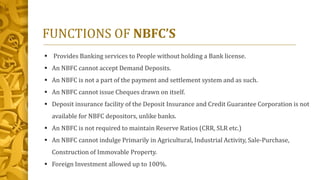

NBFCs, or non-banking financial companies, are registered under the Companies Act and provide banking services without a bank license. Some major NBFCs operating in India include NABARD, Shriram Transport Finance, and LIC Housing Finance. NBFCs cannot accept demand deposits, issue checks, or offer deposit insurance. They also have more lenient loan conditions than banks but charge higher interest rates. The top 10 NBFCs in India are led by Reliance Capital, L&T Finance, and Mahindra Finance.