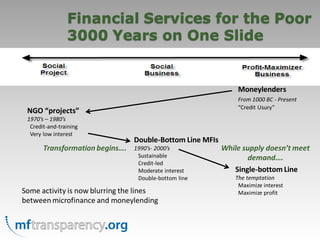

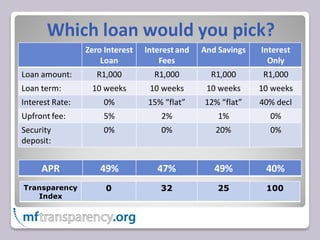

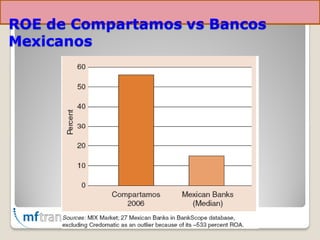

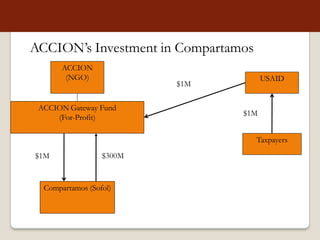

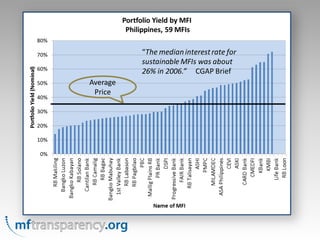

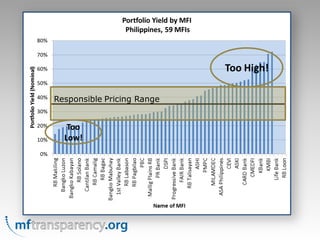

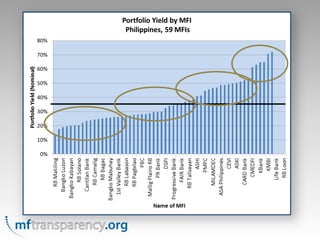

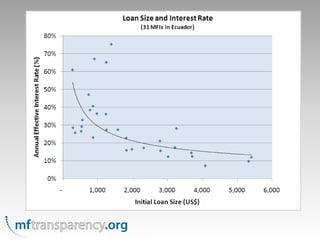

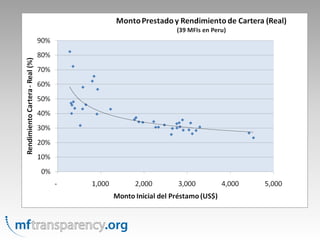

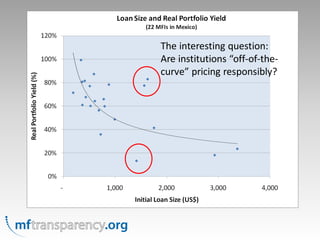

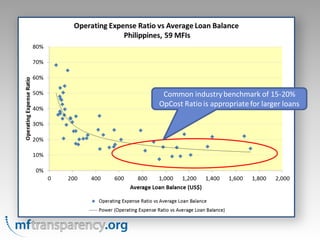

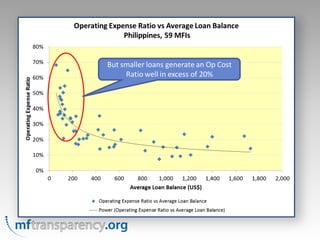

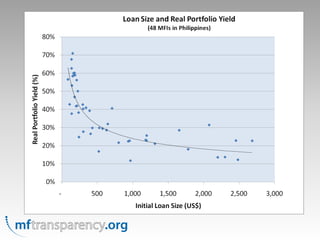

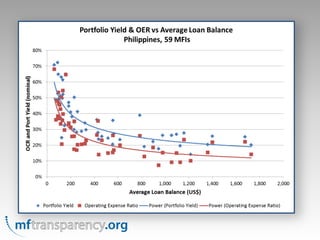

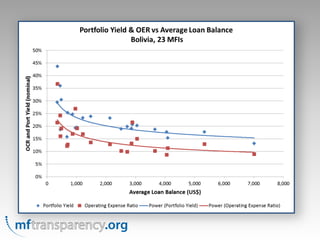

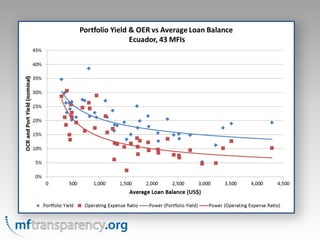

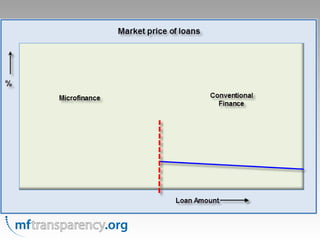

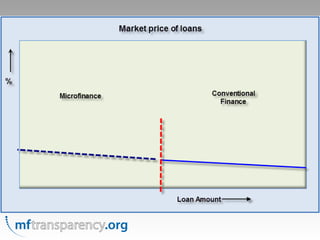

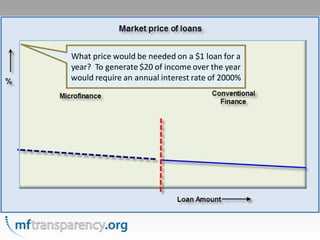

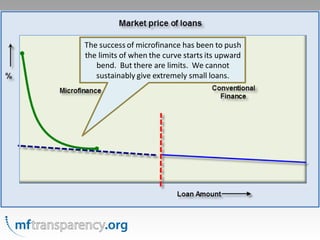

