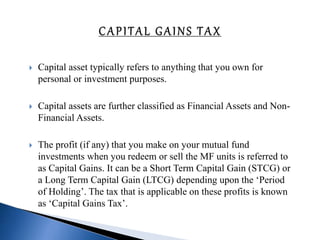

The document provides an overview of mutual funds in India, including their history, structure, guidelines, terms, types of funds, ratios, taxation, and future outlook. Some key points:

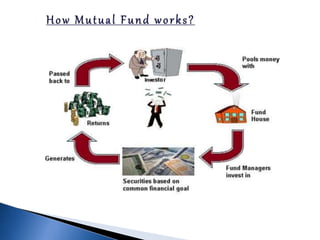

- A mutual fund pools money from investors and invests it in stocks, bonds, and other securities to generate returns. Returns and capital appreciation are shared proportionally by unit holders.

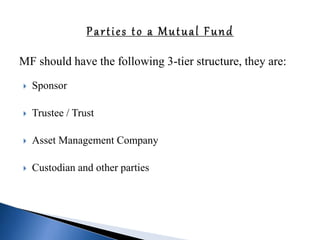

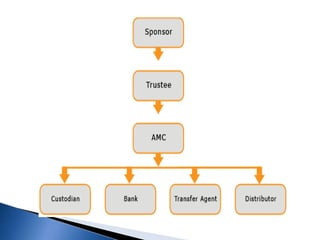

- SEBI regulates the mutual fund industry and has established a three-tier structure of sponsors, trustees, and asset management companies.

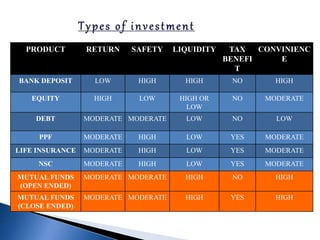

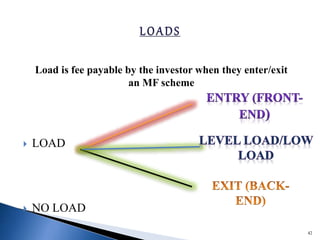

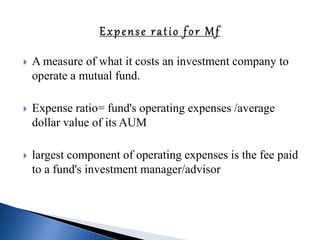

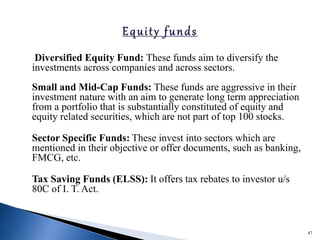

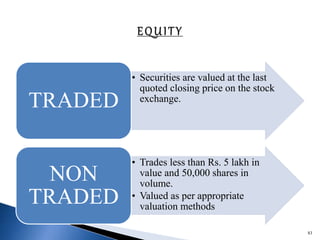

- There are various types of mutual funds that invest in different asset classes like equity, debt, hybrid, and money market instruments. Expense ratios, loads, and taxation vary across fund types.

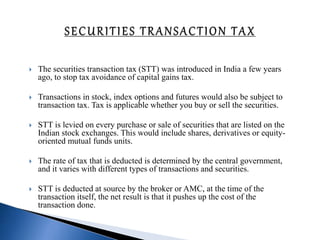

![ It is rate of return for the period of holding

Also known as total return or point to point returns.

HPR = {[INCOME+(END PRICE – BEGINNING

PRICE)]*BEGINNING PRICE}*100

HPR ={ [2+(12-10)]/10}*100 = 40%

DIVIDEND 2 HPR 40%

BEG.PRICE 10

ENDPRICE 12

HOLDINGPERIOD 1YEAR](https://image.slidesharecdn.com/group1mutual-fund-160218173559/85/mutual-fund-66-320.jpg)

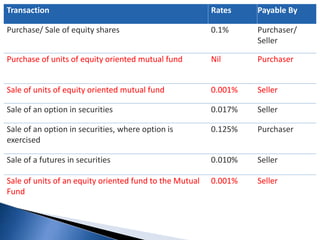

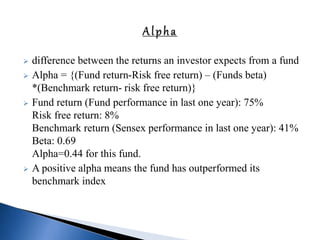

![Alpha is the risk-adjusted return on an investment

Alpha demonstrates whether your investment

outperformed or underperformed a risk-related

benchmark

The formula for alpha is expressed as follows:

a = Rp – [Rf + (Rm – Rf) ß]

Where:

Rp = Realized return of portfolio

Rm = Market return

Rf = risk-free rate

80](https://image.slidesharecdn.com/group1mutual-fund-160218173559/85/mutual-fund-80-320.jpg)

![Capital Gain Taxation applicable to Schemes other than equity oriented

schemes

Resident Individual /

HUF

Domestic

Corporates

NRI

Long Term Capital Gains

[Units held for more than

36 months] (Listed Units)

20% with indexation + 12%

Surcharge + 3% Cess

= 23.072%

20% with indexation +

Surcharge as applicable +

3% Cess

= 22.042% or 23.072%

20% with indexation +

12% Surcharge + 3%

Cess

= 23.072%

Tax deducted at Source =

NIL

Tax deducted at Source =

NIL

Tax deducted at Source

= 23.072%

Long Term Capital Gains

[Units held for more than

36 months] (Unlisted

Units)

20% with indexation + 12%

Surcharge + 3% Cess

= 23.072%

20% with indexation +

Surcharge as applicable +

3% Cess

= 22.042% or 23.072%

10% without indexation

+ 12% Surcharge + 3%

Cess

= 11.536%

Tax deducted at Source =

NIL

Tax deducted at Source =

NIL

Tax deducted at Source

= 11.536%

Short Term Capital Gains

(Units held for less than 36

months)

30%^ + 12% Surcharge +

3% Cess = 34.608%

30% + Surcharge as

applicable + 3% Cess =

34.608% or 33.063%

30%^ + 12% Surcharge

+ 3% Cess = 34.608%

Tax deducted at Source =

NIL

Tax deducted at Source =

NIL

Tax deducted at Source

= 34.608% (Listed and

Unlisted) ^](https://image.slidesharecdn.com/group1mutual-fund-160218173559/85/mutual-fund-91-320.jpg)