The document provides solutions to an engineering economics assignment involving time value of money calculations. It includes calculations for problems involving compound interest, effective interest rates, future values, and annuity payments. For each problem, it clearly shows the relevant cash flow diagram, formulas, calculations, and solutions. It also discusses ensuring the appropriate time periods are used for weekly and monthly cash flows.

![ENVE292 – Engineering Economics Fall 2005

ASSIGNMENT #1 SOLUTIONS

Due: September 29, 2005

Text: 2.11, 2.13, 2.18, 2.25, 2.30, 3.18, 3.19, 3.20

2.11 Greg will invest $20 000 today in five-year investment certificates that pay 8% nominal

interest, compounded quarterly. How much money will this be in five years?

Cash Flow Diagram:

4 compounding periods per year

i = 8% p.a. compounded

l

?F =

$20 000

20 compounding periods require a modification of the nominal (quarterly) interest rate to an

effective (annual) interest rate.

08243.0

1

4

08.0

1

11

4

=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

m

e

m

r

i

The effective interest rate for quarterly compounding of a nominal rate of 8% is 8.243% per year.

Transfer factor to use is Compound Amount Factor. Here, we use N = 5 because we have

converted the interest rate to the equivalent annual interest rate including quarterly compounding.

5

08243.0

?

20000

=

=

=

=

N

i

F

P [ ]

[ ]

65.29718

08243.0120000

,,/

5

=

+=

= NiPFPF

Therefore Greg will have $29 719 at the end of 5 years from an initial investment of $20 000

(earning $9 719 in interest)

1](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-1-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

2.13 You have a bank deposit now worth $5000. How long will it take for your deposit to be

worth more than $8000 if:

a) The account pays 5% actual interest every half year (6 months) and is compounded?

b) The account pays 5% nominal interest, compounded semi-annually?

Cash Flow Diagram

$8000+

i = 5% (nominal/effective)

Semi-annual compounding

(unknown number of periods)

$5000

The future value of ~$8000 will be at N (semi-annually) periods.

a)

To determine the number of compounding periods required, first, we need to understand the

interest rate that is given.

The account pays 5% actual interest every half year. Therefore every six months, the balance of

the account accumulates 5% interest. Assuming it is compounding semi-annually as well, the

compounding periods and the interest rates match.

8000

5000

periodsannualsemi

annually-semi05.0

=

=

−=

=

F

P

N

ie

[ ]

[ ]

( ) ( )

( )

( )

periodsannual-semi10

63.9

05.1log

6.1log

05.1log6.1log

05.16.1

05.0150008000

%,5,/

=

=

=

=

=

+=

=

N

N

NPFPF

N

N

As there are two periods per year, the number of years to achieve $8000 is 5 (10 compounding

periods) years.

2](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-2-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

b) The account pays 5% nominal interest and is compounded semi-annually. This is different to

that of Part A. The annual effective interest rate is:

050625.0

1

2

05.0

1

11

2

=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

m

e

m

r

i

8000

5000

periodsannual

050625.0

=

=

=

=

F

P

N

ie

[ ]

[ ]

( ) ( )

( )

( )

periodsannual10

517.9

050625.1log

6.1log

050625.1log6.1log

050625.16.1

050625.0150008000

%,0625.5,/

=

=

=

=

=

+=

=

N

N

NPFPF

N

N

As there is only one period per year, the number of years to achieve $8000 is 10 years (20

compounding periods).