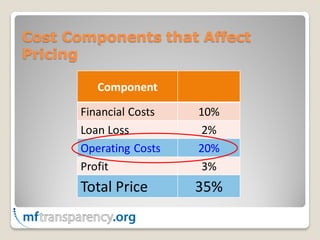

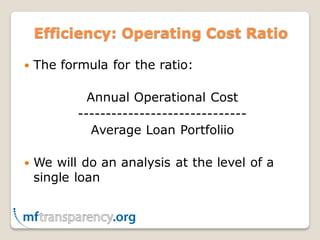

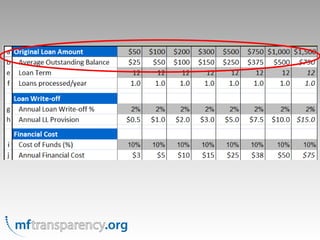

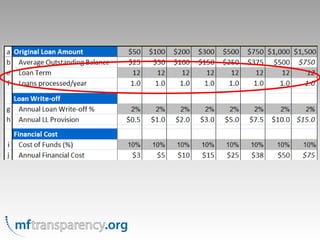

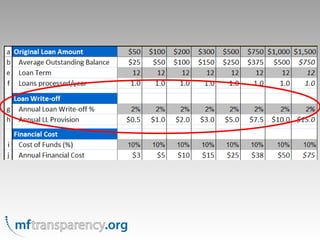

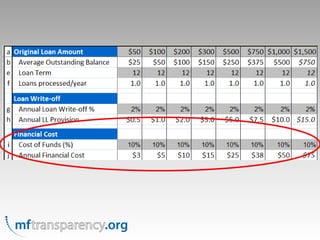

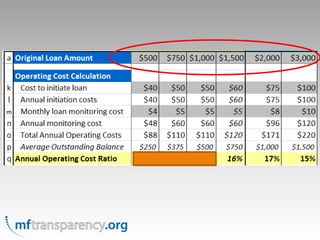

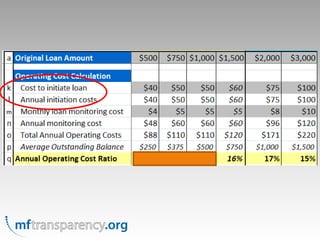

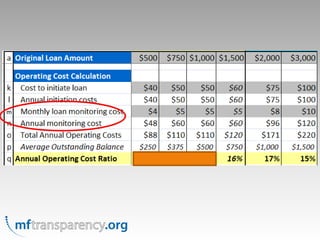

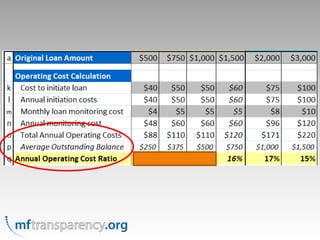

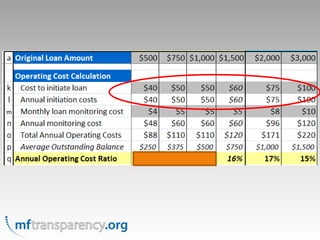

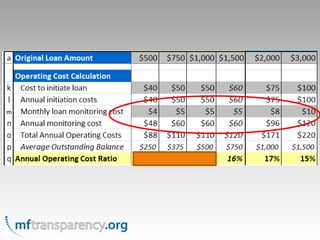

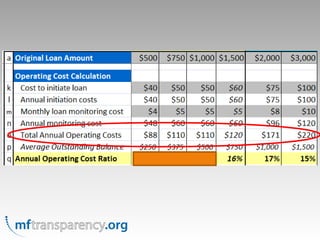

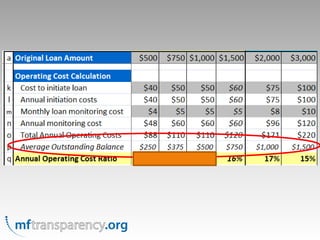

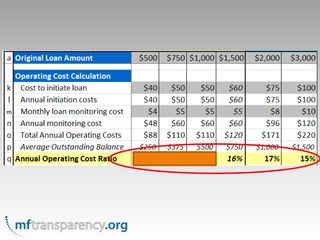

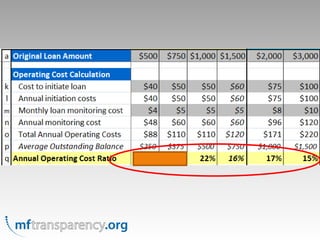

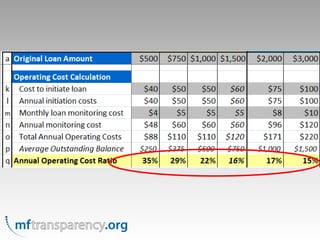

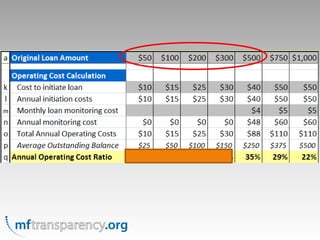

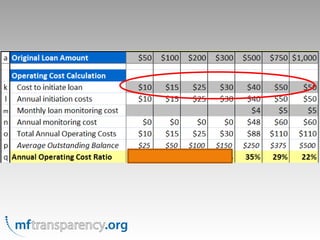

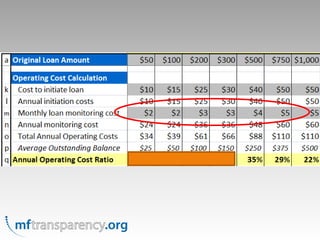

