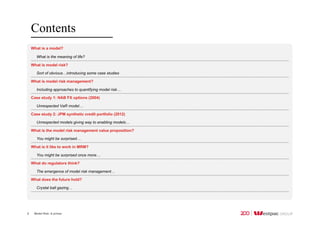

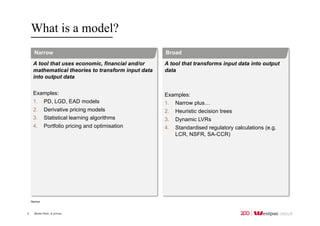

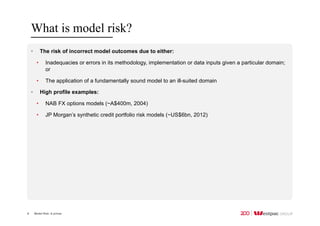

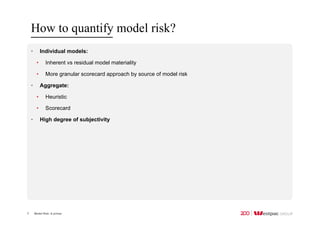

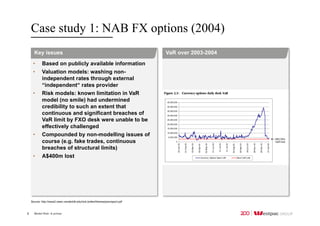

This document provides an overview of model risk and model risk management. It defines a model, discusses what model risk is using examples from NAB and JPMorgan, and describes the key aspects of model risk management including validation, quantification, and a control framework. It also discusses two case studies of model risk issues at NAB and JPMorgan, the value of model risk management, what it's like to work in the field, and regulators' increasing focus on it.