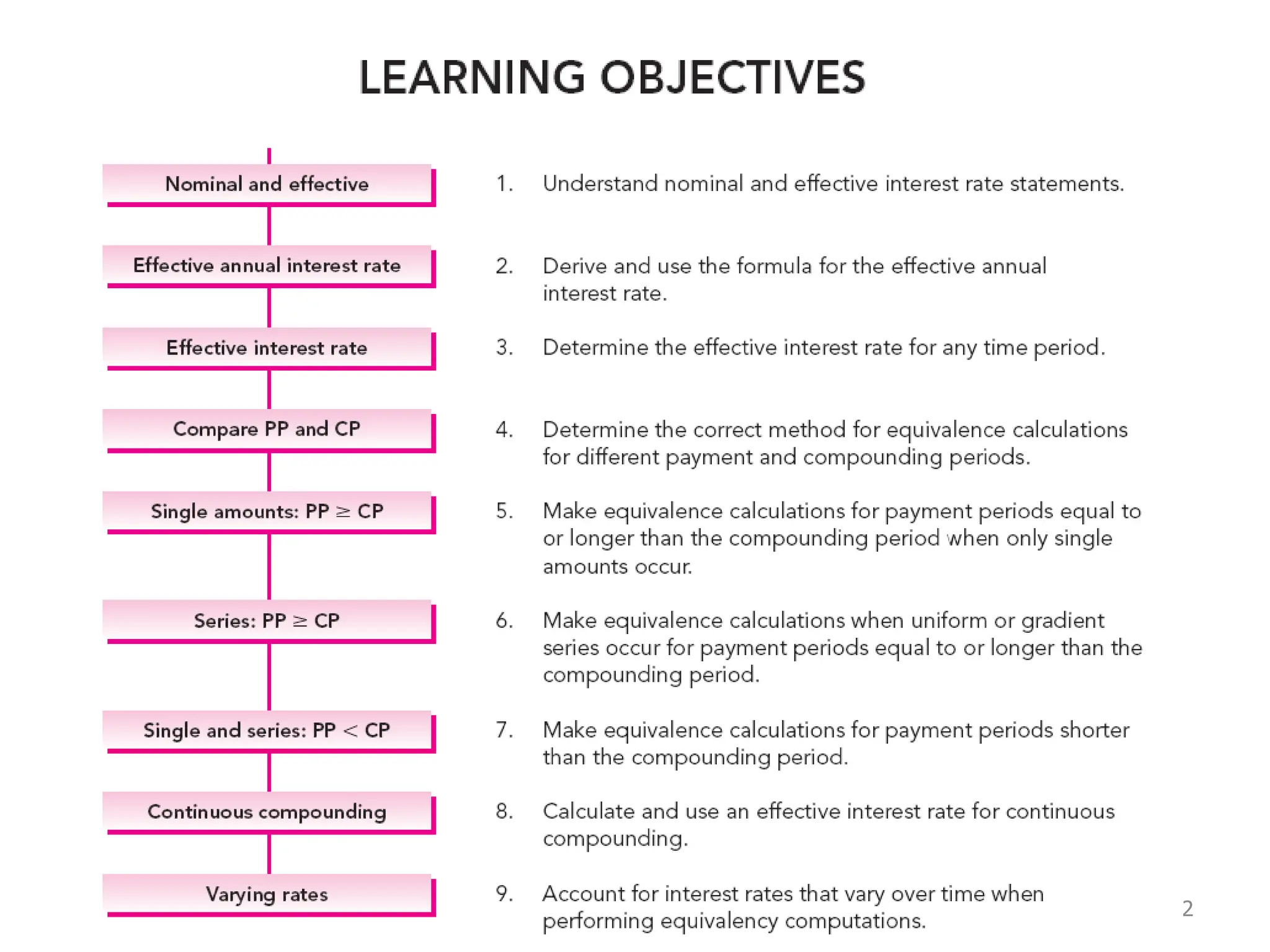

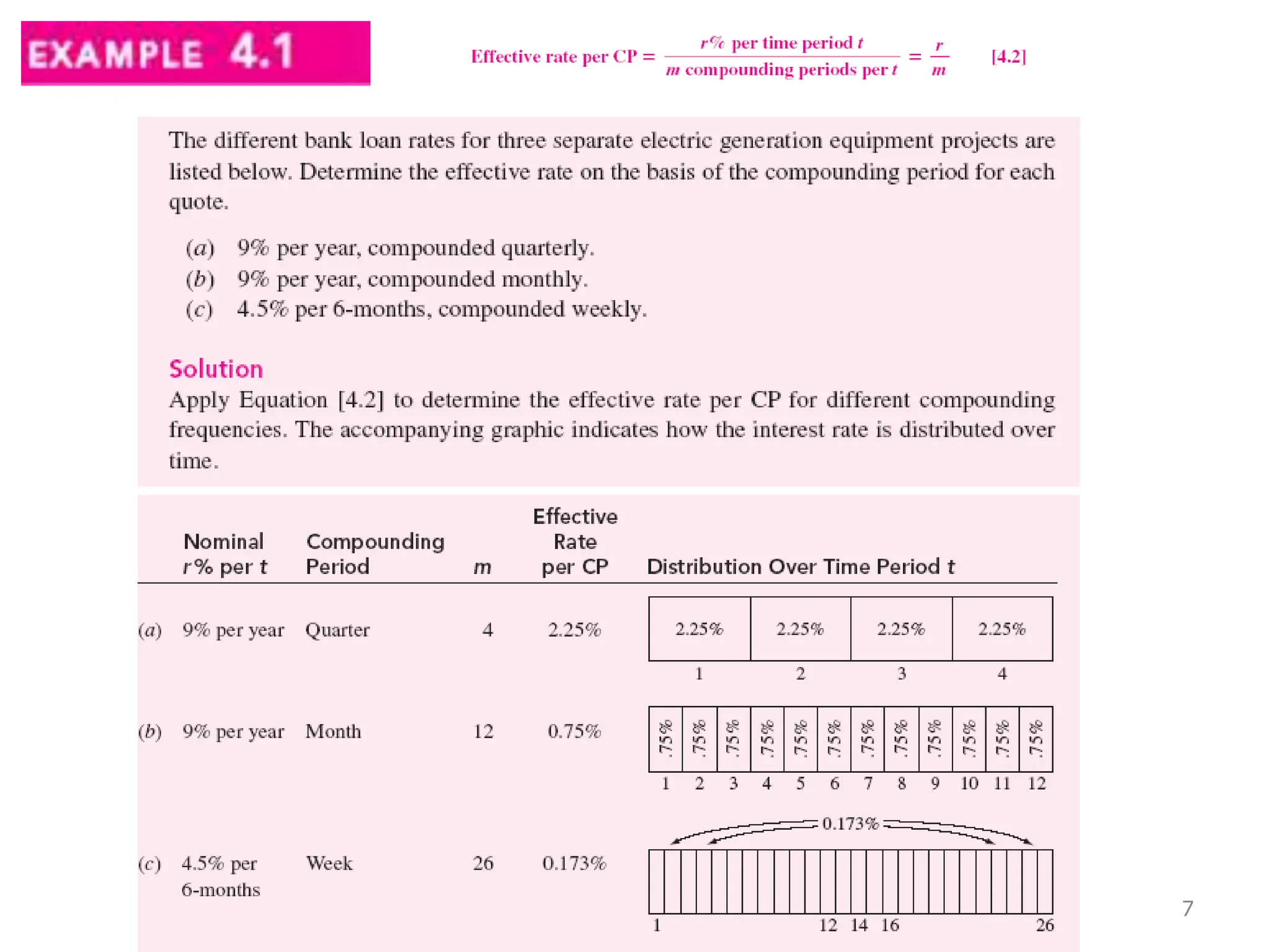

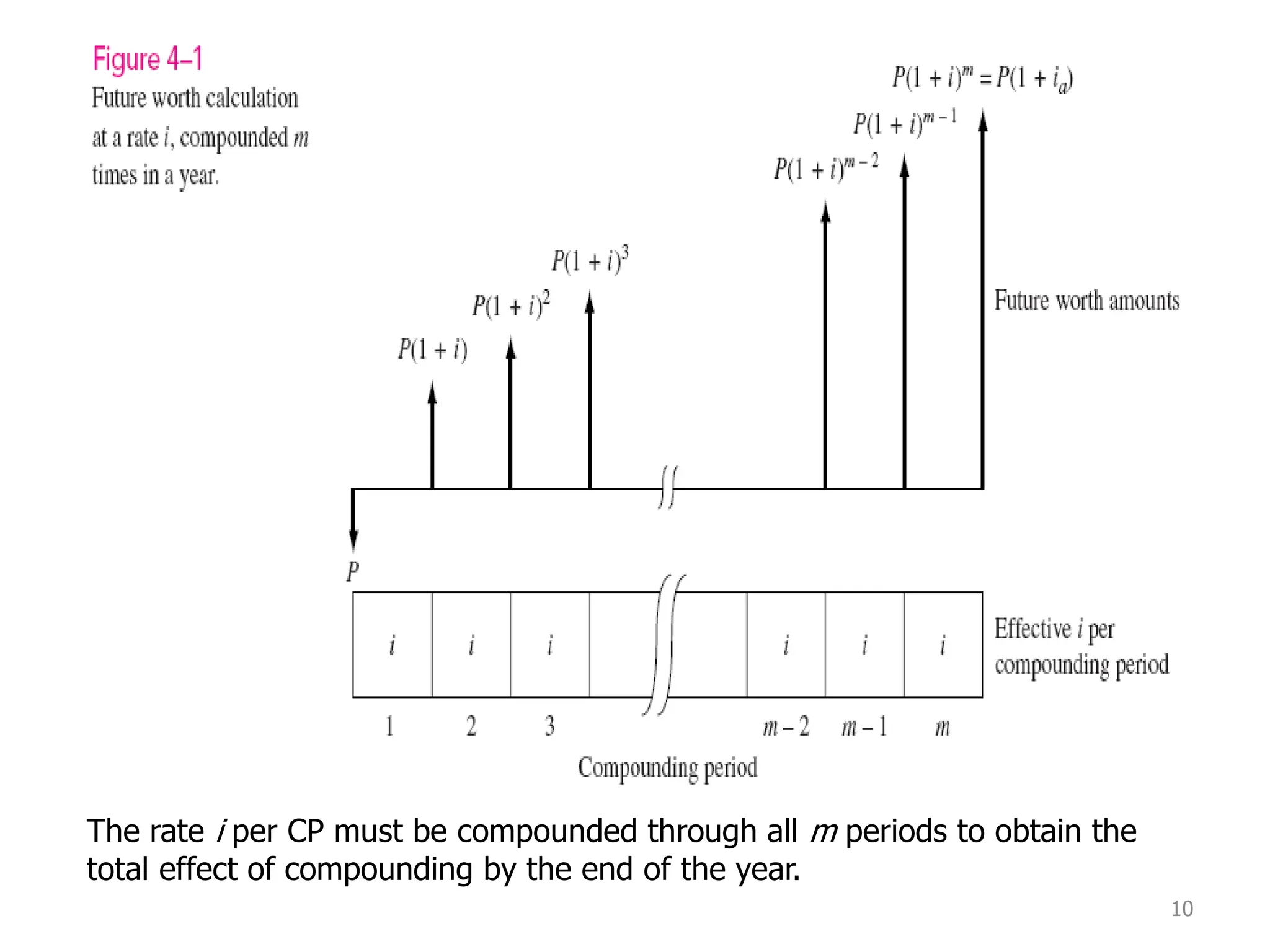

