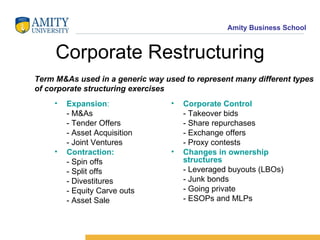

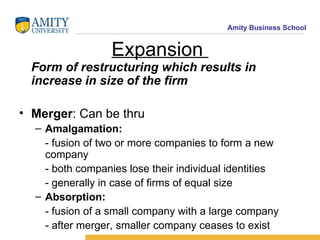

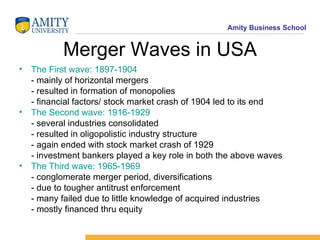

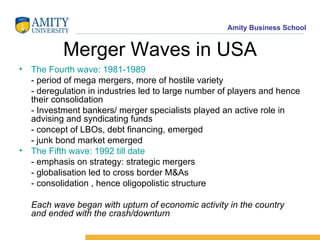

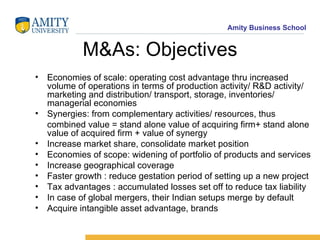

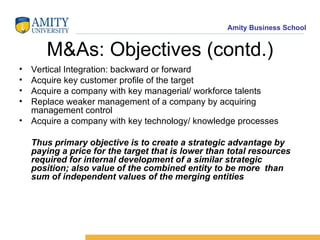

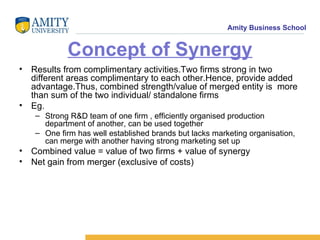

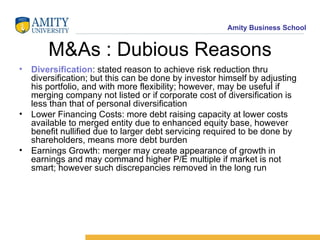

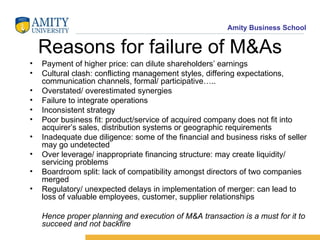

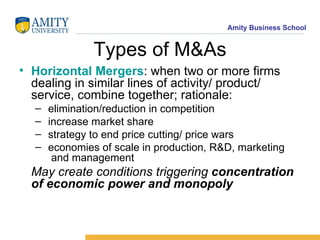

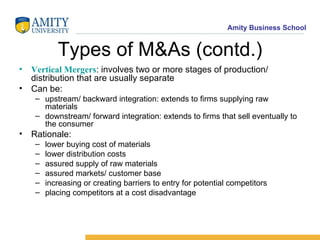

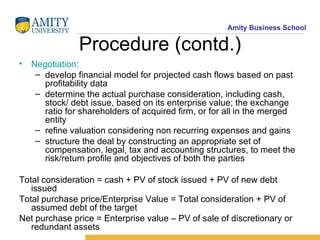

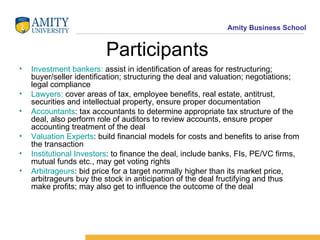

The document provides an overview of mergers and acquisitions (M&As), including the objectives, types, and procedures involved in structuring an M&A transaction. It discusses various types of M&As such as horizontal, vertical, and conglomerate mergers. The procedures involved in an M&A deal include developing a business plan, conducting due diligence, negotiating the terms, financing the deal, developing an integration plan, and closing the transaction. Key participants in an M&A deal include investment bankers, lawyers, accountants, valuation experts, and institutional investors.