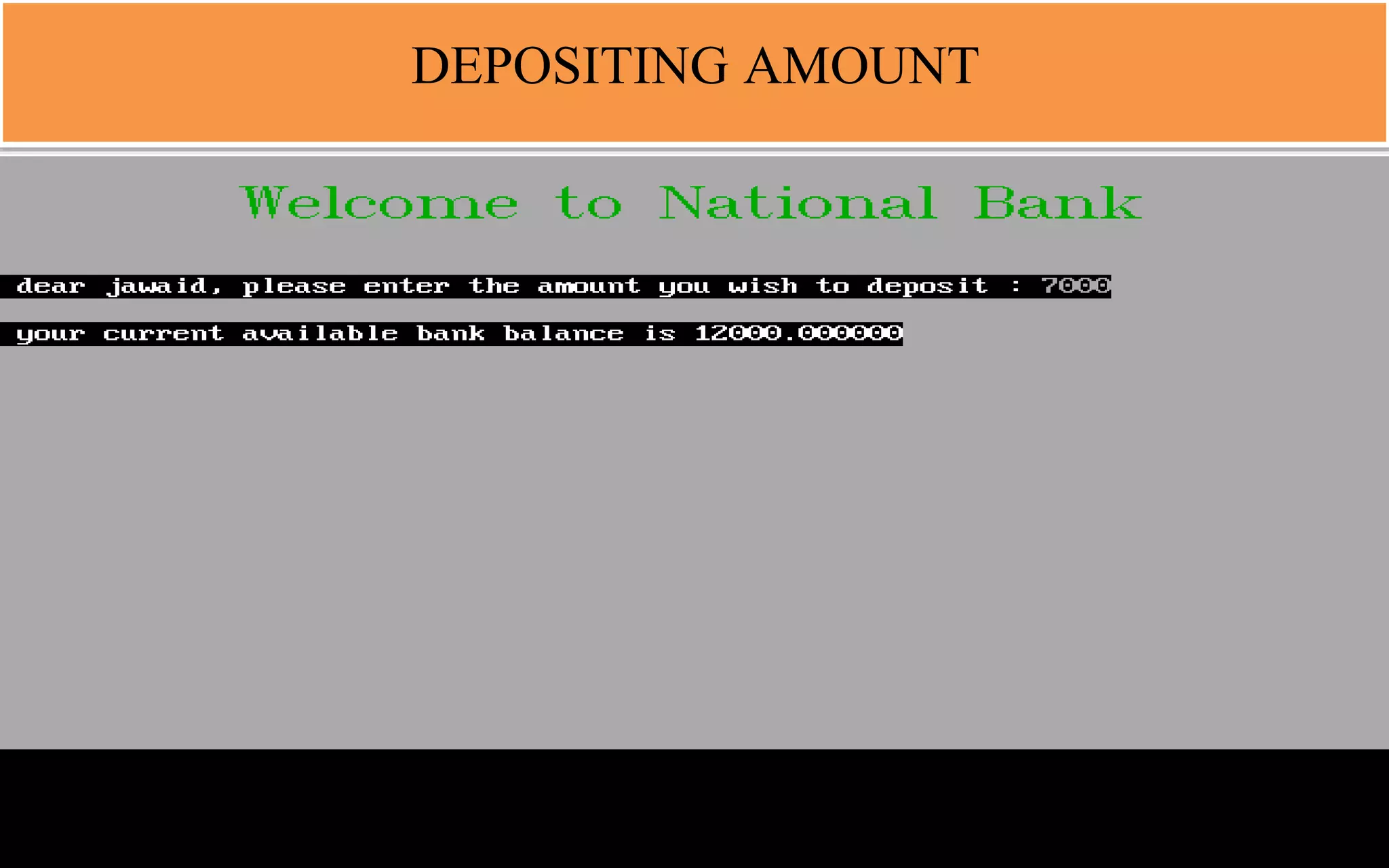

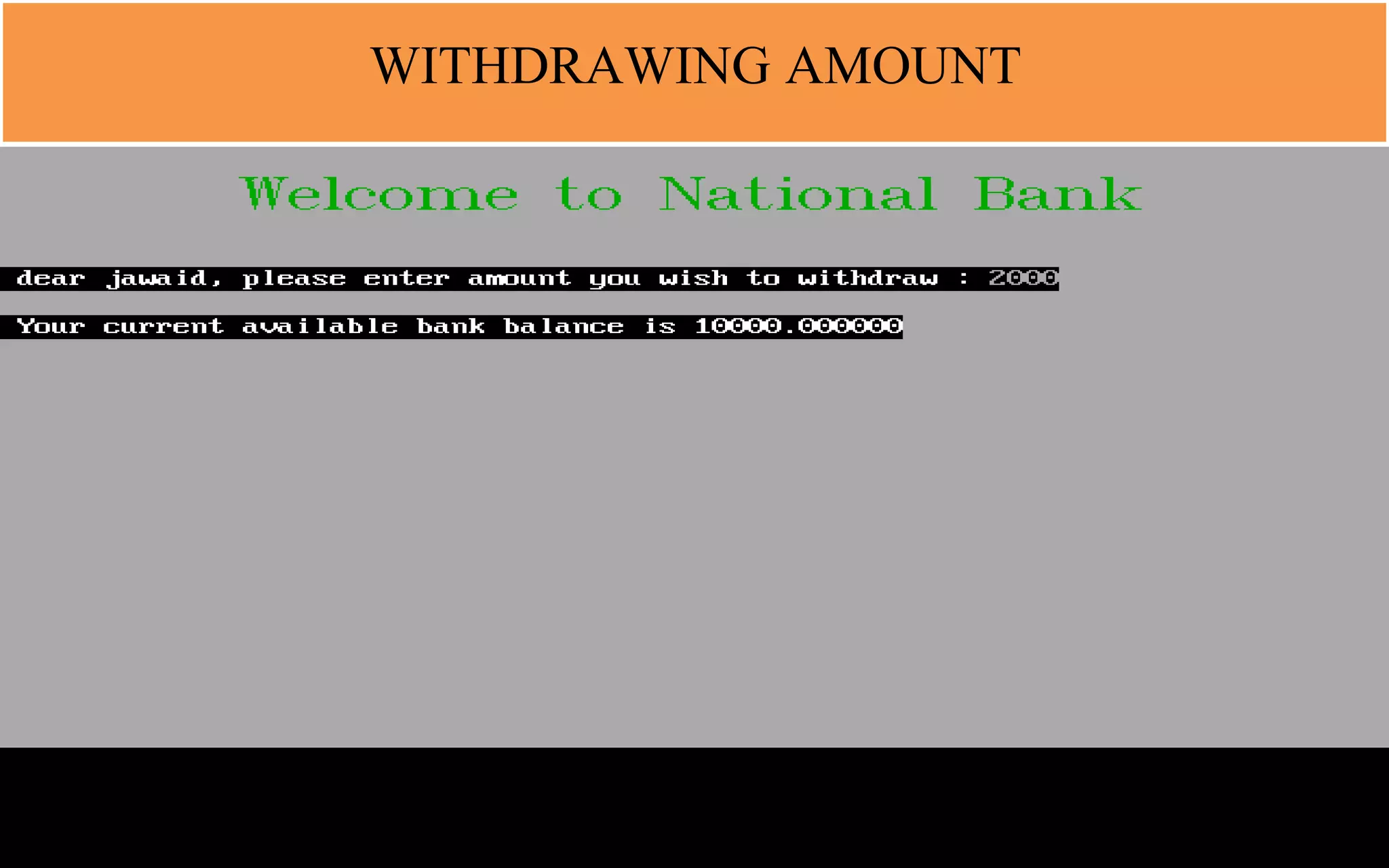

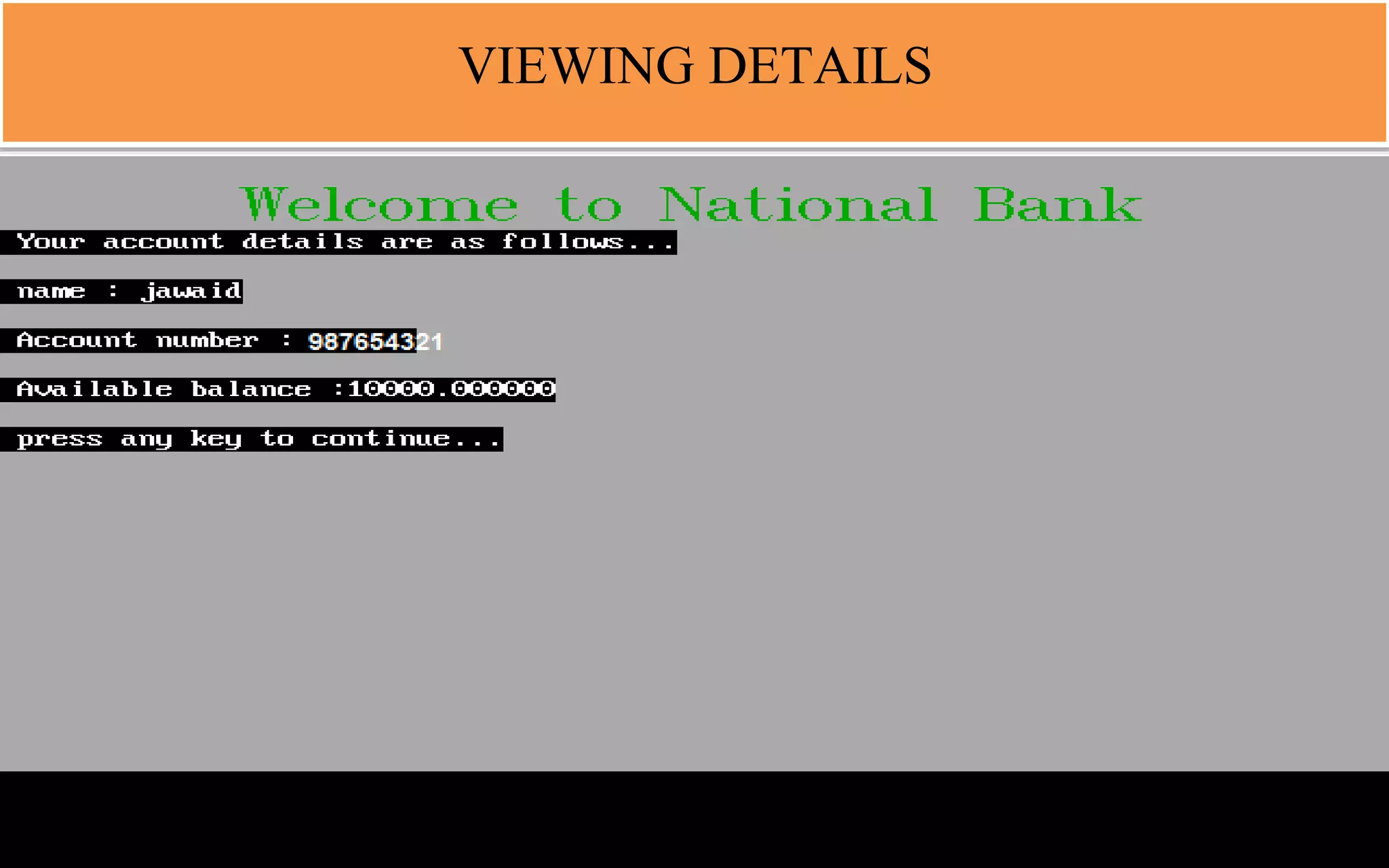

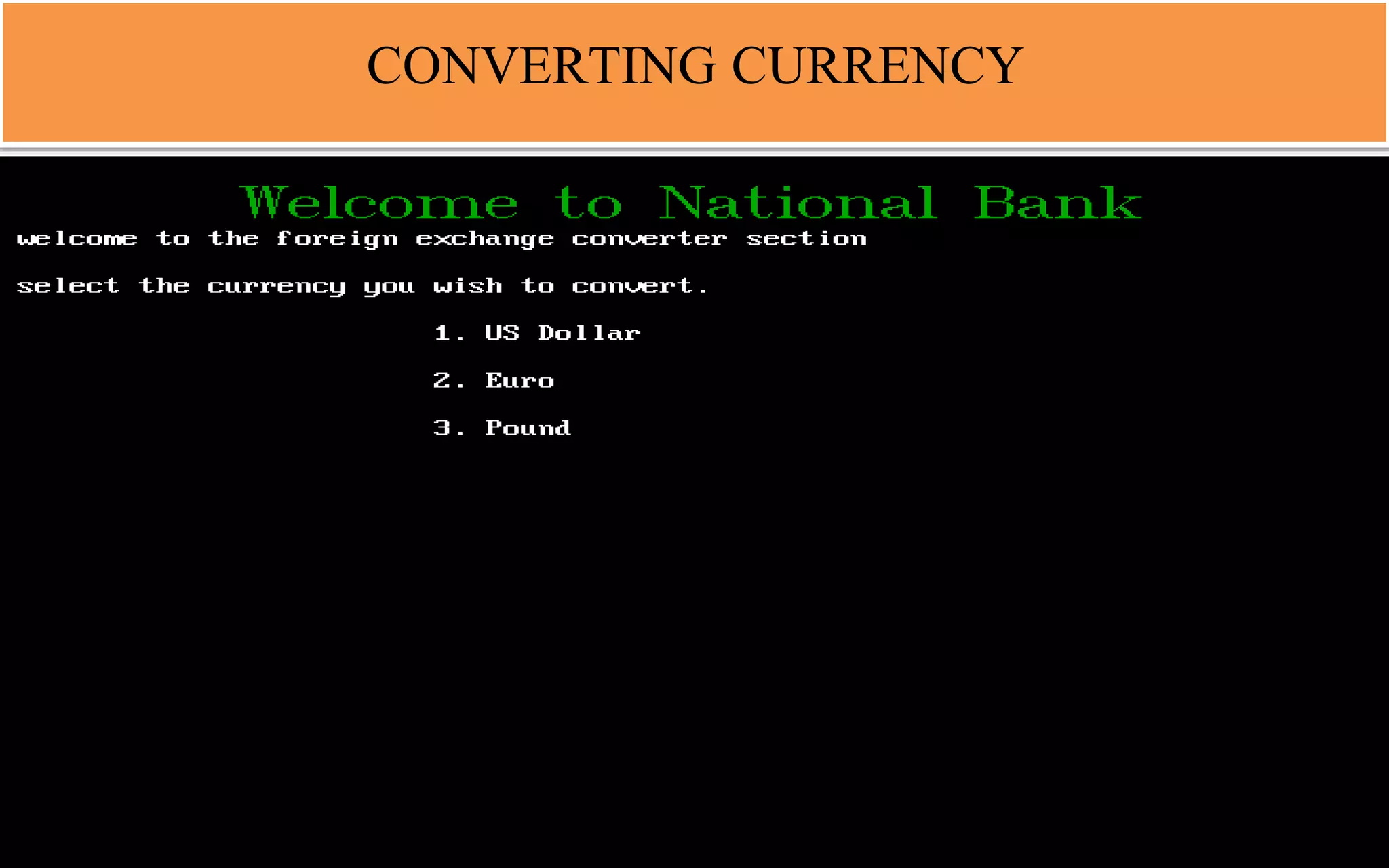

This document outlines a banking management system project that includes maintaining customer accounts, deposits, withdrawals, currency conversion, and other banking tasks. The project supervisor is Ahmad Aslam and the group members are Chaudhry Sajid, Mohsin Riaz, Affan Shahzad, and Ebad Ur Rahman. The system provides customers access to create accounts, deposit and withdraw cash, and view account balances. Requirements include software like Oracle Database, hardware specifications, and functionalities like registration, transactions, inquiries, and administration. Diagrams show entity relationships and use cases. Code examples demonstrate queries and functionality.