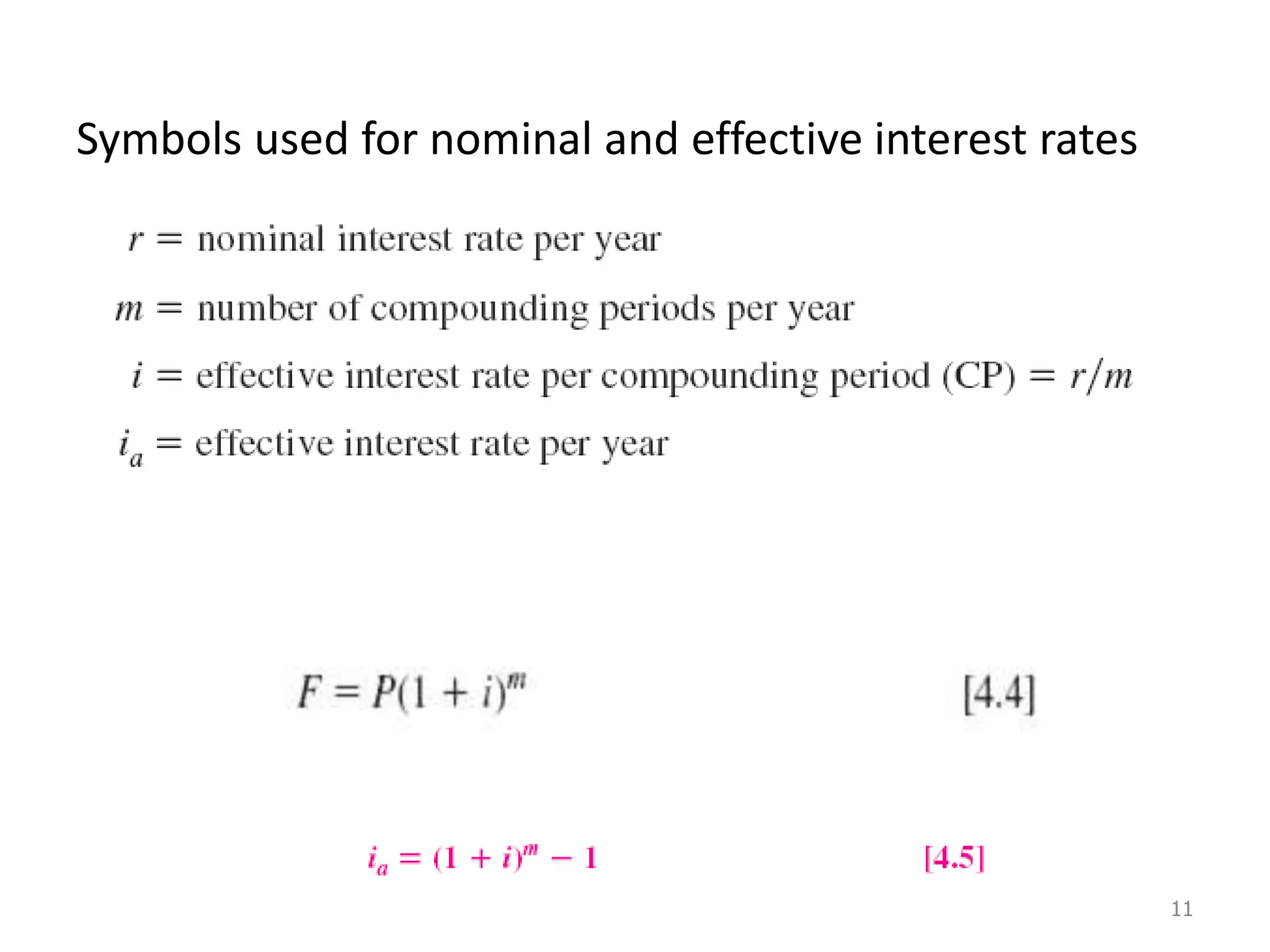

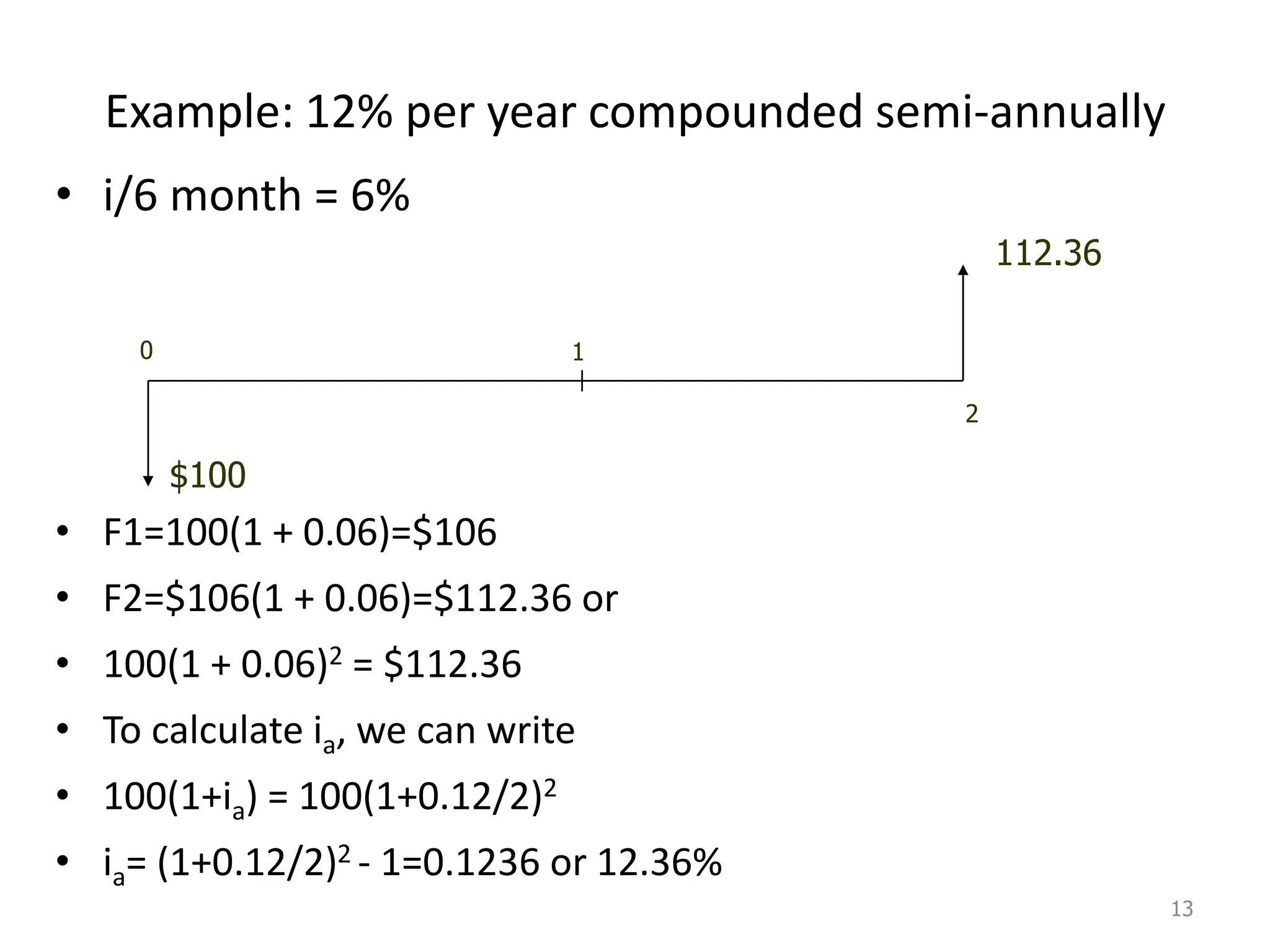

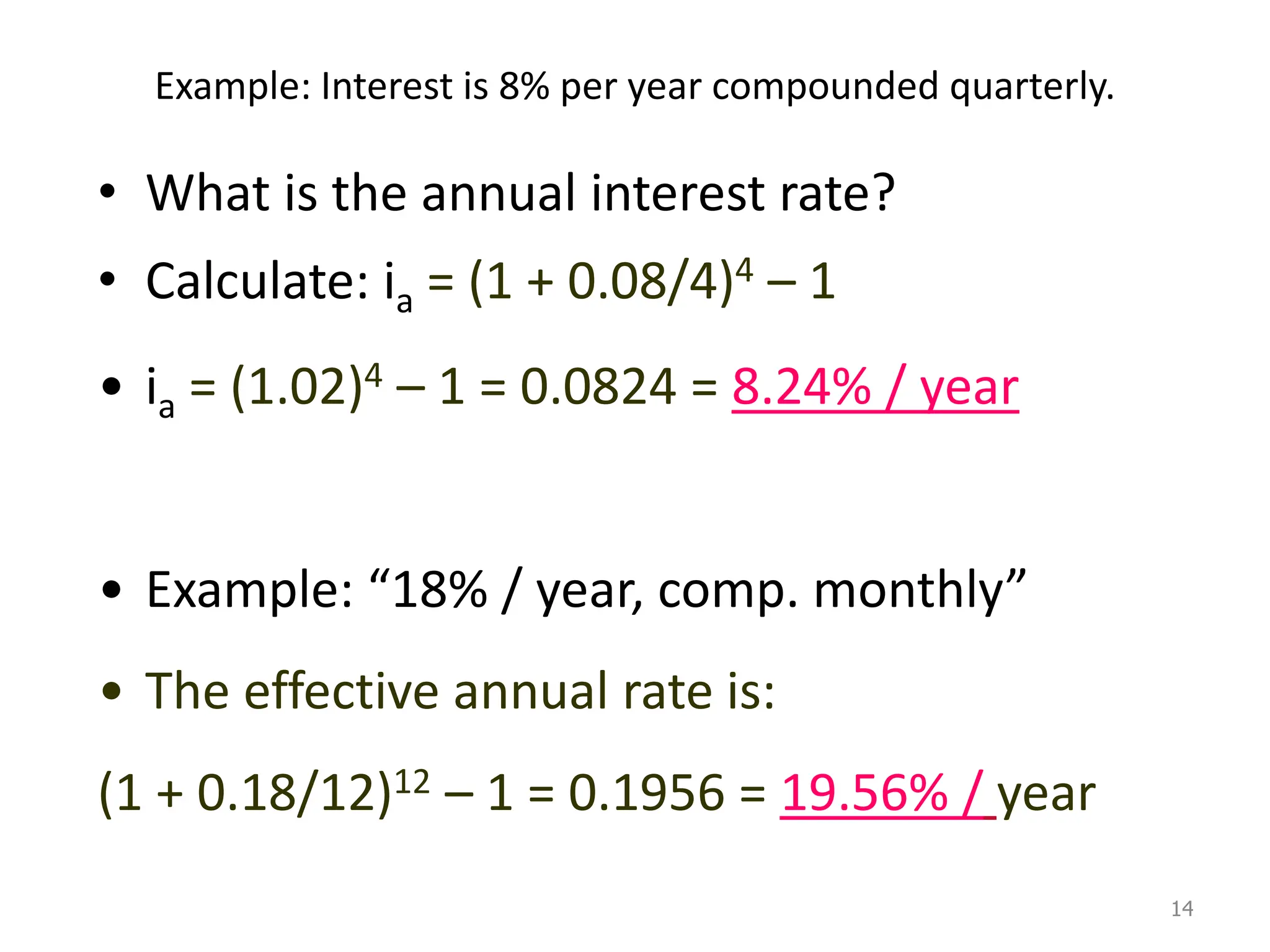

