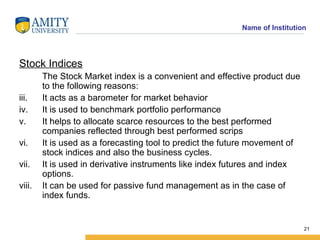

The Indian financial system consists of a variety of capital markets, financial intermediaries, and instruments. The key capital markets include the treasury bill market, inter-bank market, stock market, and public debt market. Major financial intermediaries include banks, mutual funds, insurance companies, pension funds, and non-banking financial institutions. Popular financial instruments include equity shares, bonds, treasury bills, commercial paper, and derivatives. Stock indices like the BSE Sensex and NSE Nifty 50 are important indicators of the stock market.