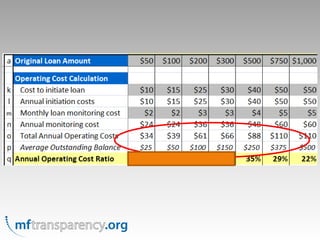

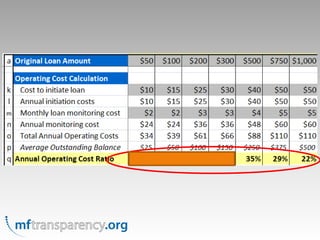

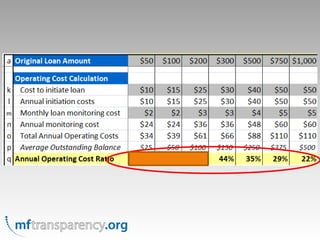

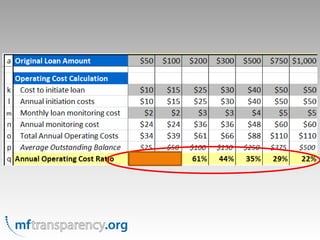

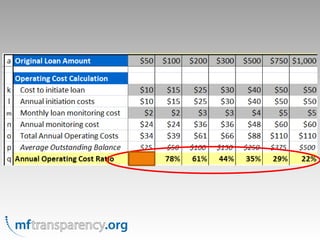

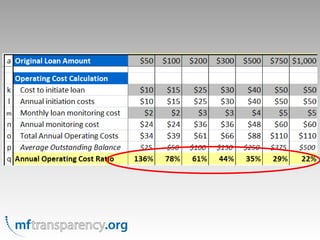

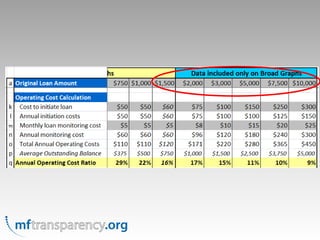

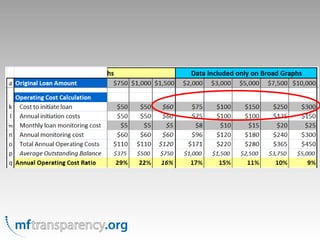

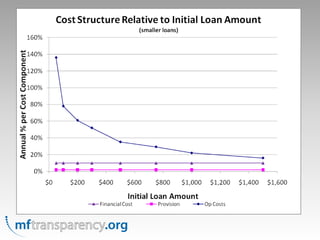

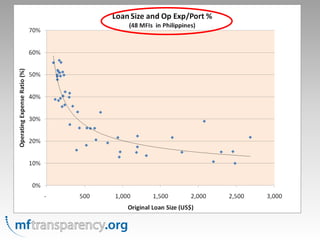

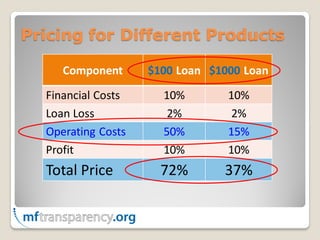

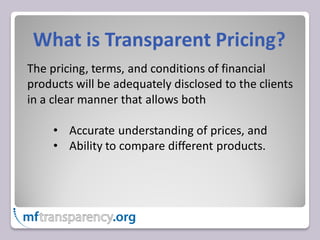

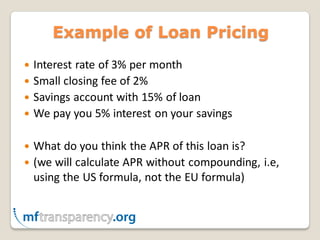

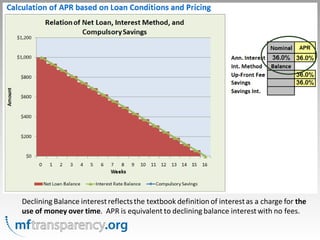

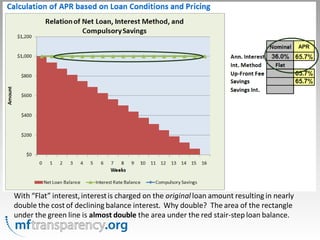

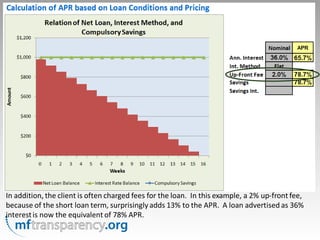

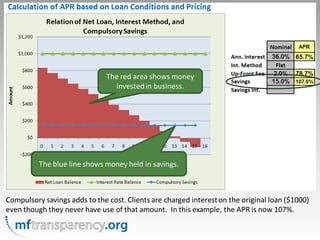

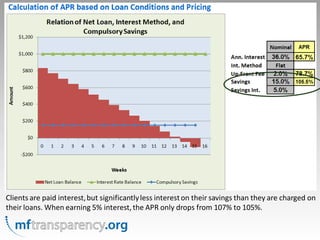

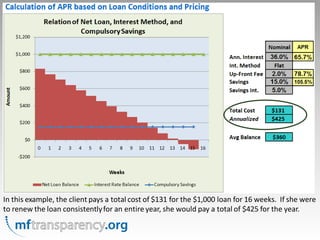

