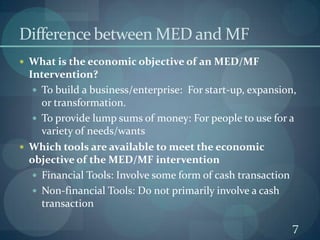

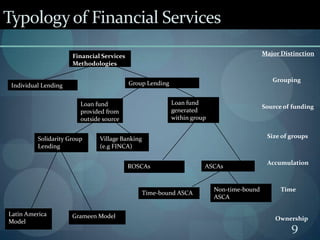

This document provides an introduction to a course on microfinance. It outlines the topics to be covered in the first week, including an introduction to household financing and different approaches to accessing financing. The key mechanisms for providing financing are discussed, such as microfinance institutions, savings and credit groups, and money lenders. Different types of financial services like group lending, individual lending, and village banking models are also introduced. The primary goals of microfinance institutions are outlined as breadth and depth of outreach, length of outreach, positive impact, and creating sustainable local institutions. The outline provided indicates future weeks will focus on specific microfinance institutions, clients' experiences, and local investors in microfinance.