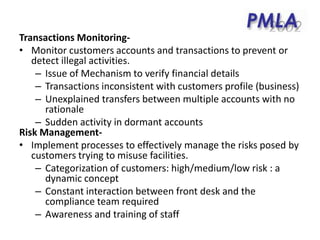

This document summarizes India's Prevention of Money Laundering Act of 2002. It defines money laundering and outlines the three stages of the process: placement, layering, and integration. It describes the obligations the Act places on banks, financial institutions, and intermediaries to maintain records and verify customer identities. These entities must appoint a Principal Officer to furnish information to authorities and retain records for official purposes. The Act aims to prevent money laundering and seize illegally obtained assets.