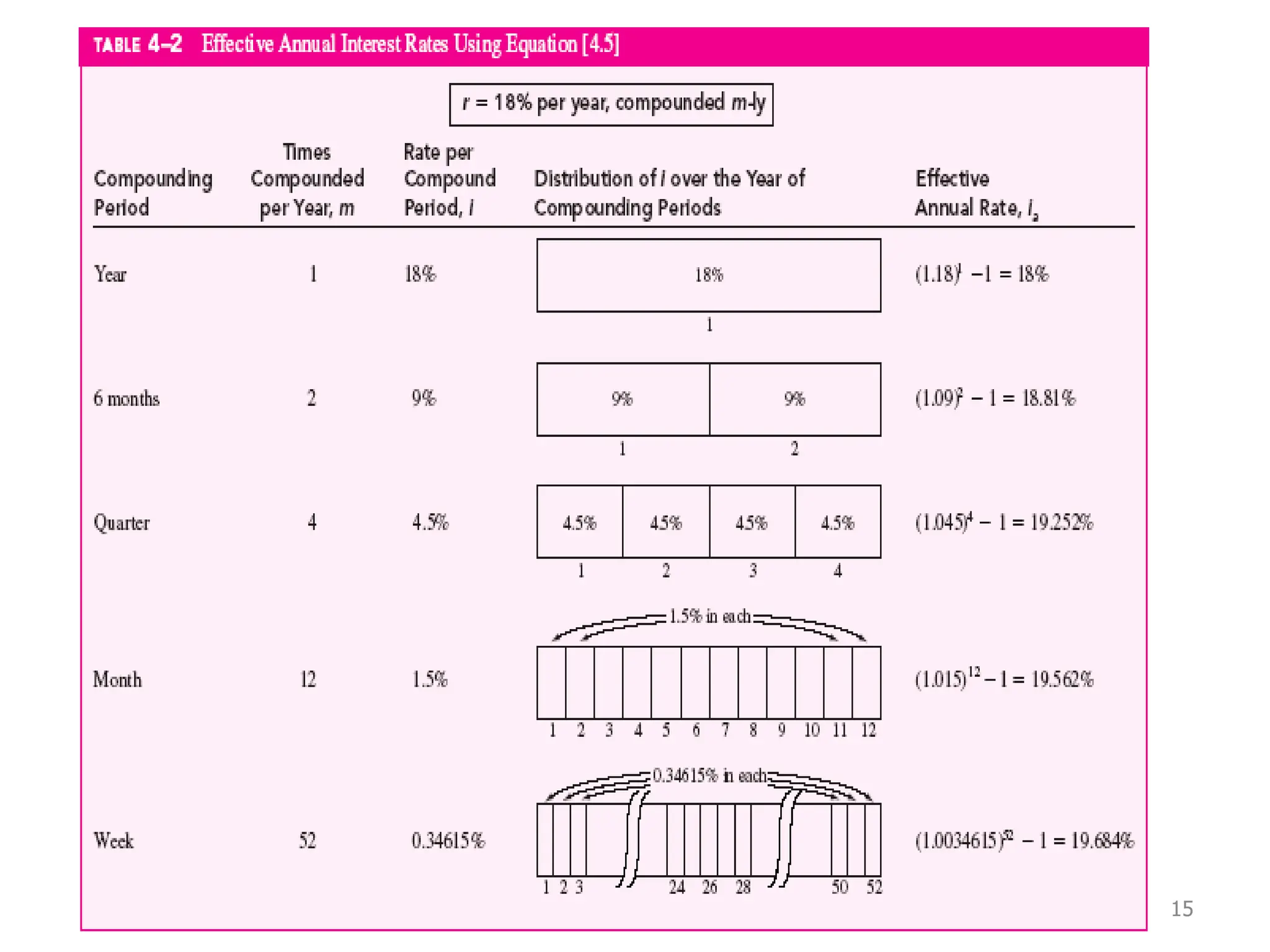

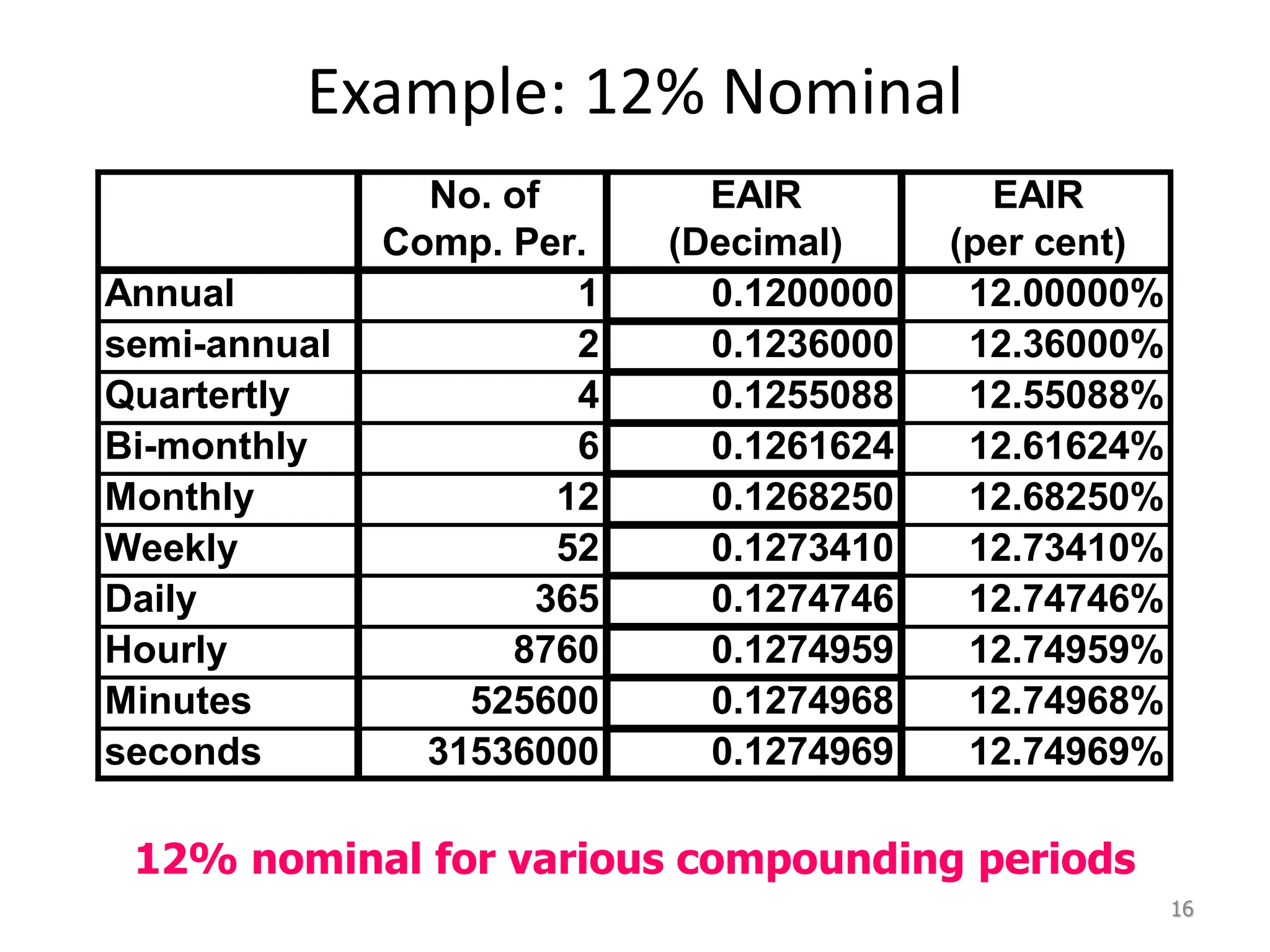

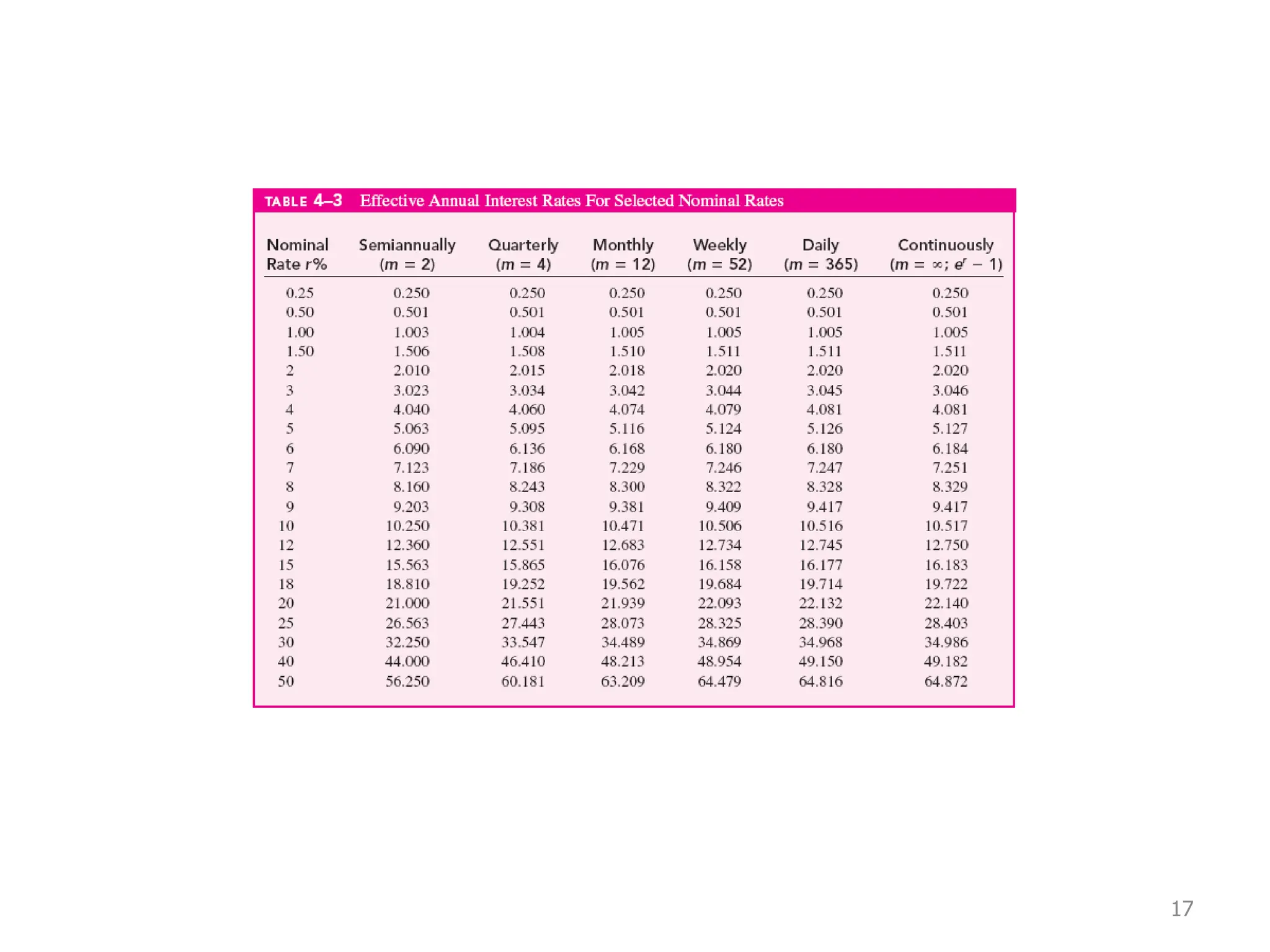

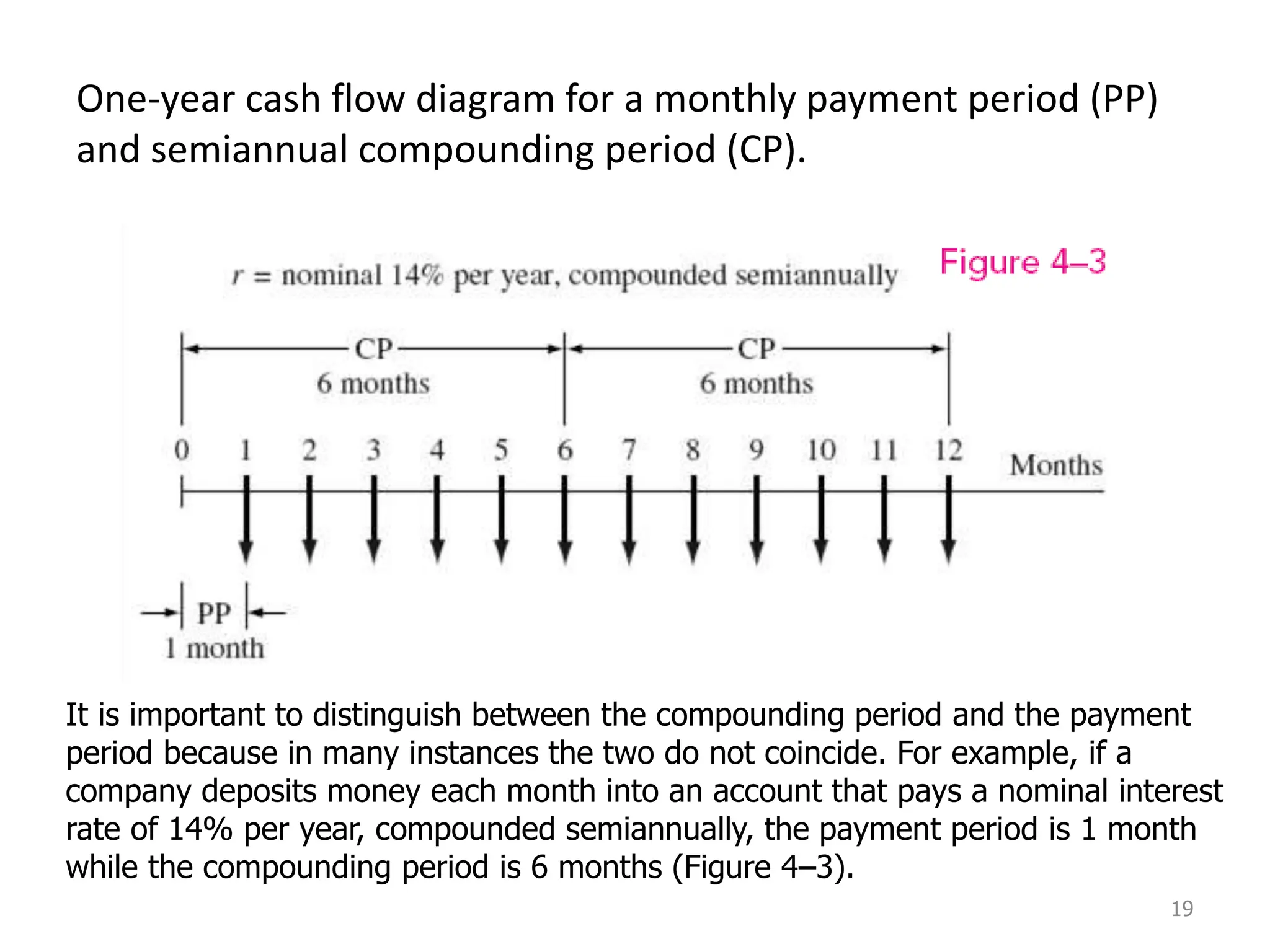

