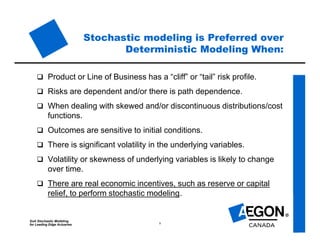

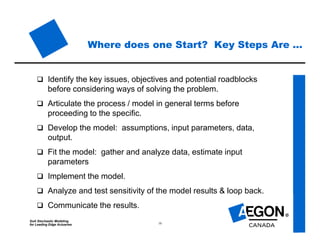

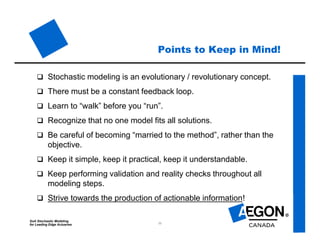

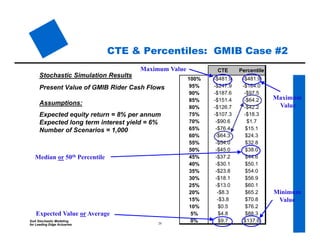

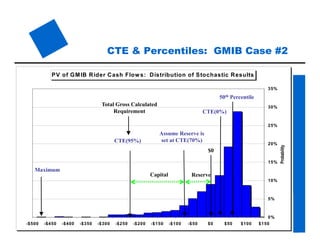

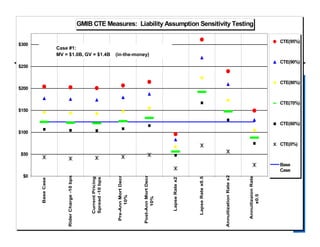

The document provides an overview of stochastic modeling for actuaries. It defines stochastic modeling as a technique that uses random variables and simulations to model complex systems over time. The key advantages are the ability to study long-term outcomes under different scenarios and to better understand risk. Limitations include significant effort required and reliance on input assumptions. Stochastic modeling is preferred when risks are complex or path dependent. The document outlines the modeling steps and discusses concepts like the conditional tail expectation.

![SoA Stochastic Modeling

for Leading Edge Actuaries 3

Stochastic Modeling - Definition

Stochastic [Greek stokhastikos: from stokhasts, diviner, from

stokhazesthai, to guess at, from stokhos, aim, goal.]

A stochastic model by definition has at least one random

variable and deals explicitly with time-variable interaction.

A stochastic simulation uses a statistical sampling of multiple

replicates, repeated simulations, of the same model.

Such simulations are also sometimes referred to as Monte

Carlo simulations because of their use of random variables.](https://image.slidesharecdn.com/ec07fd5d-42a8-4ba1-8a74-3837342b1daa-150215002208-conversion-gate02/85/Practical-Aspects-of-Stochastic-Modeling-pptx-3-320.jpg)