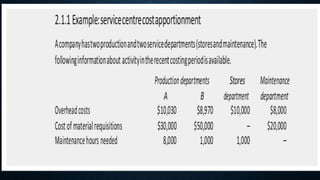

This document discusses absorption costing and marginal costing methods. Absorption costing recognizes fixed costs as part of the unit cost of production, allocating overhead costs based on various bases like direct labor hours. Marginal costing only includes variable costs in the cost of goods sold and treats fixed costs as a period expense. The document provides examples of calculating predetermined overhead rates and analyzing overhead under/over-absorption. It also justifies absorption costing as including an appropriate share of total overhead costs in the product cost.