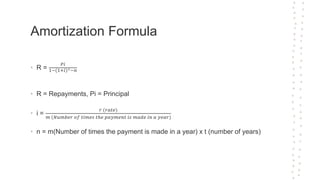

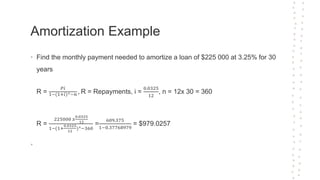

This document discusses amortization, which refers to the reduction of a debt over time through equal monthly payments of both principal and interest. It explains that as more principal is repaid each month, less interest is charged on the remaining balance. An amortization formula is provided to calculate monthly loan payments based on the principal, interest rate, and term of the loan. An example calculation is shown for a 30-year $225,000 mortgage loan at 3.25% interest.