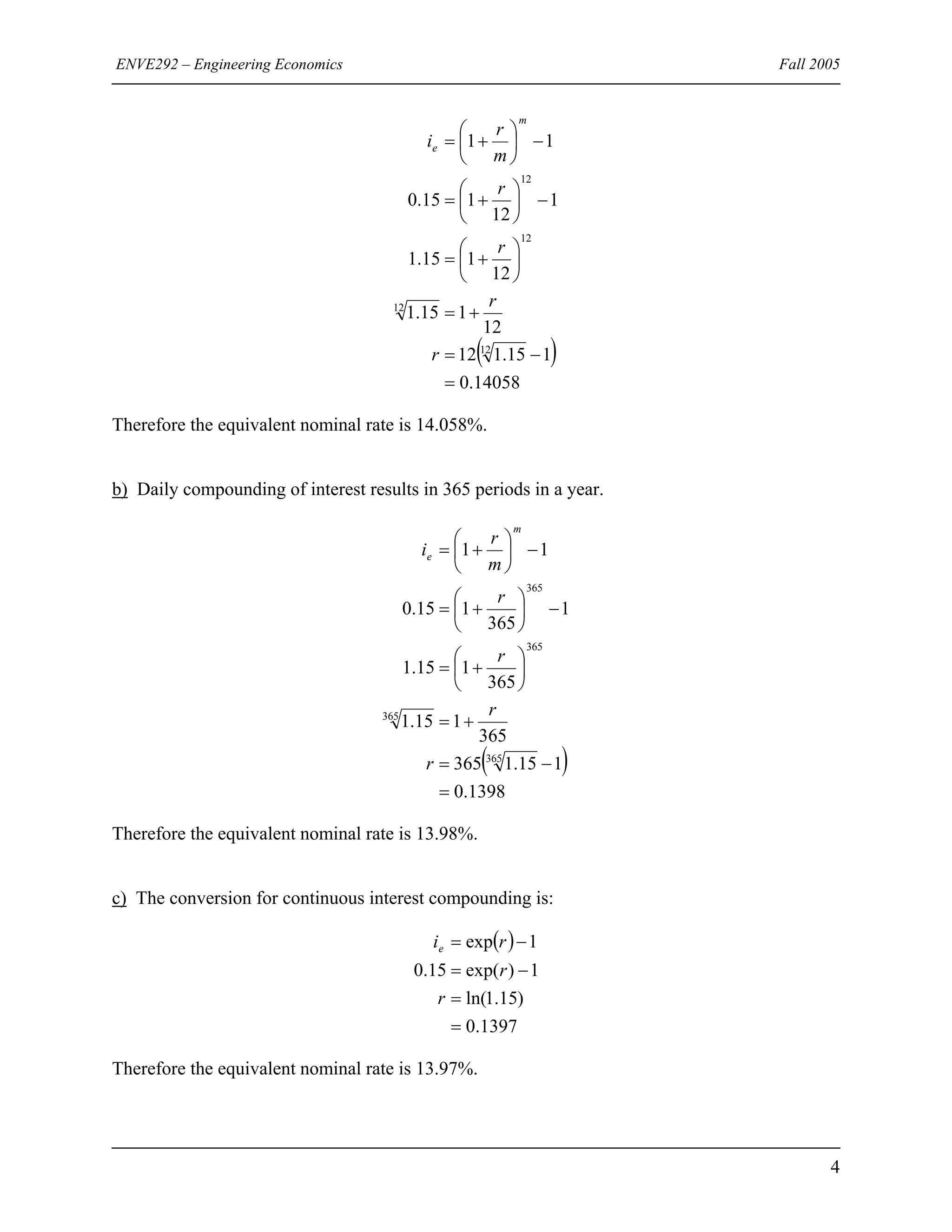

2.18 For a 15% effective annual interest rate, what is the nominal rate if:

a) Interest is compounded monthly?

b) Interest is compounded daily?

c) Interest is compounded continuously?

The general formula to convert from nominal to effective interest rates is (discrete

compounding):

11 −⎟

⎠

⎞

⎜

⎝

⎛

+=

m

e

m

r

i

a)

Monthly compounding of interest results in 12 periods in a year.

3](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-3-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

