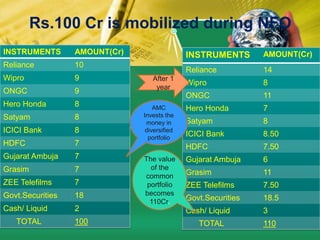

The document provides a comprehensive overview of mutual funds in India, detailing their structure, functions, and regulatory framework established by SEBI. It explains the processes involved in mutual fund operations, including the roles of asset management companies, trustees, and various other functionaries. Additionally, it categorizes different types of mutual fund schemes and highlights their benefits, emphasizing the importance of mutual funds in mobilizing investments and contributing to capital formation.