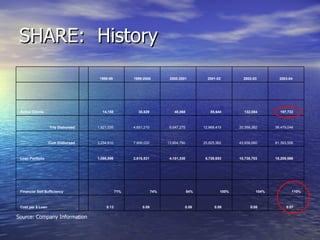

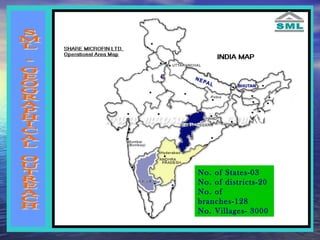

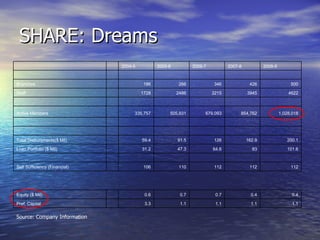

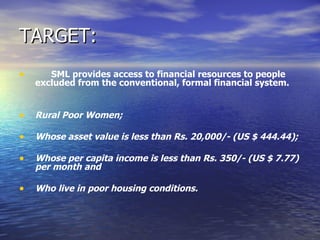

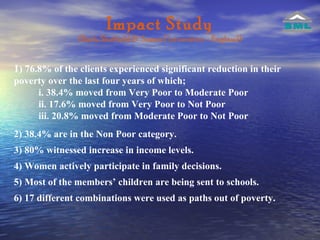

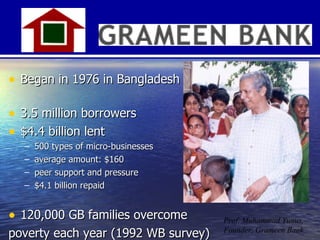

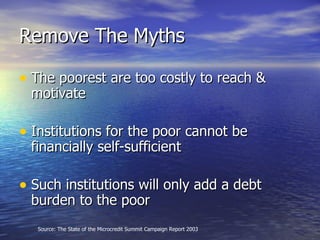

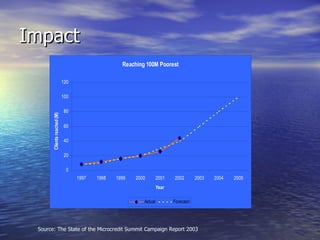

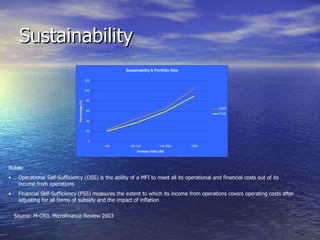

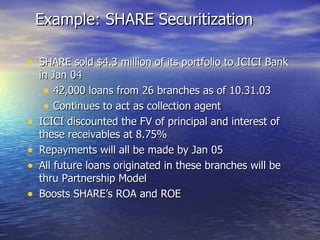

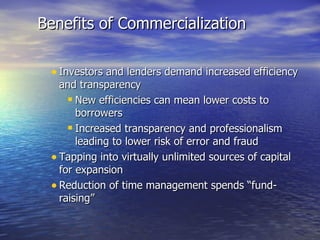

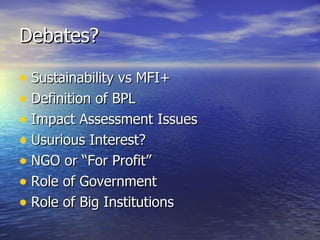

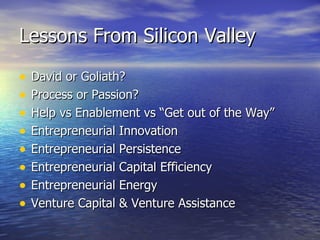

This document discusses microfinance and its role in empowering entrepreneurs and reducing poverty. It provides examples of microfinance institutions (MFIs) that have grown significantly by providing small loans to poor individuals, especially women. While MFIs have helped many, the document also notes debates around ensuring their focus remains on poverty targeting and impact. It advocates for the right balance of incentives to achieve social and financial goals through microfinance.

![Comments? [email_address]](https://image.slidesharecdn.com/microfinancemay2004-110927065048-phpapp02/85/Microfinance-may2004-33-320.jpg)