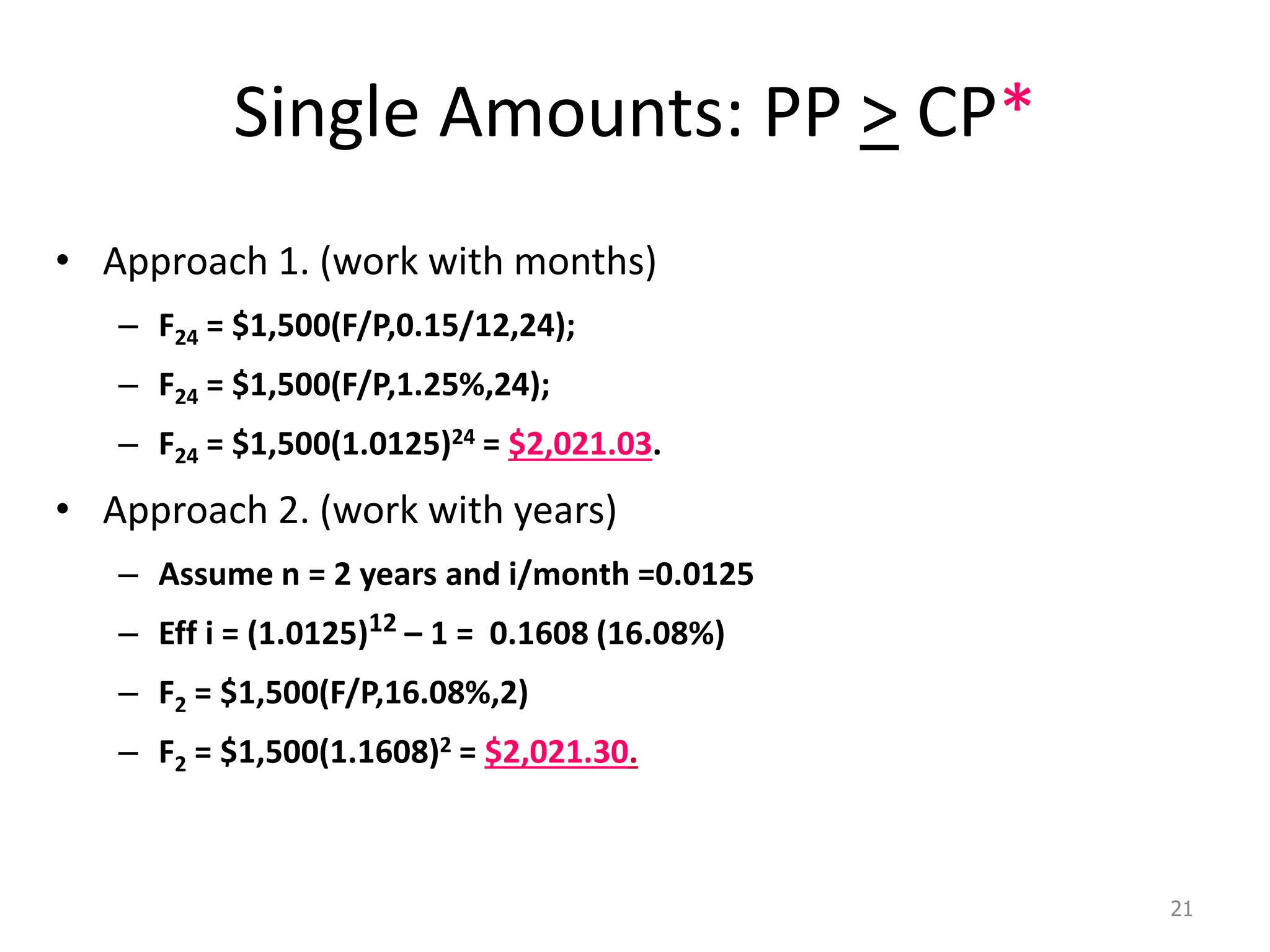

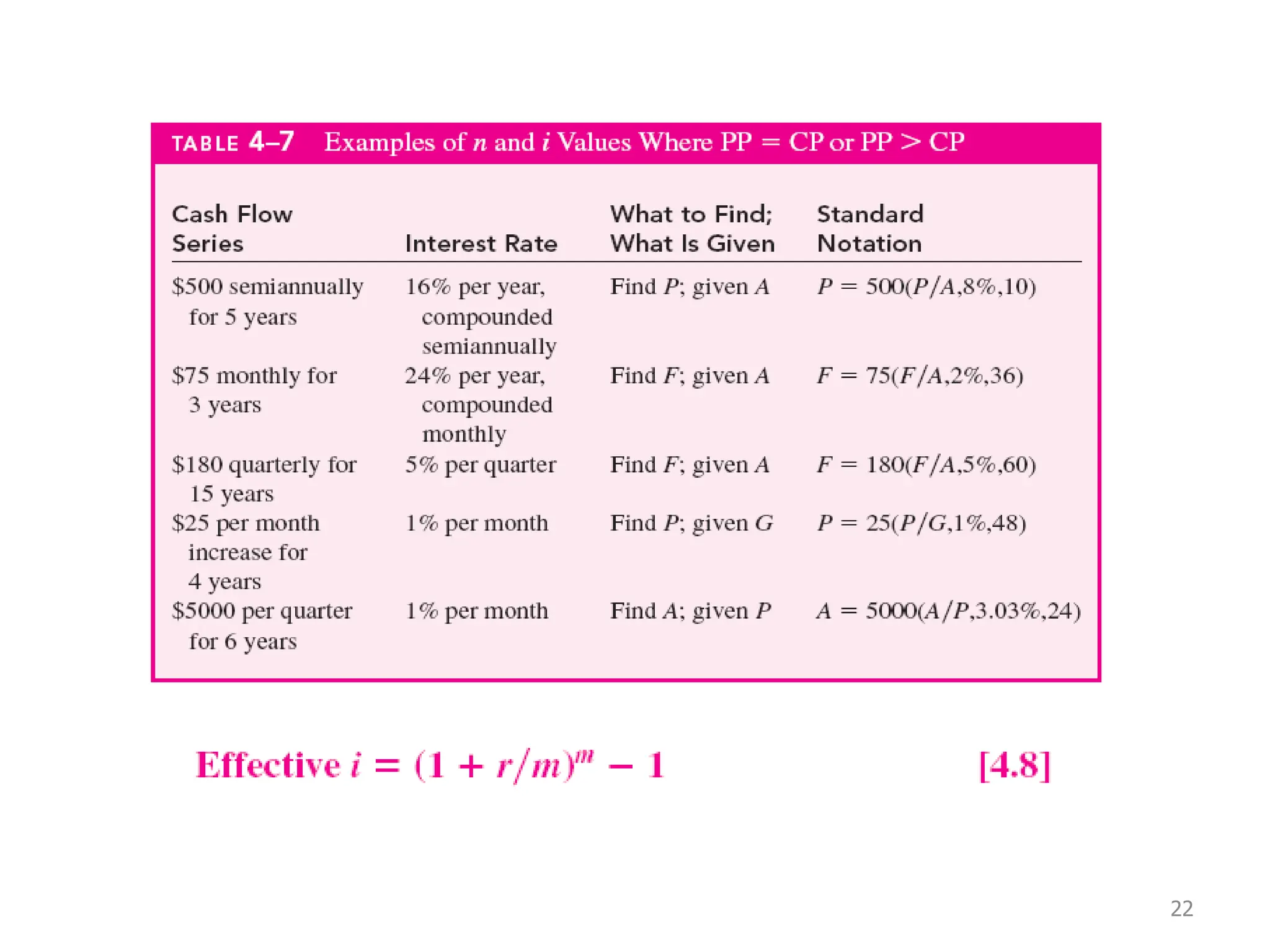

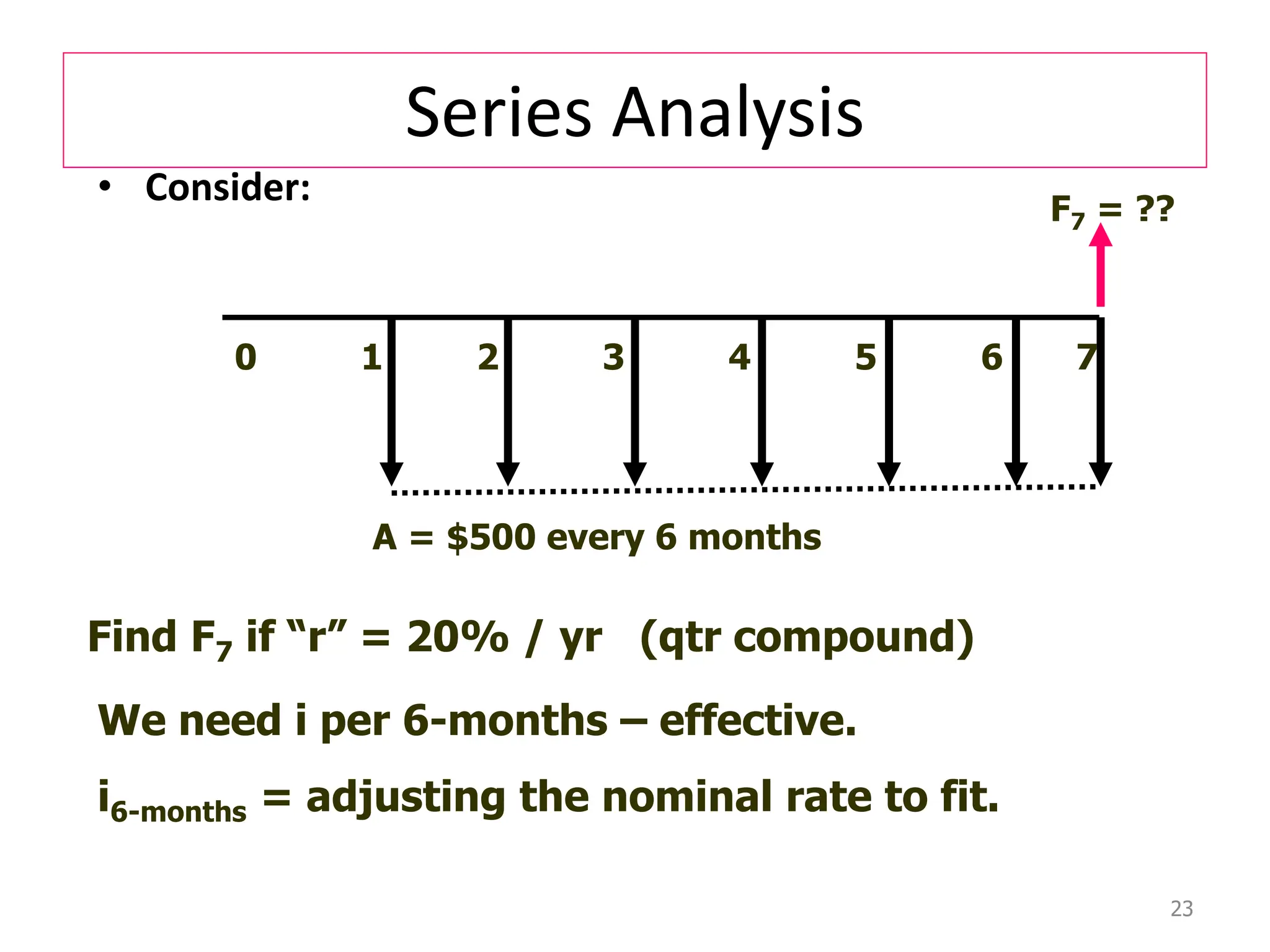

