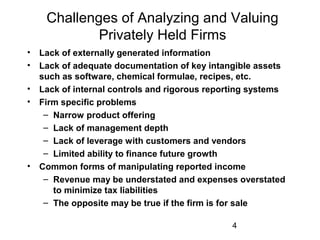

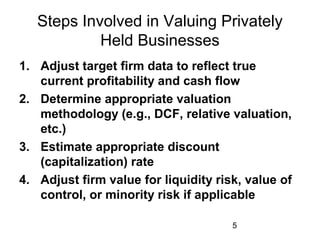

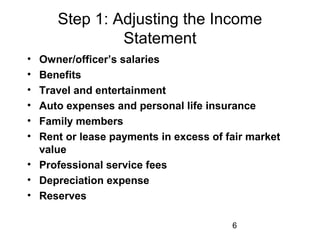

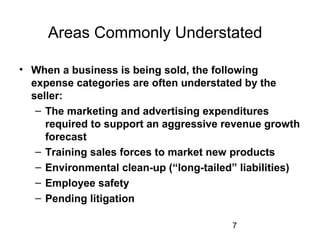

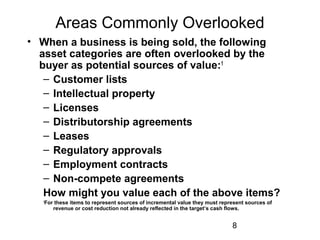

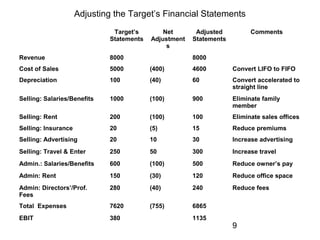

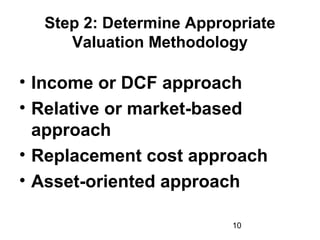

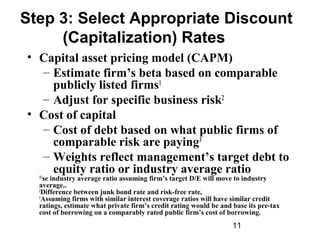

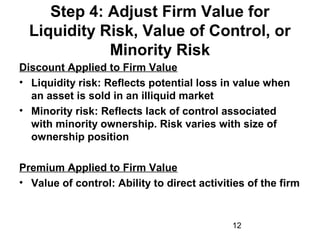

This document discusses key issues in analyzing and valuing privately held companies. It notes that privately held firms have concentrated ownership and lack publicly available financial information. The valuation process involves adjusting financial statements, selecting a valuation method, determining discount rates, and adjusting the value for factors like liquidity, control, or minority stakes. Privately held firms require more adjustments to financials and consideration of these additional factors compared to public companies.