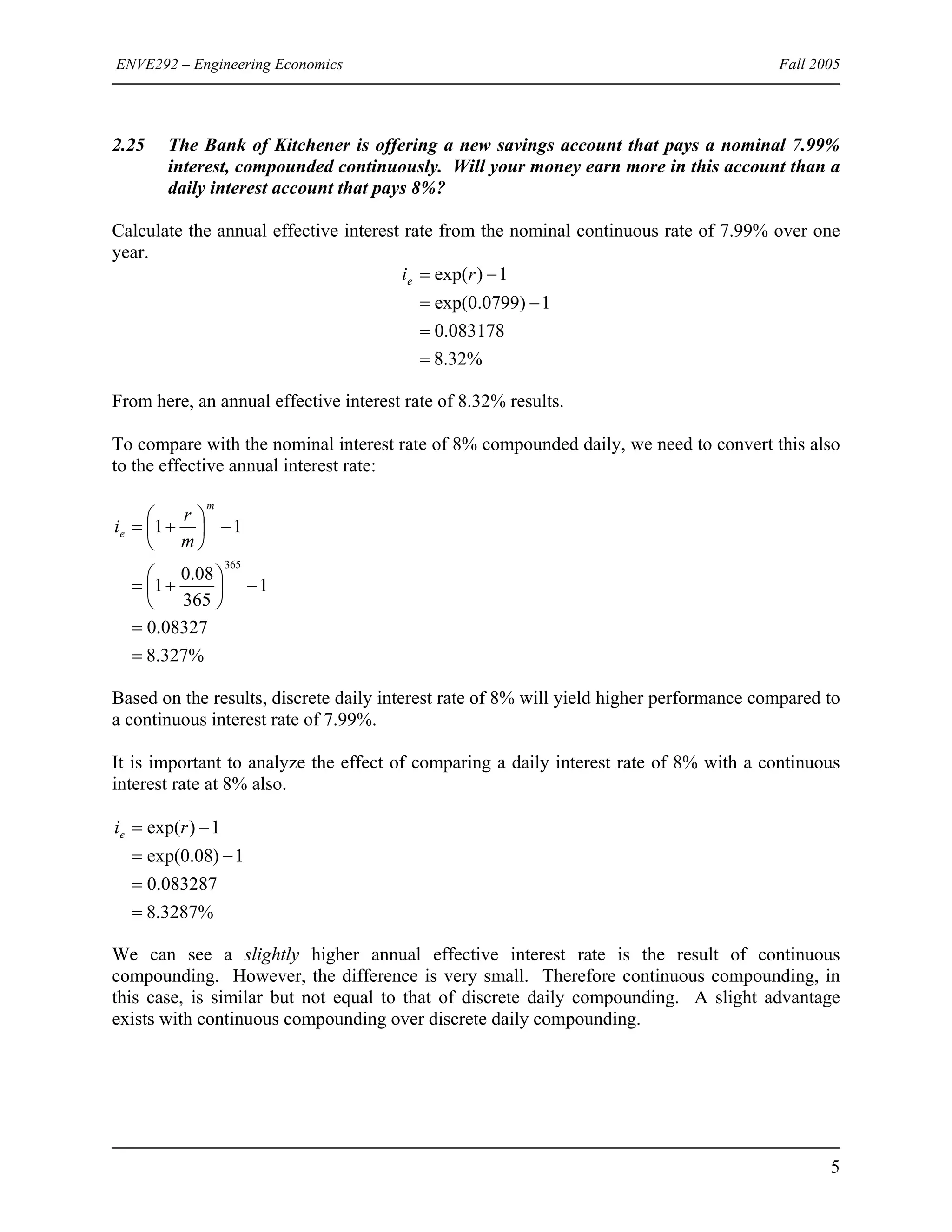

2.30 You have $50 000 to invest in the stock market and have sought the advice of Adam, an

experienced collegue who is willing to advise you for a fee. Adam has told you that he

has found a one-year investment for you that provides 15% interest compounded

monthly.

a) What is the effective annual interest rate, based on a 15% nominal annual rate and

monthly compounding?

b) Adam says he will make the investment for you for a modest fee of 2% of the

investments value one year from now. If you invest $50 000 today, how much will you

have at the end of one year? (Before Adam’s fee)

c) What is the effective annual interest rate of this investment including Adam’s fee?

Part A

To determine the effective annual interest rate we require the use of the conversion formula:

%08.16

16075.0

1

12

15.0

1

11

12

=

=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

m

e

m

r

i

Therefore the effective annual interest rate is estimated at 16.08%.

Part B

If $50 000 was invested today at the aforementioned scenario, then we would like to know the

value after one year (before Adam’s fee).

Cash Flow Diagram:

1 year

One compounding

period

ie = 16.08% per year

F1

$50 000

[ ]

[ ]

58037.43OR58040

1608.0150000

1%,08.16,

1

1

=

+=

=

P

FPF

6](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-6-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

Part C

To determine the effective annual interest rate including Adam’s fee, we can do the following:

Firstly, the fee Adam imposes is 2% of F1 ($58 040) = $1160.80

Secondly, we subtract this fee from F1 yielding the net value at the end of year 1.

20.56879

80.1160580401

=

−=NET

F

Now we can represent this in a revised (net) cash flow diagram.

1 year

One compounding

period

ie = ?% per year

$56879.20

$50 000

[ ]

[ ]

%76.13

1376.0

15000020.56879

1,,/

1

=

=

+=

=

e

e

i

i

iPFPF

Therefore, with the fee Adam has charged, the effective annual interest rate of this investment is

approximately 13.76%.