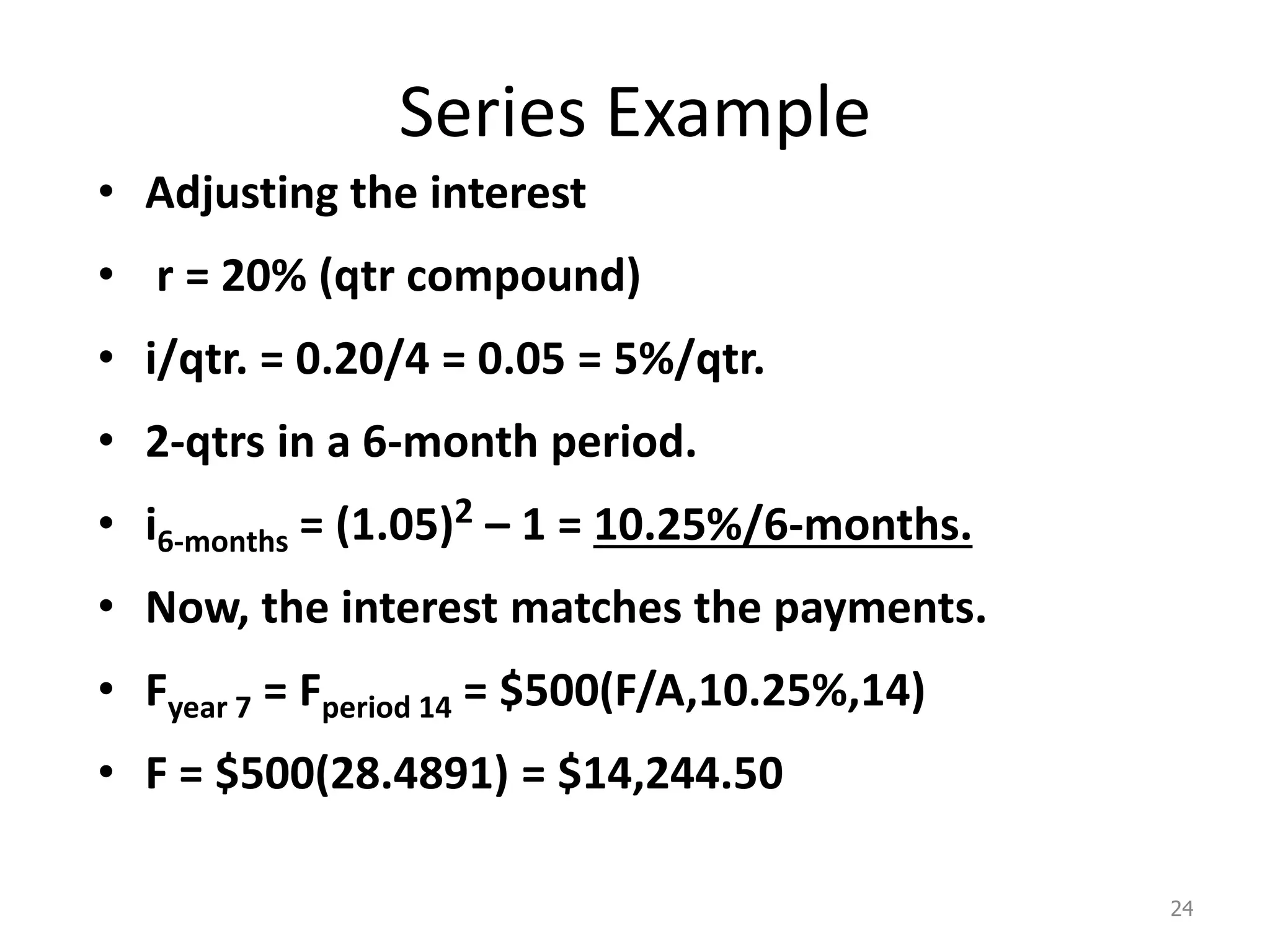

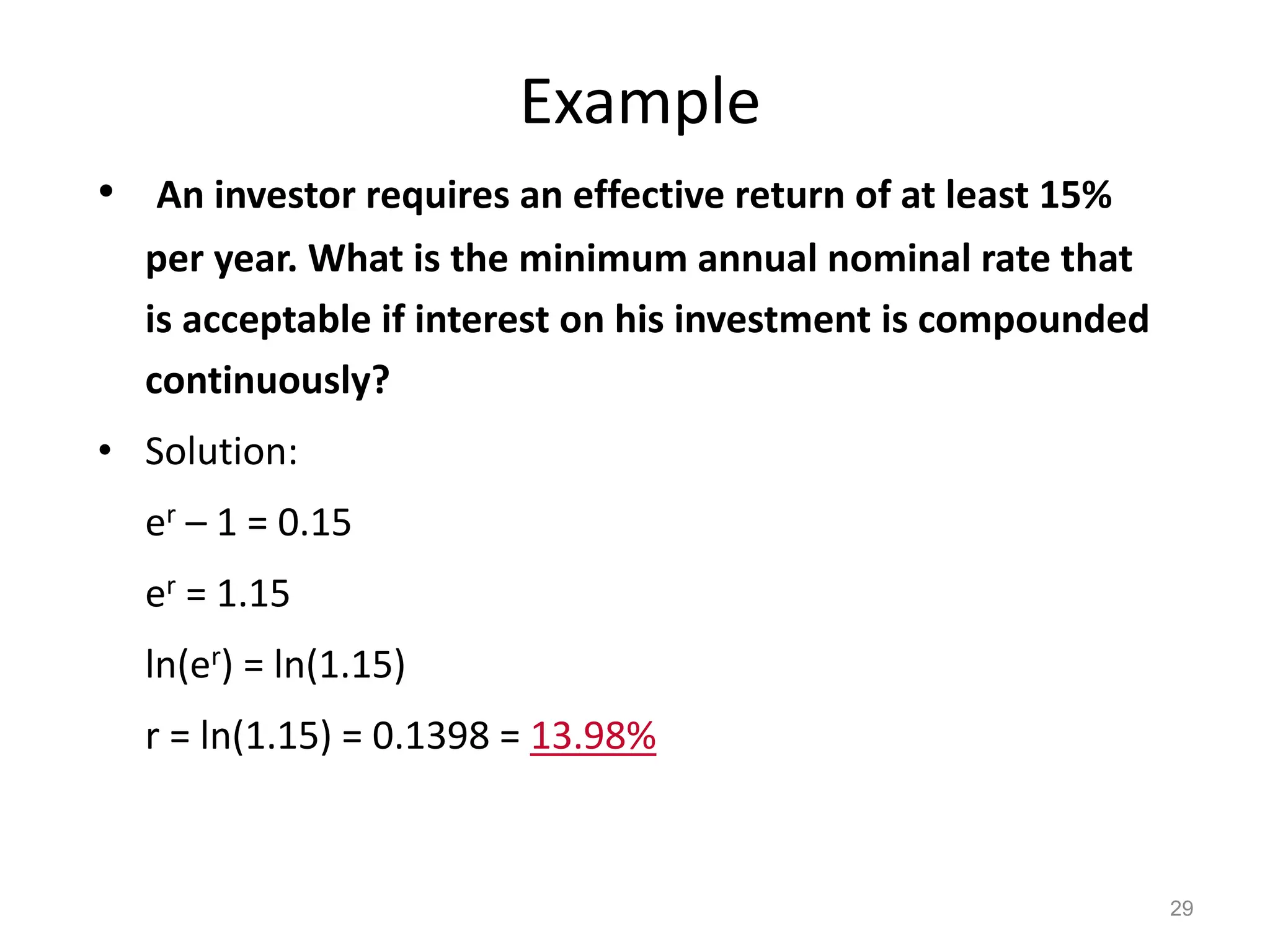

Nominal interest rates do not account for compounding, while effective interest rates do. Effective interest rates are calculated using the nominal rate and compounding period to determine the actual return. There are three key time units for any interest rate statement: the time period, compounding period, and compounding frequency. Effective rates are often higher than nominal rates due to the effects of compounding interest over time.