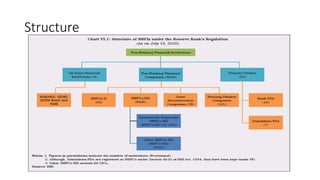

Non-banking financial companies (NBFCs) are entities registered under the Companies Act engaged primarily in financial activities, differing from banks as they cannot accept demand deposits or participate in the payment system. The Reserve Bank of India (RBI) regulates NBFCs to ensure they predominantly conduct financial activities, defined by the '50-50 test', and requires a minimum net owned fund for registration. Various types of NBFCs exist, including asset finance companies, investment companies, and microfinance institutions, each with specific regulatory standards and operational guidelines.