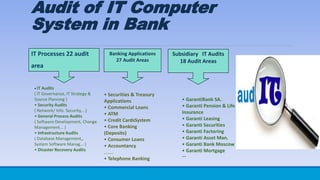

The document provides an overview of bank auditing. It discusses that bank audits are independently conducted by internal and external auditors to examine banking documents and provide an opinion. Bank audits are needed to increase efficiency, quickly present accounts, prepare interim reports, provide technical knowledge, ensure regularity of client staff, and identify errors and frauds. The main types of bank audits are internal audit, which is designed to improve risk management and governance, and external audit, which is conducted by independent auditors to audit annual financial statements. The document outlines the bank audit process, areas that are audited such as income, expenses, IT systems, and qualifications and duties of appointed auditors. Auditors can issue qualified, unqualified