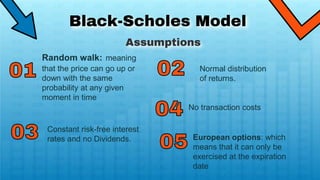

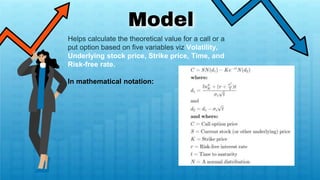

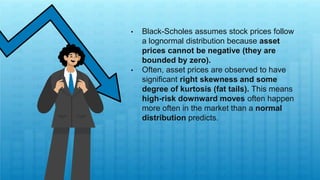

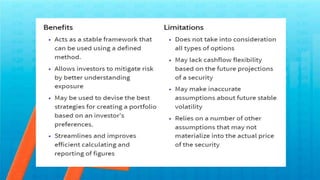

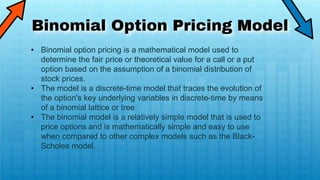

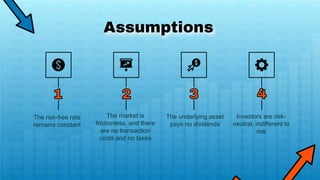

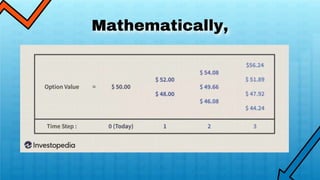

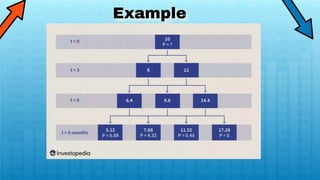

Option pricing models use mathematical formulas to calculate the theoretical value of an option based on variables like volatility, stock price, strike price, time to expiration, and risk-free interest rates. The most common models are the Black-Scholes model for European options and the binomial model. Both make assumptions like constant interest rates and that stock prices follow random walks. The models provide estimates of an option's fair value to help investors evaluate prices and make informed trading decisions.