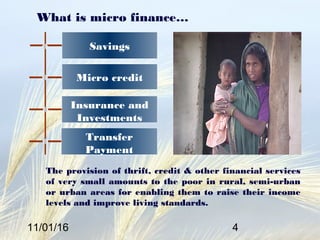

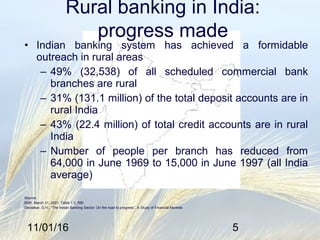

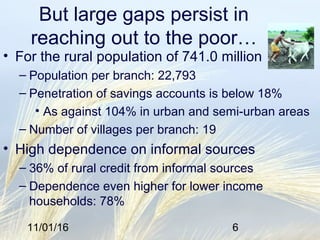

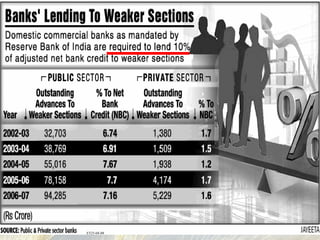

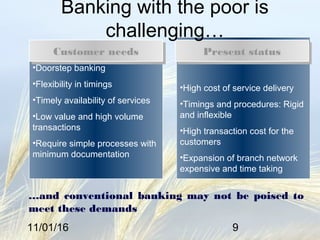

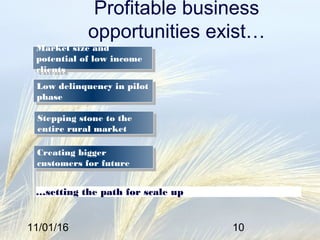

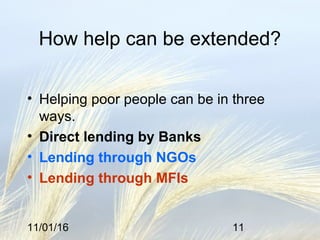

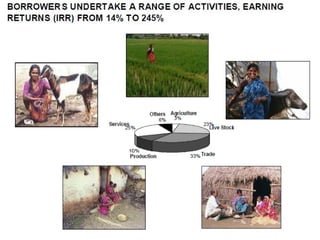

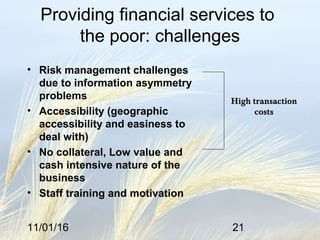

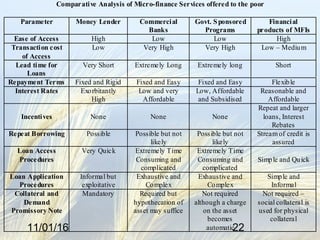

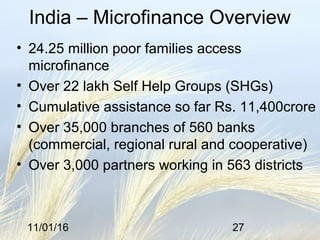

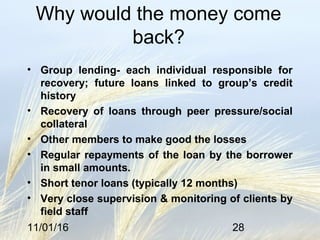

This document provides an overview of microfinance in India. It defines microfinance as the provision of small loans, savings, insurance, and other financial services to the poor. It discusses how microfinance addresses gaps in access to financial services for rural and low-income populations. Specifically, it notes that microfinance institutions use group lending models and social collateral to provide affordable credit to clients who lack physical assets or collateral. The document also outlines some of the common challenges in providing financial services to the poor, as well as the growth and potential of microfinance in India.