7](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-7-2048.jpg)

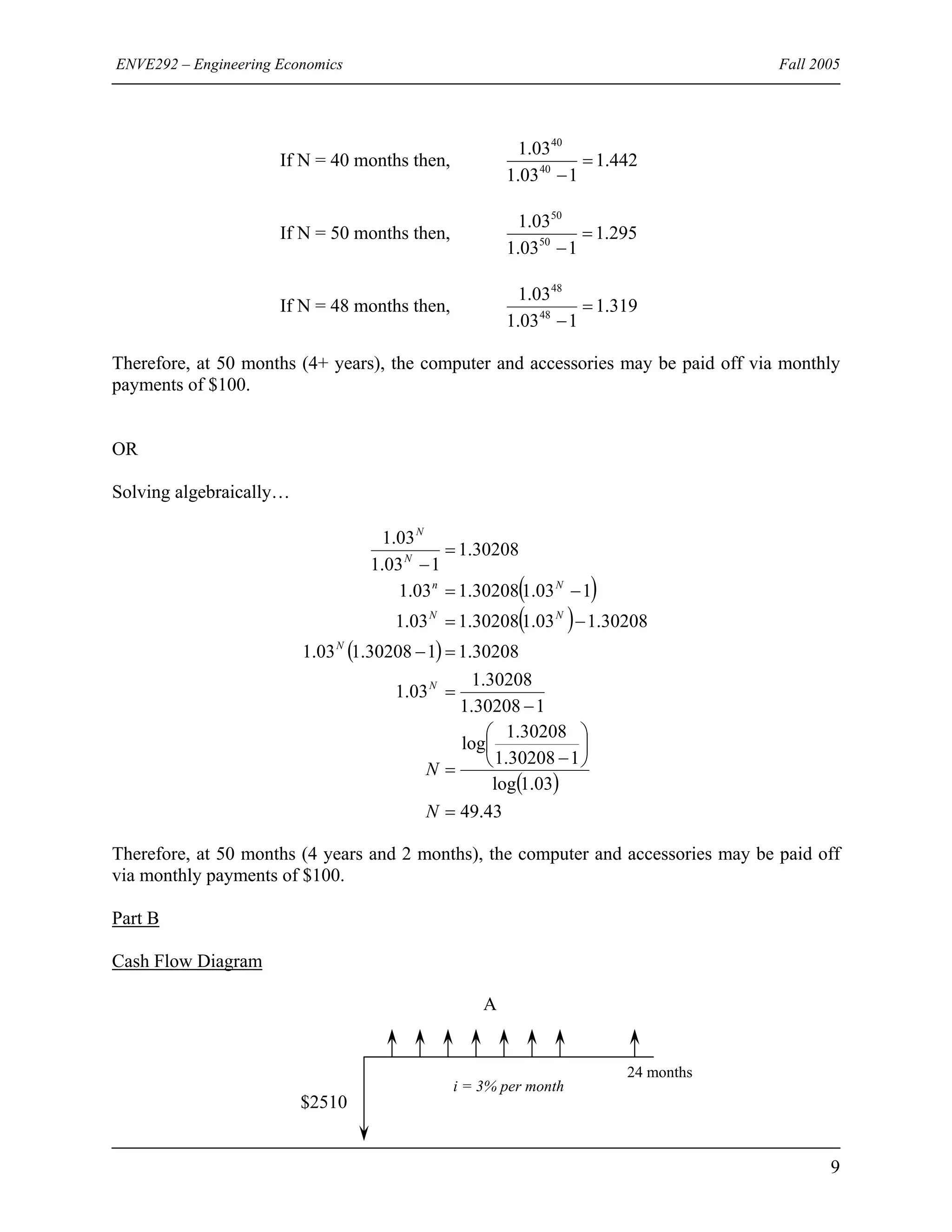

![ENVE292 – Engineering Economics Fall 2005

3.18 Yoko has just bought a new computer ($2000), a printer ($350) and a scanner ($210).

She wants to take the monthly payment option. There is a monthly interest of 3% on

her purchase.

a) If Yoko pays $100 per month, how long does it take to complete her payment?

b) If Yoko wants to finish paying in 24 months, how much will her monthly payments be?

Total initial investment of (assume values include taxes):

2560

2103502000

=

++=P

Part A

Cash flow diagram

A = $100

ip = 3% per month

N

$2560

The interest rate is given as 3% per month. From this, we can assume this is the effective period

interest rate (ip).

[ ]

( )

( )

( )

( )

103.1

03.1

30208.1

103.01

03.0103.0

2560100

11

1

%,3,/

−

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

+

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

+

=

=

N

N

N

N

N

N

i

ii

PA

NPAPA

To solve, must equate LEFT and RIGHT sides.

If N = 10 months then, 908.3

103.1

03.1

10

10

=

−

If N = 20 months then, 241.2

103.1

03.1

20

20

=

−

8](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-8-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

[ ]

( )

( )

( )

( )

17.151

103.01

03.0103.0

2560

11

1

24%,3,/

24

24

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

+

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

+

=

=

A

A

i

ii

PA

PAPA

N

N

If she would like to pay off her computer and accessories in 2 years (24 months) then monthly

payments of $151.17 is required.

