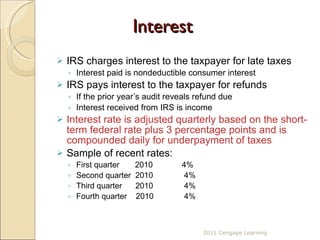

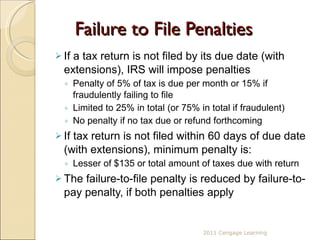

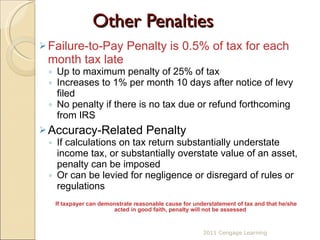

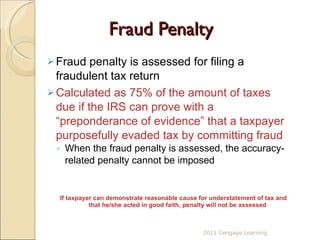

The document summarizes key aspects of tax administration and planning according to US law. It describes the organizational structure of the Internal Revenue Service (IRS) and its audit processes. It also outlines taxpayer penalties, statutes of limitations, the roles of tax practitioners, and concepts of tax planning to minimize liability legally.