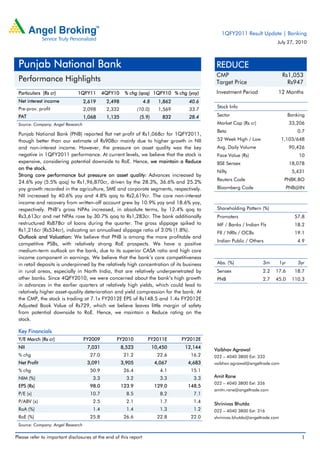

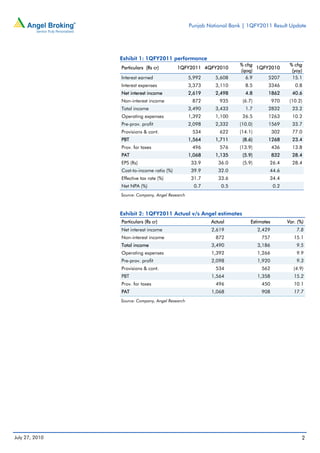

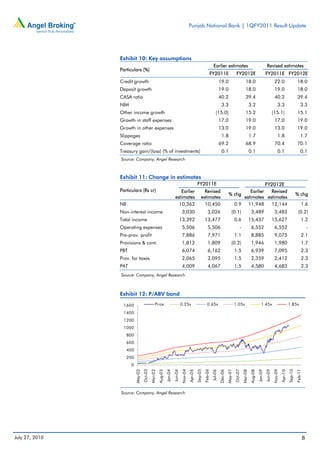

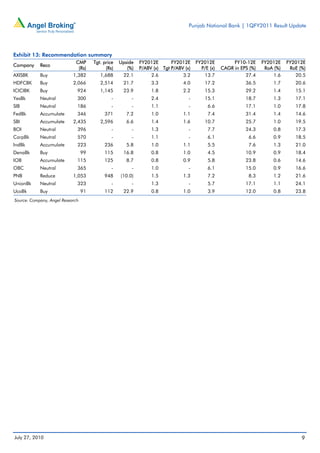

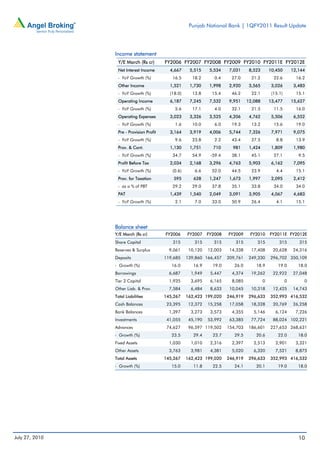

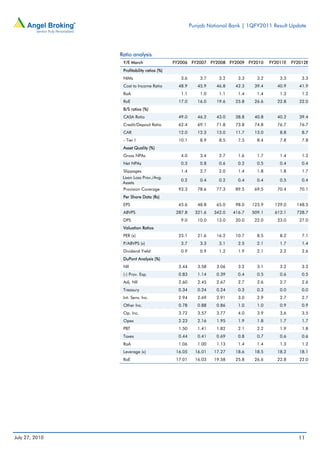

Punjab National Bank reported flat net profit of Rs1,068cr for 1QFY2011, higher than estimates due to strong growth in net interest income and non-interest income. However, asset quality pressures increased with gross and net NPAs rising significantly. Total advances grew 24.6% year-over-year driven by growth in the agriculture, SME, and corporate segments. Net interest margins declined slightly due to higher cost of deposits outpacing growth in asset yields. The bank increased provisions for NPAs in the quarter and restructured an additional Rs878cr in loans.