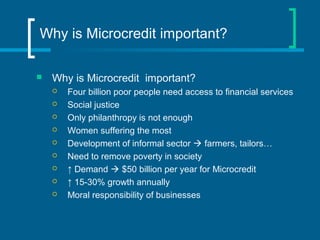

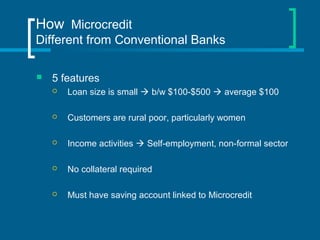

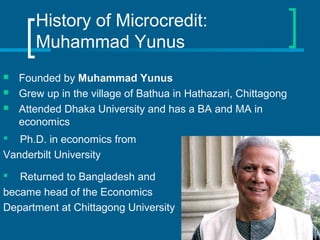

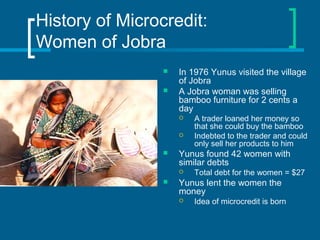

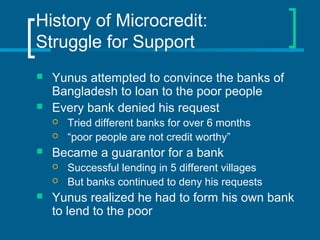

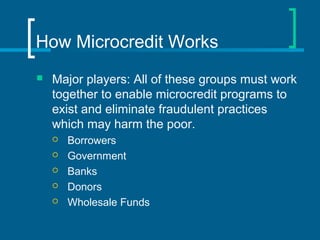

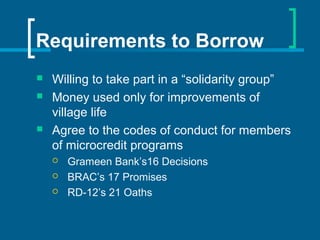

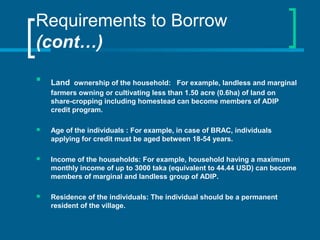

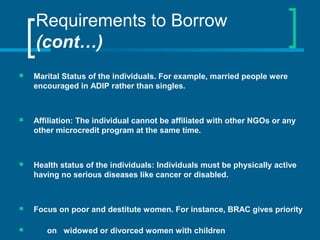

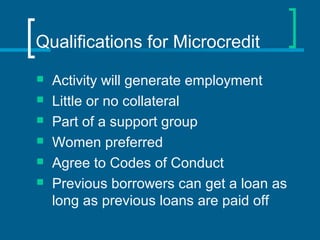

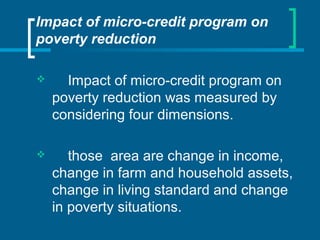

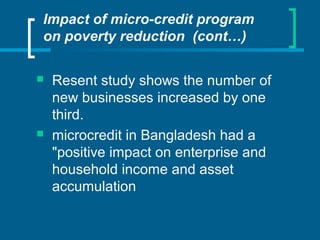

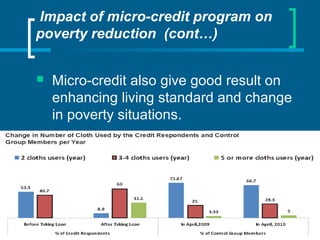

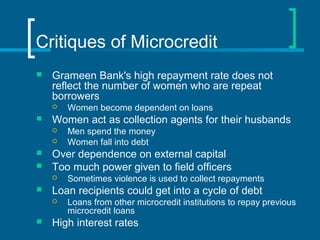

Microcredit is a system that provides small loans to poor individuals without collateral to start self-employment projects. Muhammad Yunus pioneered microcredit by providing small loans to 42 poor women in Bangladesh in 1976. This led to the founding of Grameen Bank in 1983, which has since loaned over $6 billion to over 7 million people, mostly women. Microcredit works by providing loans in small group through community support and accountability. It has significantly reduced poverty by generating income and empowering the poor, especially women. However, some critiques argue it can increase debt cycles and over-dependence on loans.