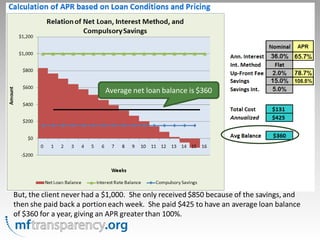

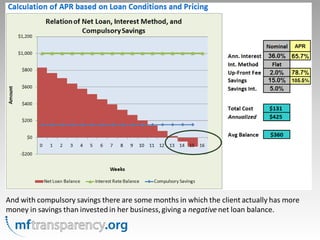

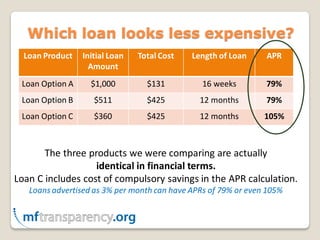

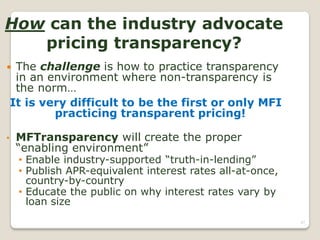

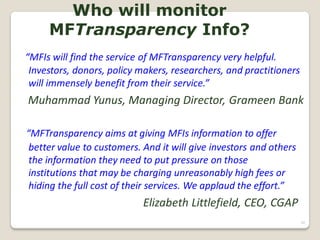

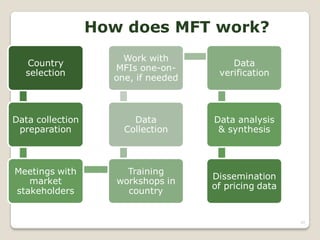

The document discusses the necessity of pricing transparency in the microfinance industry, highlighting various interest rates and their impacts on clients, including the practice of charging high prices that may exploit poorer clients. It emphasizes the importance of clearly communicating the costs associated with loans to enable clients to make informed comparisons, while addressing the challenges of achieving transparency in a non-transparent environment. The initiative, mftransparency, aims to improve pricing clarity and fairness in microfinance, benefiting both clients and stakeholders.