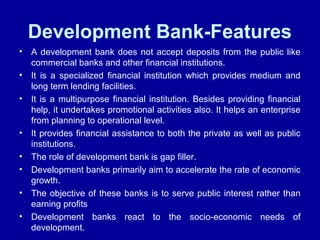

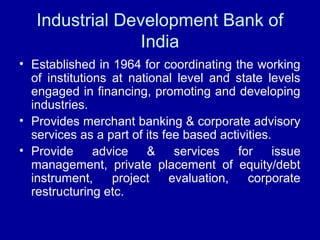

Development financial institutions provide medium and long-term financing to promote key sectors like industry, agriculture, and infrastructure. They include specialized banks like the World Bank, IDBI, SIDBI, and EXIM Bank that offer loans, underwriting, and advisory services. Unlike commercial banks, they do not accept deposits but rather aim to accelerate economic growth and serve public interests. Major development financial institutions were established in India after independence to promote industries and address regional imbalances.