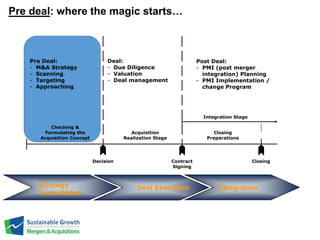

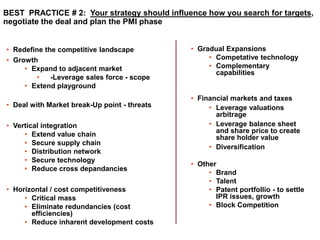

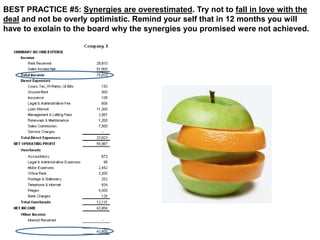

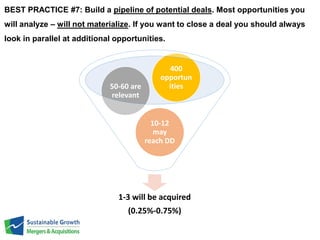

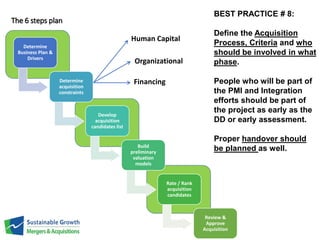

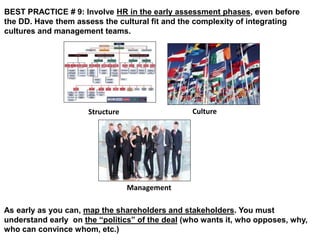

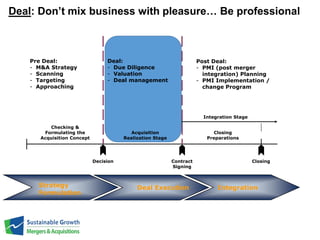

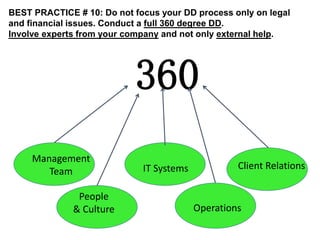

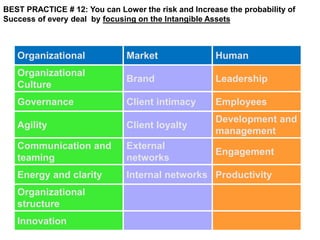

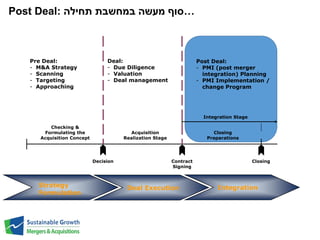

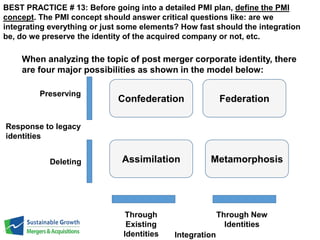

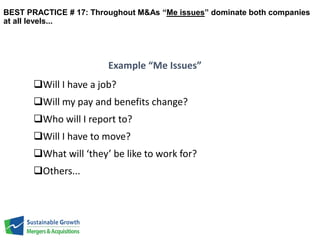

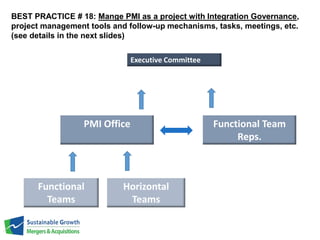

This document contains best practices for mergers and acquisitions (M&A) from deal planning through post-merger integration. It discusses defining clear goals for acquisitions, ensuring cultural and strategic fit, conducting thorough due diligence, managing people and communication issues, and treating integration as a project. Key recommendations include being realistic about synergies, having devil's advocate reviews, planning for talent retention, and differentiating aspects to integrate quickly versus slowly. The best practices are meant to increase the likelihood of M&A deal success.