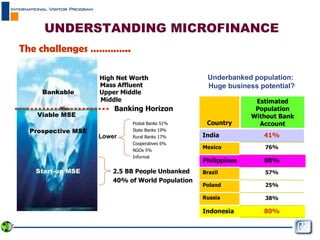

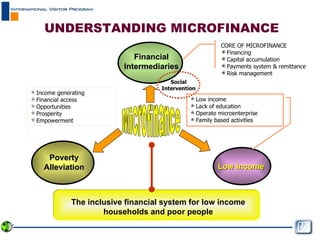

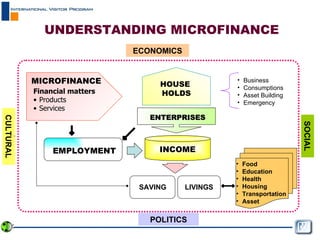

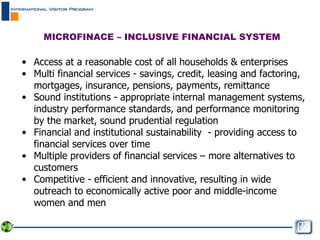

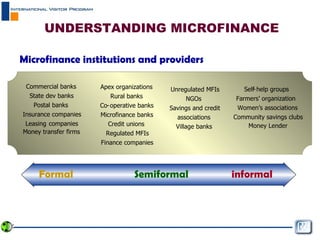

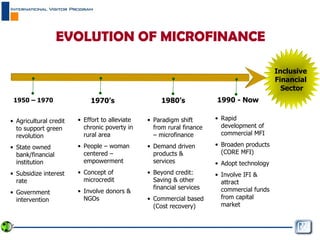

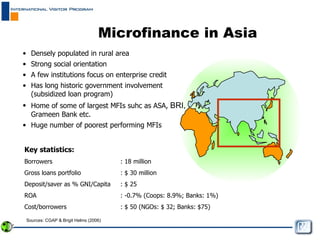

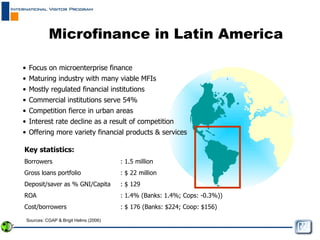

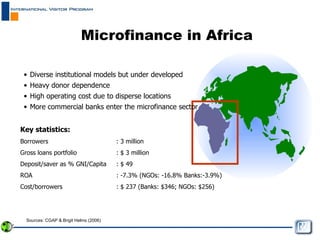

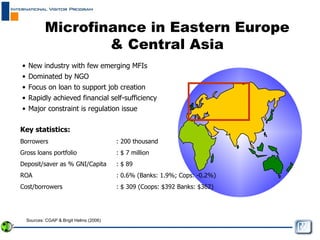

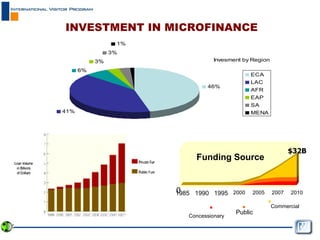

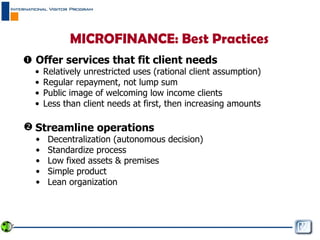

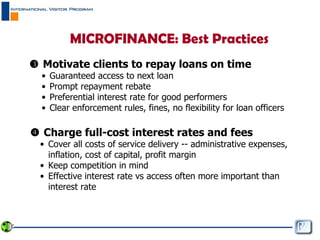

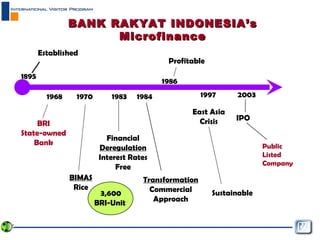

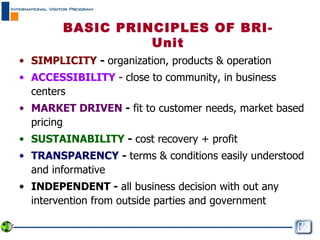

The document discusses microfinance and its evolution towards more commercial and inclusive models. It provides an overview of microfinance in different regions, highlighting key statistics. It outlines best practices for microfinance institutions, including offering services that fit client needs, motivating repayment, and charging full cost-covering rates. It also summarizes the principles and history of the commercial microfinance model of Bank Rakyat Indonesia.