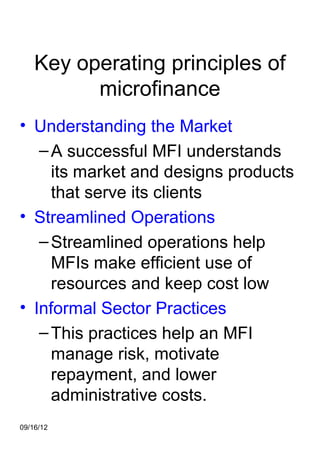

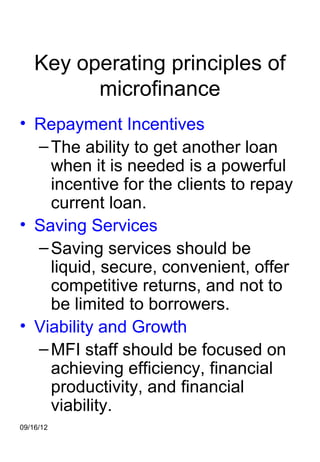

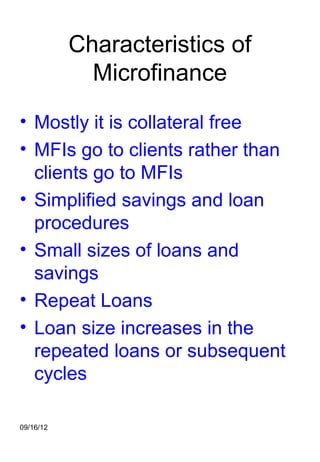

The document provides an overview of microfinance concepts, principles, characteristics, and best practices. It discusses that microfinance aims to provide financial access to low-income groups through loans, savings, and other services. Key principles include understanding the market, streamlined operations, repayment incentives, and sustainable interest rates. Characteristics are collateral-free and small loans with flexible terms. Best practices are effective management systems, financial sustainability, and involving clients.

![Overview….Country

Scenario

• More than 31% of the Nepal's

population lives in extreme poverty.

• Informal financial system remains

dominant

• The sector has experienced growth of

microfinance institutions (MFIs) and

significant progress in terms of clientele,

outreach, savings and credit

management.

• Microfinance Development Banks (22)

are providing microfinance services to

8,46,517 rural poor women across 57

districts through self-managed centers

and groups[1];

[1] Source: NRB, Mid-July, 2011

09/16/12](https://image.slidesharecdn.com/microfinance-1-notes-120915205024-phpapp01/85/Microfinance-1-notes-3-320.jpg)

![Overview….Country

Scenario

• 10,558 Savings and Credit Cooperatives and Credit

Unions provide services to 14,06,021 clients (female

651,512 and male 754,509) in 75 districts[1] ( this

includes urban saving and credit cooperatives that may

not represent microfinance services);

• Small Farmers Cooperative Limiteds (SFCLs: 243) are

providing financial services to 1,69,686 clients-SKBBL,

Mid-June, 2011

• 38 Financial Intermediary NGOs are providing financial

services to a further 454,026 predominately poor people[2]

.

• This shows that 25,95, 046 of the rural population have

access to microfinance services in Nepal, which

contributes 10.25 % of the total population and 33.05 %

of those is living below the poverty line. This is the 20%

reduction in total clients of saving and credit clients. It is

assumed that 20% urban population do not represent

MF clients that was also included in the total clients of

saving and credit coops.

[1] Department of Cooperative, 2011

09/16/12

[2] Compiled by CMF, 2011](https://image.slidesharecdn.com/microfinance-1-notes-120915205024-phpapp01/85/Microfinance-1-notes-4-320.jpg)

![Overview….Country

Scenario

• A total of 2,048,742 of the rural population

have access to microfinance services in

Nepal, which contributes 8.09% of the

total population[1] and 26.1% of those is

living below the poverty line[2],

• Of which 1,233,058 are women,

representing 9.73% of all Nepalese

women[3]. Data shows that the majority of

microfinance service recipients are

women

• Nevertheless, the women led MFIs are

approximately 2545 saving & credit

cooperatives.

• [1] Total population about 25,296,537 as of 2005 Projection ( Informal Sector Research

and Study Center: 2004)

• [2] 31% of total population ( NLSS:2003/04)

• [3]( NIDI, CMF: 2006)

09/16/12](https://image.slidesharecdn.com/microfinance-1-notes-120915205024-phpapp01/85/Microfinance-1-notes-5-320.jpg)