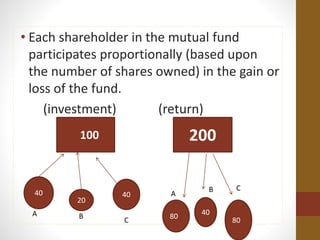

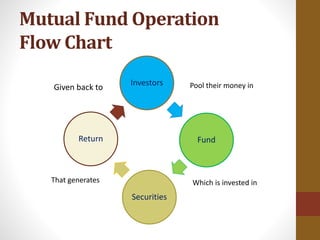

Mutual funds are collective investment vehicles pooling resources from various investors to invest in securities based on a stated objective, offering both returns through dividends and capital appreciation. The Indian mutual fund industry began in 1963, with significant regulatory developments leading to growth and diversification of fund types by 1993, overseen by organizations like AMFI and SEBI. Investors benefit from professional management and diversification but face challenges like delays in redemption and management fees.