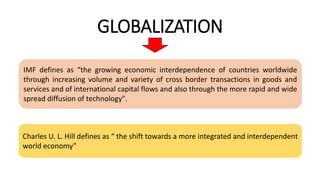

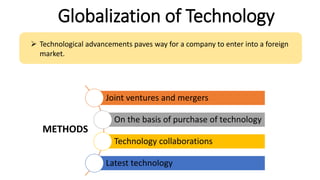

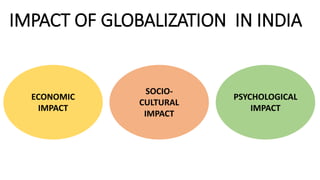

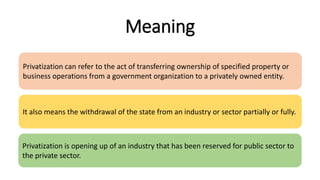

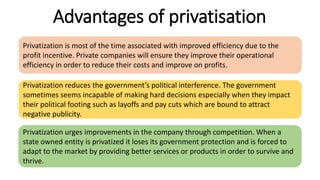

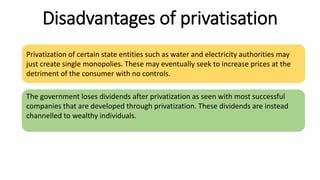

The document discusses globalization and privatization, defining globalization as the increased economic interdependence of countries and outlining its features, processes, and impacts. It highlights the advantages and disadvantages of globalization, including job creation and competition, while also addressing the complexities of privatization, its objectives, forms, and effects on efficiency and resource management. Both topics reflect significant changes in the global economy and the varying implications for developed and developing countries.