3.19 Rinku has just finished her first year of university. She wants to go to Europe when

she graduates in three years. By having a part-time job through the school year and a

summer job during the summer, she plans to make regular weekly deposits into a

savings account at 18% interest compounded monthly.

a) If Rinku deposits $15 per week, how much will she have in three years? How about

$20 per week?

b) Find out exactly how much Rinku needs to deposit every week is she wants to save

$5000 in 3 years.

It has been assumed the part-time job was not done in Rinku’s first year in University. Therefore

only years 2, 3, and 4 will be considered.

The textbook solves this question through the assumption of 4 weeks per month and 12 months

per year. Unfortunately, this results in only 48 weeks being analyzed, 4 short of the typical 52

week year. Therefore, it is important to transfer all cash flows from monthly to weekly

annuities.

Part A

Regular weekly deposits of $A will be done. A total of 156 weekly installments of $A will be

completed over three years.

Cash Flow Diagram

i = 18% p.a. compounded monthly

F

156 weeks

A

10](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-10-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

First, we calculate an effective annual interest rate with monthly compounding:

%56.19

195618.0

1

12

18.0

1

11

12

=

=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

−⎟

⎠

⎞

⎜

⎝

⎛

+=

m

e

m

r

i

As we are working with weekly installments, we must convert this into a weekly effective

interest rate (ip). Notice the exponent n is 52 indicating we would like to achieve an period

interest rate for 52 equal periods (i.e. weekly) from the effective annual rate.:

( )

( )

%34417.0

0034417.0

11195618.0

11

52

=

=

−+=

−+=

p

p

n

pe

i

i

ii

Now we use 0.34417% in the following as the weekly interest rate for the calculations.

If weekly deposits of $15:

[ ]

( )

( )

61.3090

0034417.0

10034417.01

15

11

%,,/

156

=

⎥

⎦

⎤

⎢

⎣

⎡ −+

=

⎥

⎦

⎤

⎢

⎣

⎡ −+

=

=

i

i

A

NiAFAF

N

If weekly deposits of $20

[ ]

( )

( )

82.4120

0034417.0

10034417.01

20

11

%,,/

156

=

⎥

⎦

⎤

⎢

⎣

⎡ −+

=

⎥

⎦

⎤

⎢

⎣

⎡ −+

=

=

i

i

A

NiAFAF

N

Part B

To achieve $5000 at the end of 36 months (or 156 weeks), we must deposit weekly deposits of

$B

11](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-11-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

[ ]

( )

( )

27.24

10034417.01

0034417.0

5000

11

%,,/

156

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

=

⎥

⎦

⎤

⎢

⎣

⎡

−+

=

=

B

i

i

F

NiFAFB

N

Therefore, weekly deposits of approximately $24.27 is required to achieve sufficient funds to

travel to Europe in three years.

3.20 Seema is looking at an investment in upgrading an inspection line at her plant. The

initial cost would be $140 000 with a salvage value of $37 000 after 5 years. Use the

Capital Recovery Formula to determine how much money must be saved each year to

justify the investment at a rate of 14%.

Here, we assume the interest rate is compounded annually.

The Capital Recovery Formula is:

( )[ ] SiNiPASPA +−= ,,/

To illustrate this equation is the cash flow diagram:

i = 14% p.a. compounded

annually

N N

AS

P

In this case, the following values are assigned to the parameters

12](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-12-2048.jpg)

![ENVE292 – Engineering Economics Fall 2005

%14

5

37000

140000

=

=

=

=

i

N

S

P

( )[ ]

( ) ( )

( )

( ) ( )

( )

( )

( )[ ] ( )

21.35182

14.0370002913.037000140000

14.037000

114.1

14.114.0

37000140000

11

1

,,/

5

5

=

+−=

+⎥

⎦

⎤

⎢

⎣

⎡

−

−=

+⎥

⎦

⎤

⎢

⎣

⎡

−+

+

−=

+−=

Si

i

ii

SP

SiNiPASPA

N

N

So what does this mean? The company will invest in equipment that will, in a five years, hold a

residual (salvage) value. The difference between the purchase price (P = $140000) and salvage

value (S = $37000) is the “depreciation” or lost value of the equipment (here it is $103000).

The capital recovery formula is simply a way of representing the lost value of the equipment

over the analysis period and spreading this loss over (for this case) 5 years. Essentially, the

company must save $35182.21 per year to justify the purchase of this machine.

If the actual annual savings is greater than $35182.21, then it is a bonus to the company.

However, if the annual savings is less than that value, it was not worth purchasing this equipment

in the first place.

13](https://image.slidesharecdn.com/assignmen1-140313105549-phpapp02/75/Assignmen-1-13-2048.jpg)