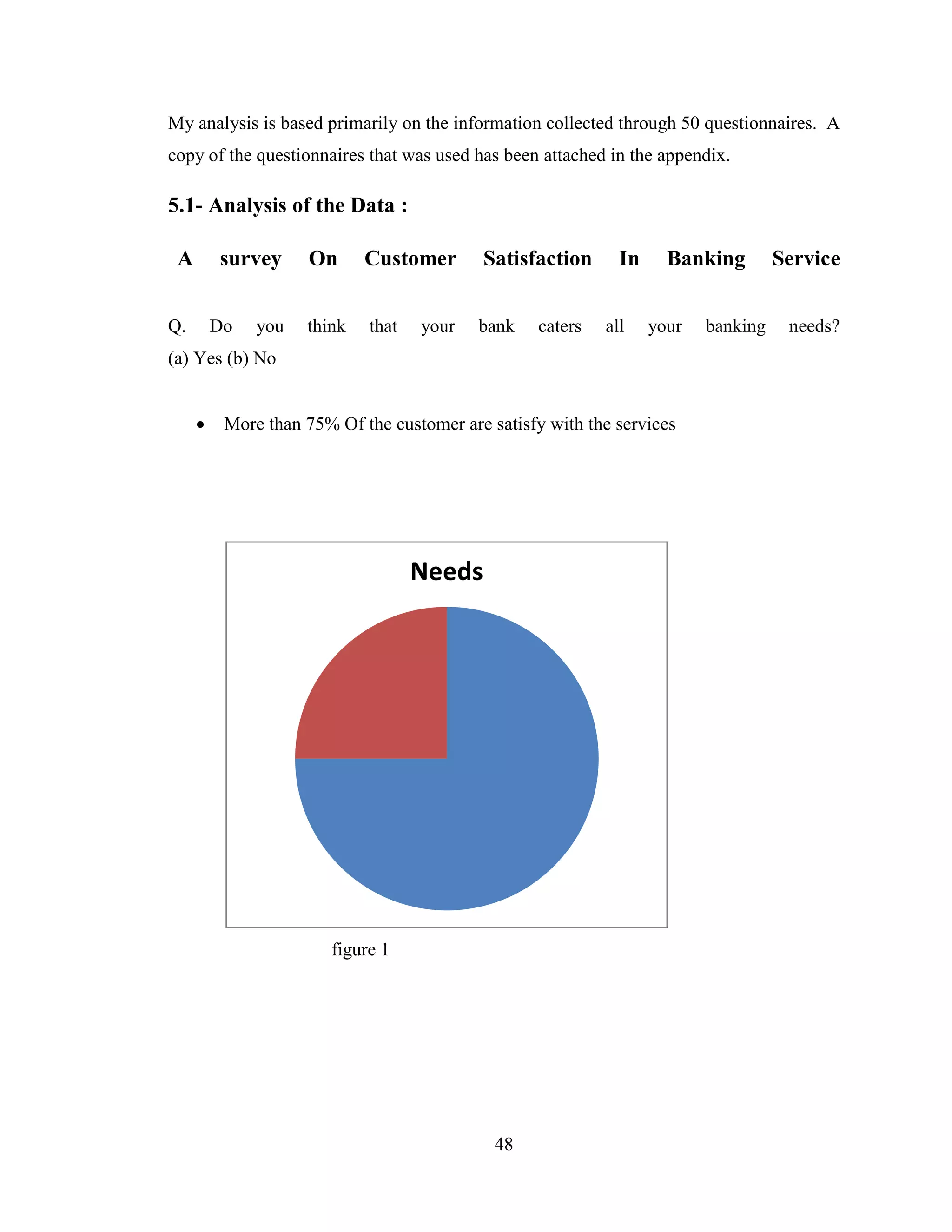

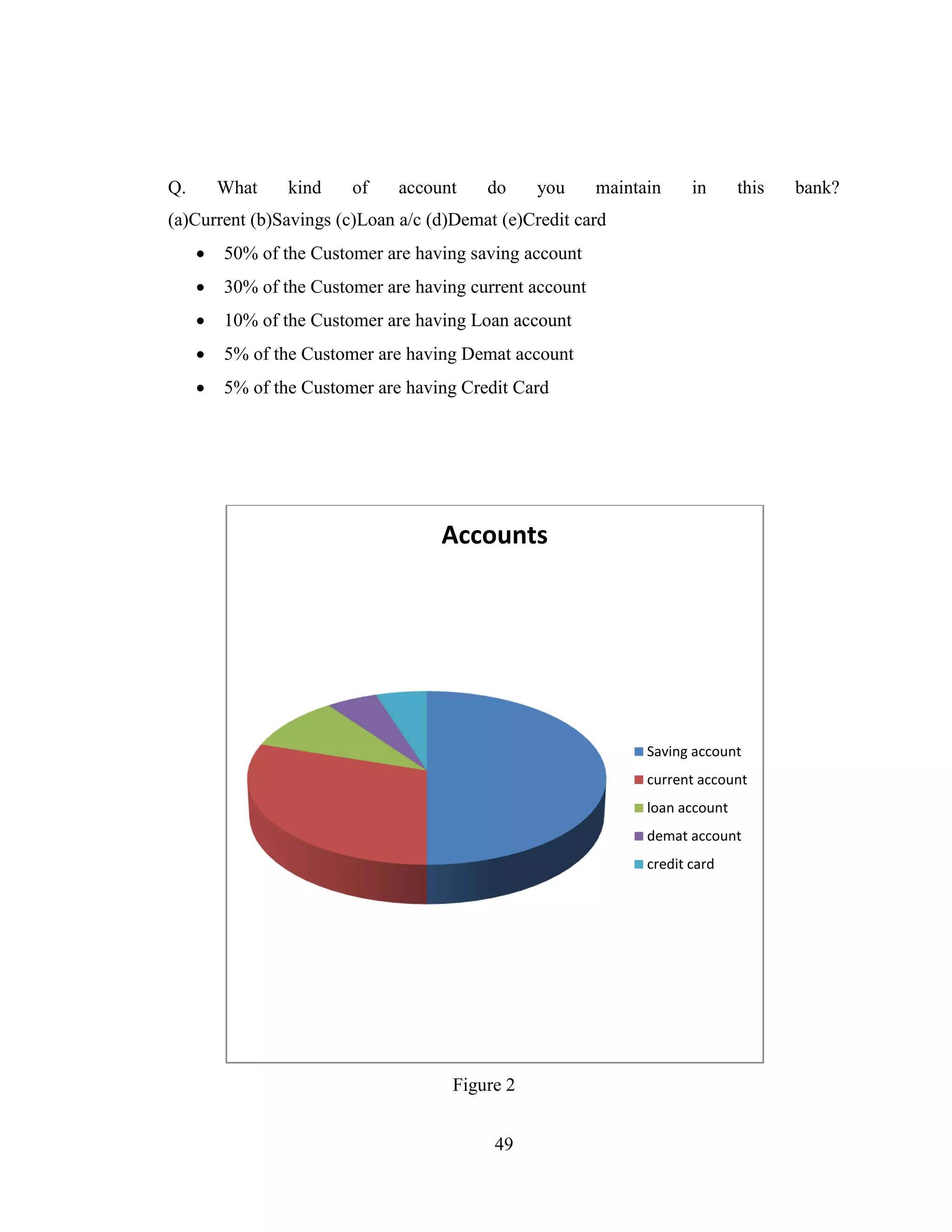

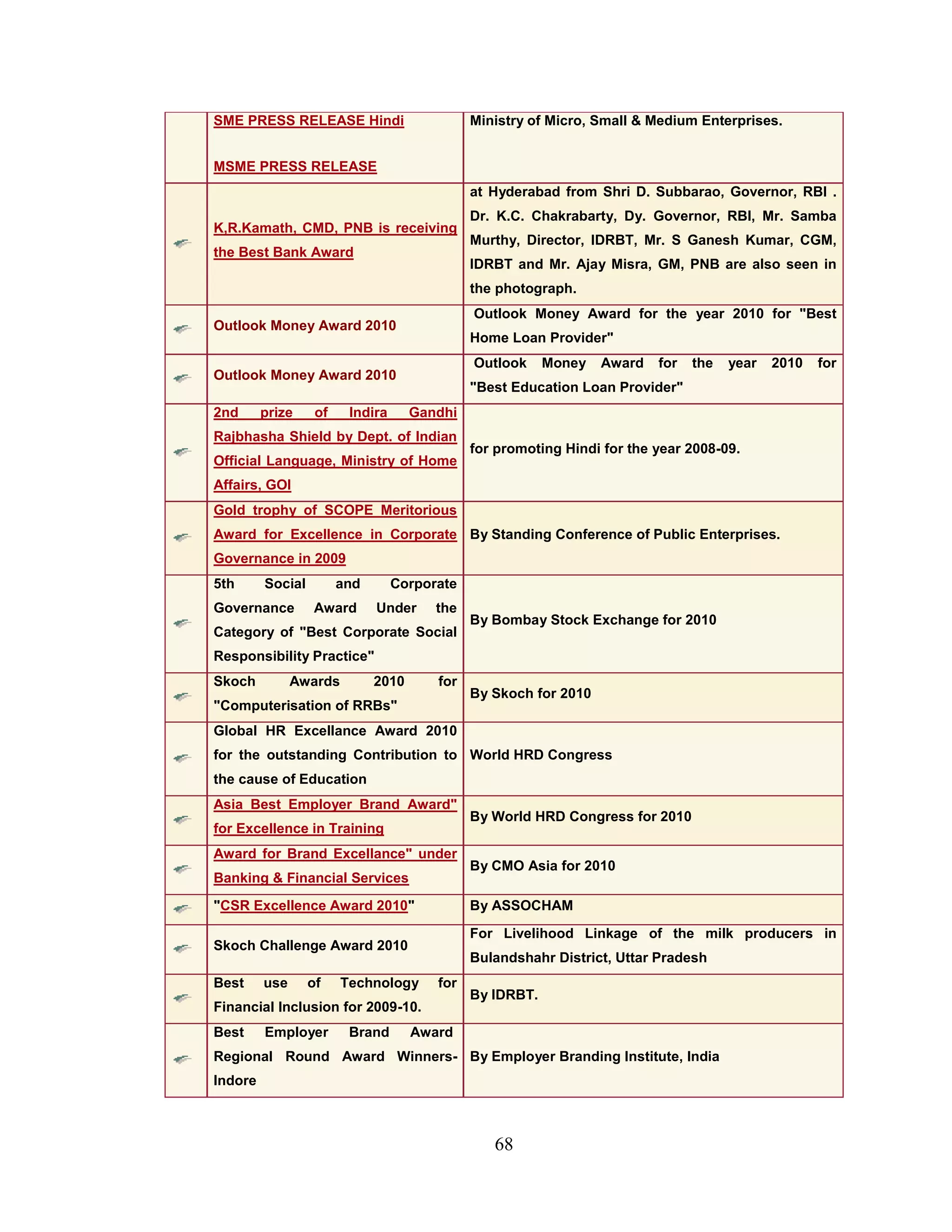

The document provides an introduction and industry profile of the banking sector in India. It discusses the origin and development of the banking industry in India from 1786 to the present. It outlines the key phases of development as: early phase from 1786 to 1969, nationalization from 1969 to 1991, and the new phase of reforms after 1991. It highlights the growth of the industry post liberalization in the 1990s and details the present status and structure of the banking sector in India including public, private, and foreign banks operating in the country.